LensCrafters 2013 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253

|

|

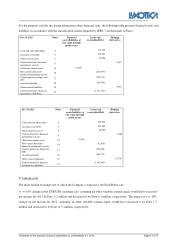

Footnotes to the statutory financial statements as of December 31, 2013 Page 12 of 71

Default and negative pledge risk

The Company's credit agreements (Mediobanca 2014, Intesa 2013, Club Deal 2013, tranche E of Oakley loan, ING

Private Placement 2020) require compliance with negative pledges and financial covenants; on the contrary, the

bond (maturing on November 15, 2015) does not contain any financial covenants.

The pledges and covenants contained in the credit agreements aim to restrict the Company's ability to use its assets

as collateral without lender consent or by more than the established limit of 30% of Group stockholders' equity.

Asset disposals by Group companies are similarly restricted to no more than 30% of consolidated assets.

Failure to comply with the above covenants, followed by failure to comply within the established grace period, could

constitute a breach of credit agreement contractual obligations.

The financial covenants require the Company to comply with the established financial ratios. The main ratios are the

Group's ratio of net debt to consolidated EBITDA and the ratio of consolidated EBITDA to finance expense.

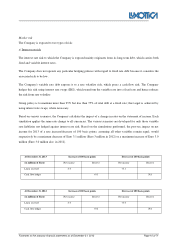

The limits for these main covenants are as follows:

Net Financial Position/ Proforma Ebitda

< 3.5

Ebitda/Proforma Finance Expense

>5

Covenants Priority Debt/Shareholders’ Equity <20

An explanation of the meaning of the above covenants is provided below:

• "Net Financial Position / Proforma Ebitda": this is an indicator of the prospective sustainability of debt

repayments; the lower the absolute value, the greater the company's ability to repay the debt (as indicated by the

Net Financial Position) through the generation of gross cash flows from ordinary operations (as indicated by the

amount of EBITDA);

• "Ebitda / Proforma Finance Expense": this is an indicator of financial stress; the higher the value, the greater

the company's ability to produce adequate resources to cover finance expense;

• "Covenants Priority Debt / Stockholders’ Equity": this is an indicator of the ability to achieve financial

equilibrium between own and third-party sources of funding; the lower the ratio, the greater the company's

ability to fund itself.

In the event the Group fails to comply with the above ratios, it could be required to make immediate repayment of

the outstanding debt if it does not return within these limits in the agreed period of 15 business days commencing

from the date of reporting such non-compliance.

The Group monitors the amount of the covenants at the end of every quarter and was in full compliance with them at

December 31, 2013. The Company also forecasts trends in these covenants in order to monitor compliance; current

forecasts show that the Group's ratios are below the limits that would trigger a possible breach of contract.