LensCrafters 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

NON-IFRS MEASURES

Adjusted measures

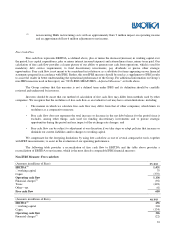

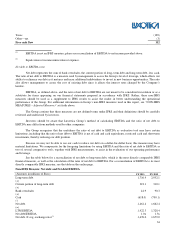

In this Management Report we discussed certain performance measures that are not in accordance with IFRS. Such

non-IFRS measures are not meant to be considered in isolation or as a substitute for items appearing on our financial

statements prepared in accordance with IFRS. Rather, these non-IFRS measures should be used as a supplement to IFRS

results to assist the reader in better understanding our operational performance.

Such measures are not defined terms under IFRS and their definitions should be carefully reviewed and understood

by investors. Such non-IFRS measures are explained in detail and reconciled to their most comparable IFRS measures below.

In order to provide a supplemental comparison of current period results of operations to prior periods, we have

adjusted for certain non-recurring transactions or events.

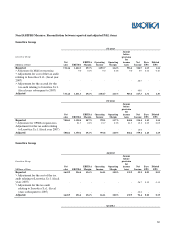

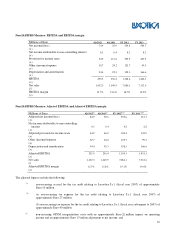

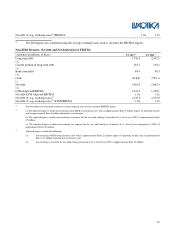

In 2012, we made such adjustments to the following measures: operating income, operating margin, EBITDA and

EBITDA margin. We have also made adjustments to net income,earnings per share, operating expenses, selling expenses and

general and administrative expenses. We adjusted the above items by excluding non-recurring costs related to (i) the

reorganization of the Australian retail business amounting to Euro 21.7 million (Euro 15.2 million net of the tax effect) and

(ii) the tax audit of Luxottica S.r.l. (fiscal year 2007), amounting to Euro 10.0 million.

In 2013, we made such adjustments to the following measures: operating income, operating margin, EBITDA and

EBITDA margin. We have also adjusted net income, earnings per share, operating expenses, selling expenses and general and

administrative expenses. We adjusted the above items by excluding non-recurring costs related to (i) the reorganization of the

newly acquired Alain Mikli business for Euro 9.0 million (Euro 5.9 million net of the tax effect), (ii) the tax audit of

Luxottica S.r.l. (fiscal year 2007) for Euro 26.7 million and (iii) the tax audit of Luxottica S.r.l. (fiscal years subsequent to

2007) for Euro 40.0 million.

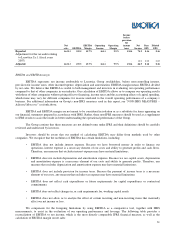

The adjusted measures referenced above are not measures of performance in accordance with International Financial

Reporting Standards(IFRS), as issued by the International Accounting Standards Board and endorsed by the European Union.

The Group believes that these adjusted measures are useful to both management and investors in evaluating the Group’s

operating performance compared with that of other companies in its industry in order to provide a supplemental view of

operations that exclude items that are unusual, infrequent or unrelated to our ongoing operations.

Non – IFRS measures such as EBITDA, EBITDA margin, free cash flows and the ratio of net debt to EBITDA are

included in this Management Report in order to:

• improve transparency for investors;

• assist investors in their assessment of the Group’s operating performance and its ability to refinance its debt as it

matures and incur additional indebtedness to invest in new business opportunities;

• assist investors in their assessment of the Group’s cost of debt;

• ensure that these measures are fully understood in light of how the Group evaluates its operating results and

leverage;

• properly define the metrics used and confirm their calculation; and

• share these measures with all investors at the same time.

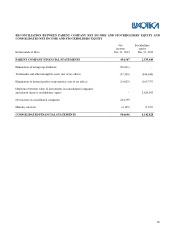

See the tables below for a reconciliation of the adjusted measures discussed above to their most directly comparable

IFRS financial measures or, in the case of adjusted EBITDA, to EBITDA, which is also a non-IFRS measure. For a

reconciliation of EBITDA to its most directly comparable IFRS measure, see the disclosure following the tables below: