LensCrafters 2013 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

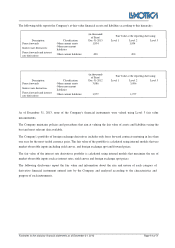

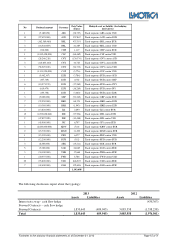

Footnotes to the statutory financial statements as of December 31, 2013 Page 7 of 71

Credit risk

Credit risk exists in relation to accounts receivable from customers outside the Group, cash and cash equivalents,

financial instruments and deposits held with banks and other financial institutions.

With reference to credit risk relating to management of financial resources and cash, this is managed and monitored

by the Treasury department, which adopts procedures to ensure that the Company operates with prime credit

institutions. Credit limits for the principal financial counterparties are based on assessments and analyses conducted

by the Treasury department.

Within the Group there are agreed guidelines governing relations with bank counterparties, and all Group companies

comply with the directives of the Financial Risk Policy.

In general, bank counterparties are selected by the Treasury department and available cash may be deposited, over a

certain limit, only with counterparties with high credit ratings, as defined in the Policy.

Transactions in derivatives are limited to counterparties with high credit ratings and solid, proven experience of

negotiating and executing derivatives, as defined in the Policy, and also require an ISDA Master Agreement (as

published by the International Swaps and Derivatives Association) to be entered into. In particular, counterparty risk

on derivatives is mitigated by spreading contracts between a number of counterparties so that no individual

counterparty ever accounts for more than 25% of the Company's total derivatives portfolio.

No circumstances arose during the year in which credit limits were exceeded. As far as the Company is aware, there

are no contingent losses arising from the inability of the above counterparties to meet their contractual obligations.

Liquidity risk

With reference to the policies and decisions adopted for addressing liquidity risks, the Company takes suitable

actions to be able to duly meet its obligations.

In particular, the Company:

• utilizes debt instruments or other credit lines to meet its liquidity requirements;

• utilizes different sources of financing and had Euro 143.2 million in available credit lines as of December 31,

2013;

• is not subject to significant concentrations of liquidity risk, either in terms of financial assets or sources of

financing;

• utilizes different sources of bank financing, but also keeps a reserve of liquidity for promptly satisfying cash

needs;

• takes part in a cash pooling system which helps manage the Group's cash flows more efficiently, by preventing

the dispersion of liquidity and minimizing borrowing costs;

• monitors through the Treasury department forecasts as to how liquidity reserves will be utilized, based on cash

flow projections.