LensCrafters 2013 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Luxottica

Group S.p.A.

credit

agreement

with various

financial

institutions(a)

Senior

unsecured

guaranteed

notes(b)

Credit

agreement

with various

financial

institutions(c)

Credit

agreement

with various

financial

institutions

for Oakley

acquisition(d)

Other loans

with banks

and other

third parties,

interest at

various rates,

payable in

installments

through 2014(e)

Total

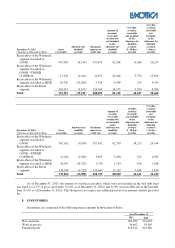

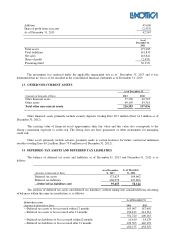

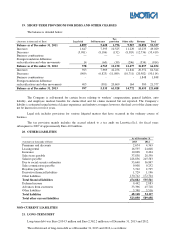

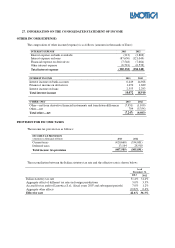

Balance as of January 1, 2013 367,743

1,723,225

45,664

174,922

50,624

2,362,178

Proceeds from new and existing

loans —

—

—

—

5,254

5,254

Repayments (70,000)

(15,063)

(45,500)

(173,918)

(22,587)

(327,068)

Loans assumed in business

combinations —

—

—

—

16,073

16,073

Amortization of fees and

interests 735

1,877

124

96

4,419

7,251

Translation difference —

(26,068)

(288)

(1,100)

(1,722)

(29,179)

Balance as of December 31,

2013

298,478

1,683,970

—

—

52,061

2,034,510

Luxottica

Group S.p.A.

credit

agreement

with various

financial

institutions(a)

Senior

unsecured

guaranteed

notes(b)

Credit

agreement

with various

financial

institutions(c)

Credit

agreement

with various

financial

institutions

for Oakley

acquisition(d)

Other loans

with banks

and other

third parties,

interest at

various rates,

payable in

installments

through 2014(e)

Total

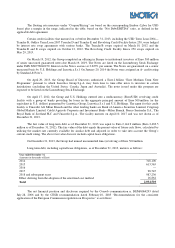

Balance as of January 1,

2012 487,363

1,226,245

225,955

772,743

30,571

2,742,876

Proceeds from new and

existing loans —

500,000

—

—

33,133

533,133

Repayments (120,000)

—

(181,149)

(607,247)

(38,159)

(946,555)

Loans assumed in business

combinations —

—

—

—

30,466

30,466

Amortization of fees and

interests 380

9,104

484

16

(4,312)

5,672

Foreign translation difference —

(12,124)

374

9,411

(1,075)

(3,415)

