LensCrafters 2013 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

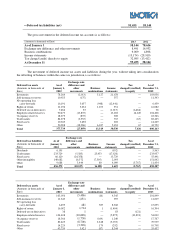

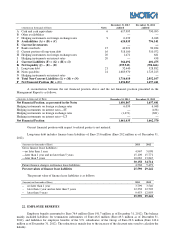

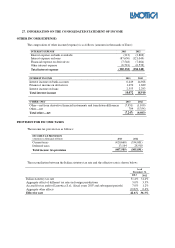

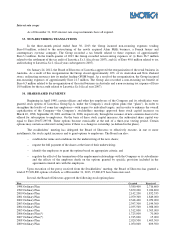

Impact on defined benefit obligation

Change in

assumption

Increase in assumption Decrease in assumption

Pension Plan SERPs Pension Plan SERPs

Discount rate 1.0% (58,638) (587) 71,122 671

Rate of

compensation

increase

1% for each age

group 6,190 323 (5,422) (238)

The sensitivity analyses are based on a change in an assumption while holding all other assumptions constant.

In practice, this is unlikely to occur. When calculating the sensitivity of the defined benefit obligations to significant

actuarial assumptions, the same method (present value of the defined benefit obligation calculated with the projected

unit credit method at the end of the reporting period) has been applied as when calculating the liabilities recognized

within the statements of financial position.

Plan Assets—The Lux Pension Plan’s investment policy is to invest plan assets in a manner to ensure over a

long-term investment horizon that the plan is adequately funded; maximize investment return within reasonable and

prudent levels of risk; and maintain sufficient liquidity to make timely benefit and administrative expense payments.

This investment policy was developed to provide the framework within which the fiduciary’s investment decisions are

made, establish standards to measure the investment manager’s and investment consultant’s performance, outline the

roles and responsibilities of the various parties involved, and describe the ongoing review process. The investment

policy identifies target asset allocations for the plan’s assets at 40% Large Cap U.S. Equity, 10% Small Cap U.S.

Equity, 15% International Equity, and 35% Fixed Income Securities, but an allowance is provided for a range of

allocations to these categories as described in the table below.

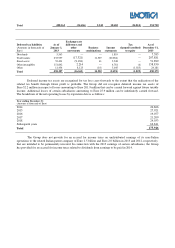

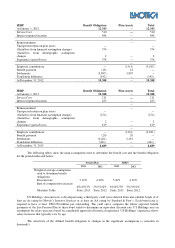

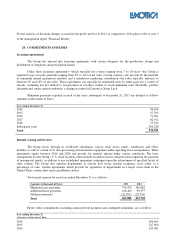

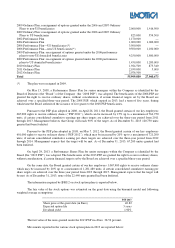

Asset Class as a Percent of

Total Assets

Asset Category

Minimum

Maximum

Large Cap U.S. Equity 37%

43%

Small Cap U.S. Equity 8%

12%

International Equity 13%

17%

Fixed Income Securities 32%

38%

Cash and Equivalents 0%

5%

The actual allocation percentages at any given time may vary from the targeted amounts due to changes in

stock and bond valuations as well as timing of contributions to, and benefit payments from, the pension plan trusts. The

Lux Pension Plan’s investment policy intends that any divergence from the targeted allocations should be of a short

duration, but the appropriate duration of the divergence will be determined by the Investment Subcommittee of the

Luxottica Group Employee Retirement Income Security Act of 1974 (“ERISA”) Plans Compliance and Investment

Committee with the advice of investment managers and/or investment consultants, taking into account current market

conditions. During 2013, the Committee reviewed the Lux Pension Plan’s asset allocation monthly and if the allocation

was not within the above ranges, the Committee re-balanced the allocations if appropriate based on current market

conditions.

Plan assets are invested in diversified portfolios consisting of an array of asset classes within the above target

allocations and using a combination of active and passive strategies. Passive strategies involve investment in an

exchange-traded fund that closely tracks an index fund. Active strategies employ multiple investment management

firms. Risk is controlled through diversification among asset classes, managers, styles, market capitalization (equity

investments) and individual securities. Certain transactions and securities are prohibited from being held in the Lux

Pension Plan’s trusts, such as ownership of real estate other than real estate investment trusts, commodity contracts, and

American Depositary Receipts (“ADR”) or common stock of the Group. Risk is further controlled both at the asset class

and manager level by assigning benchmarks and excess return targets. The investment managers are monitored on an

ongoing basis to evaluate performance against the established market benchmarks and return targets.

Quoted market prices are used to measure the fair value of plan assets, when available. If quoted market prices

are not available, the inputs utilized by the fund manager to derive net asset value are observable and no significant

adjustments to net asset value were necessary.

Contributions—U.S. Holdings expects to contribute Euro 48.5 million to its pension plan and Euro 1.5

million to the SERP in 2014.