LensCrafters 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253

|

|

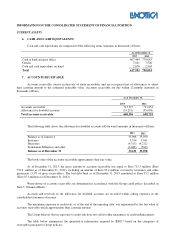

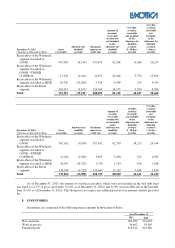

INFORMATION ON THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION

CURRENT ASSETS

6. CASH AND CASH EQUIVALENTS

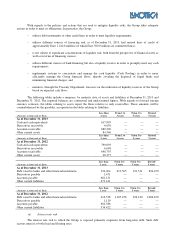

Cash and cash equivalents are comprised of the following items (amounts in thousands of Euro):

As of December 31

2013 2012

Cash at bank and post office 607,499

779,683

Checks 7,821

7,506

Cash and cash equivalents on hand 2,676

2,904

Total 617,995

790,093

7. ACCOUNTS RECEIVABLE

Accounts receivable consist exclusively of trade receivables and are recognized net of allowances to adjust

their carrying amount to the estimated realizable value. Accounts receivable are due within 12 months (amounts in

thousands of Euro):

As of December 31,

2013 2012

Accounts receivable 715,527

733,854

Allowance for doubtful accounts (35,231)

(35,098)

Total accounts receivable 680,296

698,755

The following table shows the allowance for doubtful accounts roll-forward (amounts in thousands of Euro):

2013 2012

Balance as of January 1 35,098

35,959

Increases 5,534

3,941

Decreases (4,313)

(4,212)

Translation difference and other (1,088)

(590)

Balance as of December 31 35,231

35,098

The book value of the accounts receivable approximates their fair value.

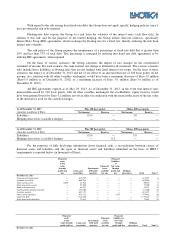

As of December 31, 2013, the gross amount of accounts receivable was equal to Euro 715.5 million (Euro

733.9 million as of December 31, 2012), including an amount of Euro 23.4 million covered by insurance and other

guarantees (3.3% of gross receivables). The bad debt fund as of December 31, 2013 amounted to Euro 35.2 million

(Euro 35.1 million as of December 31, 2012).

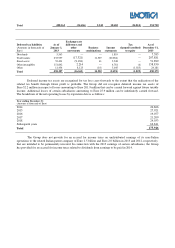

Write-downs of accounts receivable are determined in accordance with the Group credit policy described in

Note 3 “Financial Risks.”

Accruals and reversals of the allowance for doubtful accounts are recorded within selling expenses in the

consolidated statement of income.

The maximum exposure to credit risk, as of the end of the reporting date, was represented by the fair value of

accounts receivable which approximates their carrying amount.

The Group believes that its exposure to credit risk does not call for other guarantees or credit enhancements.

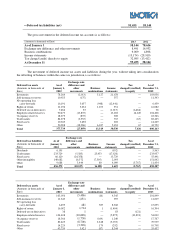

The table below summarizes the quantitative information required by IFRS 7 based on the categories of

receivables pursuant to Group policies: