LensCrafters 2013 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

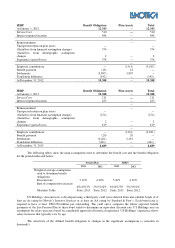

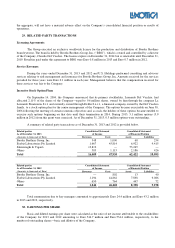

Interest rate swaps

As of December 31, 2013 interest rate swap instruments have all expired.

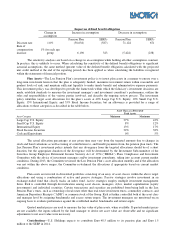

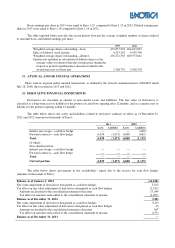

33. NON-RECURRING TRANSACTIONS

In the three-month period ended June 30, 2013 the Group incurred non-recurring expenses totaling

Euro 9.0 million, related to the restructuring of the newly acquired Alain Mikli business, a French luxury and

contemporary eyewear company. The Group recorded a tax benefit related to these expenses of approximately

Euro 3.1 million. In the fourth quarter of 2013 the Group recorded non-recurring expenses of (i) Euro 26.7 million

related to the settlement of the tax audit of Luxottica S.r.l. (fiscal year 2007), and (ii) of Euro 40.0 million related to tax

audit relating to Luxottica S.r.l. (fiscal years subsequent to 2007).

On January 24, 2012, the Board of Directors of Luxottica approved the reorganization of the retail business in

Australia. As a result of this reorganization the Group closed approximately 10% of its Australian and New Zealand

stores, redirecting resources into its market leading OPSM brand. As a result of the reorganization, the Group incurred

non-recurring expenses of approximately Euro 21.7 million. The Group also recorded a non-recurring tax benefit of

Euro 6.5 million related to the reorganization of the retail business in Australia and a non-recurring tax expense of Euro

10.0 million for the tax audit related to Luxottica S.r.l (fiscal year 2007).

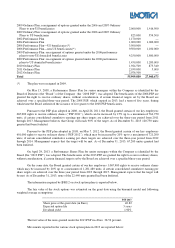

34. SHARE-BASED PAYMENTS

Beginning in April 1998, certain officers and other key employees of the Company and its subsidiaries were

granted stock options of Luxottica Group S.p.A. under the Company’s stock option plans (the “plans”). In order to

strengthen the loyalty of some key employees—with respect to individual targets, and in order to enhance the overall

capitalization of the Company—the Company’s stockholders meetings approved three stock capital increases on

March 10, 1998, September 20, 2001 and June 14, 2006, respectively, through the issuance of new common shares to be

offered for subscription to employees. On the basis of these stock capital increases, the authorized share capital was

equal to Euro 29,457,295.98. These options become exercisable at the end of a three-year vesting period. Certain

options may contain accelerated vesting terms if there is a change in ownership (as defined in the plans).

The stockholders’ meeting has delegated the Board of Directors to effectively execute, in one or more

installments, the stock capital increases and to grant options to employees. The Board can also:

– establish the terms and conditions for the underwriting of the new shares;

– request the full payment of the shares at the time of their underwriting;

– identify the employees to grant the options based on appropriate criteria; and

– regulate the effect of the termination of the employment relationships with the Company or its subsidiaries

and the effects of the employee death on the options granted by specific provision included in the

agreements entered into with the employees.

Upon execution of the proxy received from the Stockholders’ meeting, the Board of Directors has granted a

total of 55,909,800 options of which, as of December 31, 2013, 27,060,673 have been exercised.

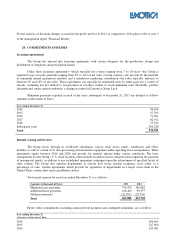

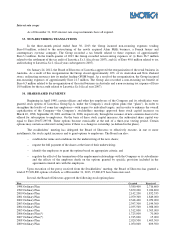

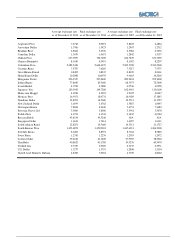

In total, the Board of Directors approved the following stock option plans:

Plan

Granted

Exercised

1998 Ordinary Plan 3,380,400

2,716,600

1999 Ordinary Plan 3,679,200

3,036,800

2000 Ordinary Plan 2,142,200

1,852,533

2001 Ordinary Plan 2,079,300

1,849,000

2002 Ordinary Plan 2,348,400

2,059,000

2003 Ordinary Plan 2,397,300

2,199,300

2004 Ordinary Plan 2,035,500

1,988,000

2005 Ordinary Plan 1,512,000

1,305,000

2006 Ordinary Plan(*) 1,725,000

70,000

2007 Ordinary Plan(*) 1,745,000

15,000

2008 Ordinary Plan 2,020,500

1,405,300

2009 Ordinary Plan 1,050,000

609,500