LensCrafters 2013 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

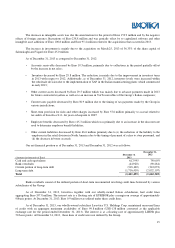

The decrease in intangible assets was due the amortization for the period of Euro 153.9 million and by the negative

effects of foreign currency fluctuations of Euro 238.8 million and was partially offset by to capitalized software and other

intangible asset additions of Euro 100.8 million and Euro 95.2 million related to the acquisitions that occurred in 2013.

The increase in investment is mainly due to the acquisition on March 25, 2013 of 36.33% of the share capital of

Salmoiraghi and Viganò for Euro 45.0 million.

As of December 31, 2013 as compared to December 31, 2012:

• Accounts receivable decreased by Euro 18.5 million, primarily due to collections in the period partially offset

by the increase in net sales ;

• Inventory decreased by Euro 29.8 million. The reduction is mainly due to the improvement in inventory turns

in 2013 with respect to 2012. Additionally, as of December 31, 2012, inventory levels were increased within

the wholesale division due to the implementation of SAP in the Italian manufacturing plants which commenced

in early 2013;

• Other current assets decreased by Euro 29.5 million which was mainly due to advance payments made in 2013

for future contracted royalties as well as to an increase in VAT receivables of the Group’s Italian companies;

• Current taxes payable decreased by Euro 56.9 million due to the timing of tax payments made by the Group in

various jurisdictions;

• Short-term provision for risks and other charges increased by Euro 57.6 million primarily to accrual related to

tax audits of Luxottica S.r.l. for years subsequent to 2007;

• Employee benefits decreased by Euro 115.3 million which was primarily due to an increase in the discount rate

used to determine employee benefit liabilities;

• Other current liabilities drecreased by Euro 66.6 million primiraly due to (i) the reduction of the liability to the

employees in the retail division in North America due to the timing of payment of salary to store personnel, and

(ii) the decrease in bonus accruals.

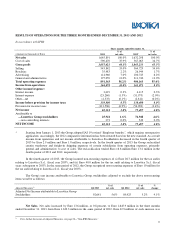

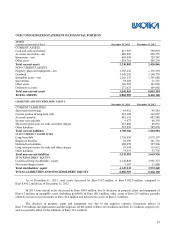

Our net financial position as of December 31, 2013 and December 31, 2012 was as follows:

(Amounts in thousands of Euro)

December 31

2013

December 31,

2012

Cash and cash equivalents 617,995

790,093

Bank overdrafts (44,920)

(90,284)

Current portion of long-term debt (318,100)

(310,072)

Long-term debt (1,716,410)

(2,052,107)

Total (1,461,435)

(1,662,369)

Bank overdrafts consist of the utilized portion of short-term uncommitted revolving credit lines borrowed by various

subsidiaries of the Group.

As of December 31, 2013, Luxottica together with our wholly-owned Italian subsidiaries, had credit lines

aggregating Euro 357.8 million. The interest rate is a floating rate of EURIBOR plus a margin on average of approximately

90basis points. At December 31, 2013, Euro 0.9 million was utilized under these credit lines.

As of December 31, 2013, our wholly-owned subsidiary Luxottica U.S. Holdings Corp. maintained unsecured lines

of credit with an aggregate maximum availability of Euro 99.8 million (USD 138 million converted at the applicable

exchange rate for the period ended December 31, 2013). The interest is at a floating rate of approximately LIBOR plus

50 basis points. At December 31, 2013, these lines of credit were not utilized by the Group.