LensCrafters 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253

|

|

3

SECTION

I

–

GENERAL

INFORMATION

AND

OWNERSHIP

STRUCTURE

I.

I

NTRODUCTION

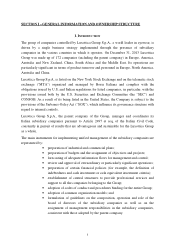

The group of companies controlled by Luxottica Group S.p.A., a world leader in eyewear, is

driven by a single business strategy implemented through the presence of subsidiary

companies in the various countries in which it operates. On December 31, 2013 Luxottica

Group was made up of 172 companies (including the parent company) in Europe, America,

Australia and New Zealand, China, South Africa and the Middle East. Its operations are

particularly significant in terms of product turnover and personnel in Europe, North America,

Australia and China.

Luxottica Group S.p.A. is listed on the New York Stock Exchange and on the telematic stock

exchange (“MTA”) organized and managed by Borsa Italiana and complies with the

obligations issued by U.S. and Italian regulations for listed companies, in particular, with the

provisions issued both by the U.S. Securities and Exchange Committee (the “SEC”) and

CONSOB. As a result of its being listed in the United States, the Company is subject to the

provisions of the Sarbanes-Oxley Act (“SOX”), which influence its governance structure with

regard to internal controls.

Luxottica Group S.p.A., the parent company of the Group, manages and coordinates its

Italian subsidiary companies pursuant to Article 2497 et seq. of the Italian Civil Code,

constantly in pursuit of results that are advantageous and sustainable for the Luxottica Group

as a whole.

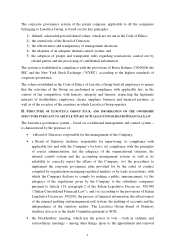

The main instruments for implementing unified management of the subsidiary companies are

represented by:

• preparation of industrial and commercial plans;

• preparation of budgets and the assignment of objectives and projects;

• forecasting of adequate information flows for management and control;

• review and approval of extraordinary or particularly significant operations;

• preparation of certain financial policies (for example, the definition of

indebtedness and cash investment or cash equivalent investment criteria);

• establishment of central structures to provide professional services and

support to all the companies belonging to the Group;

• adoption of codes of conduct and procedures binding for the entire Group;

• adoption of common organization models; and

• formulation of guidelines on the composition, operation and role of the

board of directors of the subsidiary companies as well as on the

assignment of management responsibilities in the subsidiary companies,

consistent with those adopted by the parent company.