LensCrafters 2013 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Footnotes to the statutory financial statements as of December 31, 2013 Page 8 of 71

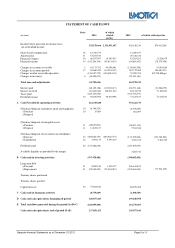

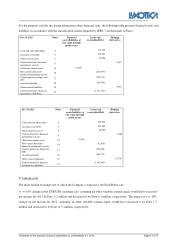

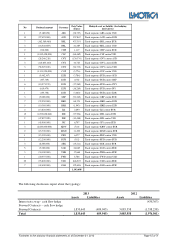

Analysis of the principal financial assets and liabilities:

The following tables analyze the maturity of assets and liabilities as of December 31, 2013 and December 31, 2012.

The figures presented are contractual undiscounted amounts. With reference to foreign exchange forwards, the asset

tables report only those cash flows relating to the obligation to receive, which will be offset by the obligation to pay,

reported in the liability tables. Cash flows relating to interest rate swaps refer to the settlement of the positive or

negative interest differentials maturing in the different periods. The various maturity bands are determined according

to the period running from the reporting date to the contractual maturity of the receipt or payment obligations.

Balances maturing within 12 months approximate the carrying amount of the related liabilities since the effect of

present value discounting is insignificant.

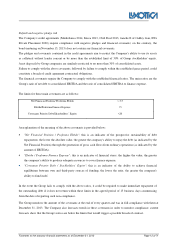

Market risk

The Company is exposed to two types of risk:

a) Interest rate risk

The interest rate risk to which the Company is exposed mainly originates from its long-term debt, which carries both

fixed and floating interest rates.

The Company's floating-rate debt exposes it to a rate volatility risk, which poses a cash flow risk. The Company

hedges this risk using interest rate swaps (IRS), which transform the floating rate into a fixed one and hence reduce

rate volatility risk.

Group policy is to maintain more than 25% but less than 75% of total debt at a fixed rate; this target is achieved by

using interest rate swaps, where necessary.

Based on various scenarios, the Company calculates the impact of a change in rates on the statement of income. Each

simulation applies the same rate change (in terms of basis points) to all currencies. The various scenarios are

developed for only those floating-rate liabilities not hedged against interest rate risk. Based on the simulations

performed, the post-tax impact on net income for 2013 of a rate increase/decrease of 100 basis points, assuming all

other variables remain equal, would respectively be a maximum decrease of Euro 3.1 million (Euro 3.0 million in

2012) or a maximum increase of Euro 3.0 million (Euro 3.0 million also in 2012).

Default and negative pledge risk

The Company's credit agreements (Mediobanca 2014, Club Deal 2013, ING Private Placement 2020) call for

compliance with negative pledges and financial covenants; however, the Company's bond issues (Bond maturing on

November 15, 2015, Bond maturing on March 19, 2019 ) do not carry any obligations to comply with financial

covenants.

The pledges and covenants contained in the credit agreements aim to restrict the Company's ability to use its assets

as collateral without lender consent or by more than the established limit of 30% of Group stockholders' equity.

Asset disposals by Group companies are similarly restricted to no more than 30% of consolidated assets.

Failure to comply with the above terms, followed by failure to comply within an established grace period, could