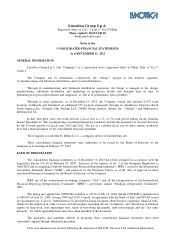

LensCrafters 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Buildings and building improvements From 19 to 40 years

Machinery and equipment From 3 to 12 years

Aircraft 25 years

Other equipment From 5 to 8 years

Leasehold Improvements The lower of useful life and the residual

duration of the lease contract

Depreciation stops when is classified as held for sales, in compliance with IFRS 5 “Non-Current Assets Held

for Sale and Discontinued Operations”.

Subsequent costs are included in the asset’s carrying amount or recognized as a separate asset, as appropriate,

only when it is probable that future economic benefits associated with the item will flow to the Group and the cost of

the item can be measured reliably. The carrying amount of the replaced part is derecognized. Repairs and maintenance

costs are charged to the consolidated statement of income during the financial period in which they are incurred.

Borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying item

of Property, Plant and Equipment are capitalized as part of the cost of that asset.

The net carrying amount of the qualifying items of Property, Plant and Equipment as well as their useful lives

are assessed and, if necessary, at each balance sheet date. Their net carrying amount written down if it is lower than

their recoverable amount.

Upon disposal or when no future economic benefits are expected from the use of an item of property, plant and

equipment, its carrying amount is derecognized. The gain or loss arising from derecognition is included in profit and

loss.

Assets held for sale

Assets held for sale include non-current assets (or disposal groups) whose carrying amount will be primarily

recovered through a sale transaction rather than through continuing use and whose sale is highly probable in the short

term. Assets held for sale are measured at the lower of their carrying amount and their fair value, less costs to sell.

Finance and operating leases

Leases in which a significant portion of the risks and rewards of ownership are retained by the lessor are

classified as operating leases. Payments made under operating leases (net of any incentives received from the lessor) are

charged to the consolidated statement of income on a straight-line basis over the lease term.

Leases where lessees bear substantially all the risks and rewards of ownership are classified as finance leases.

Finance leases are capitalized at the lease’s commencement at the lower of the fair value of the leased property and the

present value of the minimum lease payments.

Each finance lease payment is allocated between the liability and finance charges. The corresponding rental

obligations, net of finance charges, are included in “long-term debt” in the statement of financial position. The interest

element of the finance cost is charged to the consolidated statement of income over the lease period. The assets acquired

under finance leases are depreciated over the shorter of the useful life of the asset and the lease term.

Intangible assets

(a) Goodwill

Goodwill represents the excess of the cost of an acquisition over the fair value of the Group’s share of the net

identifiable assets of the acquired subsidiary at the date of acquisition. Goodwill is tested at least annually for

impairment and carried at cost less accumulated impairment losses. Impairment losses on goodwill are not reversed.

Gains and losses on the disposal of an entity include the carrying amount of goodwill relating to the entity sold.

(b) Trademarks and other intangible assets