Balance as of December 31,

2012

367,743

1,723,225

45,664

174,922

50,624

2,362,178

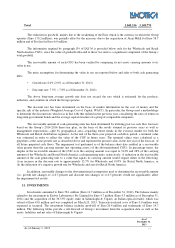

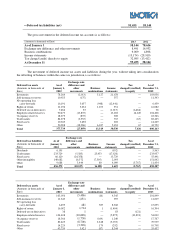

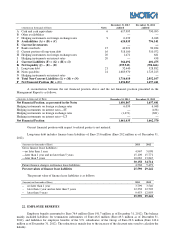

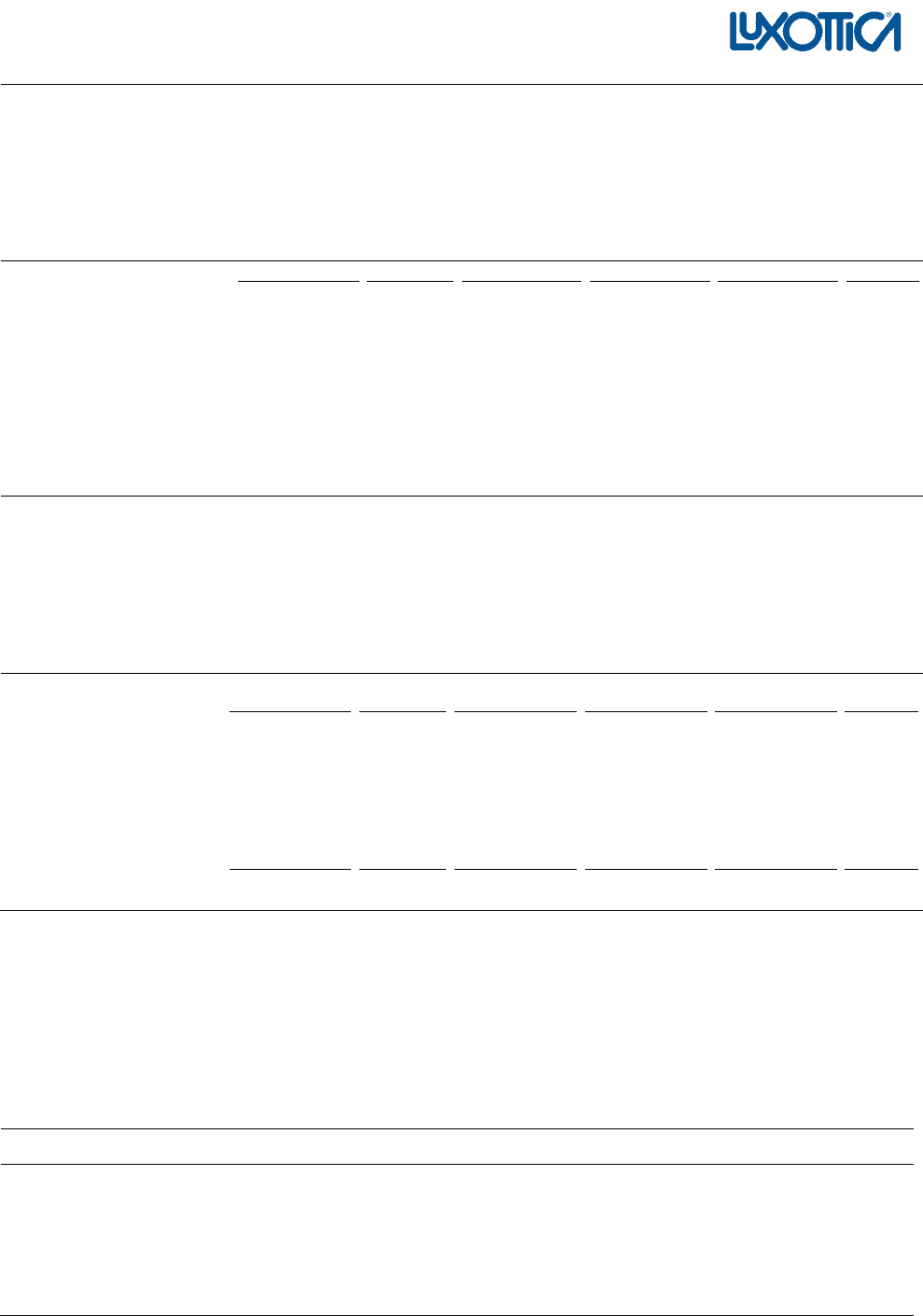

The Group uses debt financing to raise financial resources for long-term business operations and to finance

acquisitions. The Group continues to seek debt refinancing at favorable market rates and actively monitors the debt

capital markets in order to take action to issue debt, when appropriate. Our debt agreements contain certain covenants,

including covenants that limit our ability to incur additional indebtedness (for more details see note 3(f)—Default risk:

negative pledges and financial covenants). As of December 31, 2013, we were in compliance with these financial

covenants.

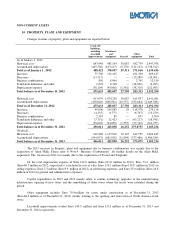

The table below summarizes the Group’s long-term debt as of December 31, 2013.

Type Series Issuer/Borrower Issue Date CCY Amount

Outstanding

amount at the

reporting date Coupon / Pricing

Interest rate as

of December 31,

2013 Maturity

2009 Term Loan

Luxottica Group

S.p.A.

November

11,

2009

EUR

300,000,000

300,000,000

Euribor

+

1.00%

/2.75

%

1.

234

%

November

30, 2014

Private Placement

B

Luxottica US Holdings

July

1, 2008

USD

127,000,000

127,000,000

6.420%

6.420%

July

1, 2015

Bond (Listed on Luxembourg Stock

Exchange) Luxottica Group S.p.A. November 10, 2010 EUR 500,000,000 500,000,000 4.000% 4.000% November 10, 2015

Private Placement

D

Luxottica US Holdings

January

29, 2010

USD

50,000,000

50,000,000

5.190%

5.190%

January

29, 2017

2012 Revolving Credit Facility

Luxottica Group

S.p.A

.

April

17, 2012

EUR

500,000,000

—

Euribor

+

1.30%/2.25%

—

April

10, 2017

Private Placement

G

Luxottica Group

S.p.A.

September

30, 2010

EUR

50,000,000

50,000,000

3.750%

3.750%

September

15, 2017

Private Placement

C

Luxottica US Holdings

July

1, 2008

USD

128,000,000

128,000,000

6.770%

6.770%

July

1, 2018

Private Placement

F

Luxottica US Holdings

January

29, 2010

USD

75,000,000

75,000,000

5.390%

5.390%

January

29, 2019

Bond (Listed on Luxembourg Stock

Exchange) Luxottica Group S.p.A. March 19, 2012 EUR 500,000,000 500,000,000 3.625% 3.625% March 19, 2019

Private Placement

E

Luxottica US Holdings

January

29, 2010

USD

50,000,000

50,000,000

5.750%

5.750%

January

29, 2020

Private Placement

H

Luxottica Group

S.p.A.

September

30, 2010

EUR

50,000,000

50,000,000

4.250%

4.250%

September

15, 2020

Private Placement

I

Luxottica US Holdings

December

15, 2011

USD

350,000,000

350,000,000

4.350%

4.350%

December

15, 2021