LensCrafters 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

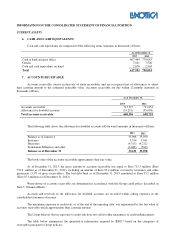

• “GOOD” (active customers), for which no accrual for doubtful accounts is recorded for accounts

receivable overdue for less than 90 days. Beyond 90 days overdue a specific accrual is made in accordance

with the customer’s credit worthiness (customers “GOOD UNDER CONTROL”); and

• “RISK” (no longer active customers), for which the outstanding accounts receivable are fully provided.

The following are examples of events that may fall into the definition of RISK:

a. Significant financial difficulties of the customers;

b. A material contract violation, such as a general breach or default in paying interest or

principal;

c. The customer declares bankruptcy or is subject to other insolvency proceedings; and

d. All cases in which there is documented proof certifying the non-recoverability of the

receivables (i.e., the inability to trace the debtor, seizures).

Furthermore, the assessment of the losses incurred in previous years is taken into account to determine the

balance of the bad debt provision.

The Group does not have significant concentrations of credit risk. In any case, there are proper procedures in

place to ensure that the sales of products and services are made to reliable customers on the basis of their financial

position as well as past experience and other factors. Credit limits are defined according to internal and external

evaluations that are based on thresholds approved by the Board of Directors.

The utilization of the credit limits is regularly monitored through automatic controls.

Moreover, the Group has entered into an agreement with an insurance company in order to cover the credit risk

associated with customers of Luxottica Trading and Finance Ltd. in those countries where the Group does not have a

direct presence.

c2) With regards to credit risk related to the management of financial resources and cash availabilities, the

risk is managed and monitored by the Group Treasury Department through financial guidelines to ensure that all the

Group subsidiaries maintain relations with primary bank counterparties. Credit limits with respect to the primary

financial counterparties are based on evaluations and analyses that are implemented by the Group Treasury Department.

Within the Group there are various shared guidelines governing the relations with the bank counterparties, and

all the companies of the Group comply with the “Financial Risk Policy” directives.

Usually, the bank counterparties are selected by the Group Treasury Department and cash availabilities can be

deposited, over a certain limit, only with counterparties with elevated credit ratings (A rating from S&P and A2 rating

from Moody’s), as defined in the policy.

Operations with derivatives are limited to counterparties with solid and proven experience in the trading and

execution of derivatives and with elevated credit ratings, as defined in the policy, in addition to being subordinate to the

undersigning of an ISDA Master Agreement. In particular, counterparty risk of derivatives is mitigated through the

diversification of the counterparty banks with which the Group deals. In this way, the exposure with respect to each

bank is never greater than 25% of the total notional amount of the derivatives portfolio of the Group.

During the course of the year, there were no situations in which credit limits were exceeded. Based on the

information available to the Group, there were no potential losses deriving from the inability of the abovementioned

counterparties to meet their contractual obligations.

(d) Liquidity risk

The management of the liquidity risk which originates from the normal operations of the Group involves the

maintenance of an adequate level of cash availabilities as well as financial availabilities through an adequate amount of

committed credit lines.