LensCrafters 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

(4)

non-recurring Mikli restructuring costs with an approximately Euro 9 million impact on operating income

and an approximately Euro 6 million adjustment to net income.

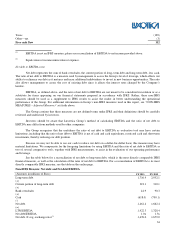

Free Cash Flow

Free cash flow represents EBITDA, as defined above, plus or minus the decrease/(increase) in working capital over

the period, less capital expenditures, plus or minus interest income/(expense) and extraordinary items, minus taxes paid. Our

calculation of free cash flow provides a clearer picture of our ability to generate net cash from operations, which is used for

mandatory debt service requirements, to fund discretionary investments, pay dividends or pursue other strategic

opportunities. Free cash flow is not meant to be considered in isolation or as a substitute for items appearing on our financial

statements prepared in accordance with IFRS. Rather, this non-IFRS measure should be used as a supplement to IFRS results

to assist the reader in better understanding the operational performance of the Group. For additional information on Group’s

non-IFRS measures used in this report, see “NON-IFRS MEASURES – Adjusted Measures” set forth above.

The Group cautions that this measure is not a defined term under IFRS and its definition should be carefully

reviewed and understood by investors.

Investors should be aware that our method of calculation of free cash flow may differ from methods used by other

companies. We recognize that the usefulness of free cash flow as an evaluative tool may have certain limitations, including:

• The manner in which we calculate free cash flow may differ from that of other companies, which limits its

usefulness as a comparative measure;

• Free cash flow does not represent the total increase or decrease in the net debt balance for the period since it

excludes, among other things, cash used for funding discretionary investments and to pursue strategic

opportunities during the period and any impact of the exchange rate changes; and

• Free cash flow can be subject to adjustment at our discretion if we take steps or adopt policies that increase or

diminish our current liabilities and/or changes to working capital.

We compensate for the foregoing limitations by using free cash flow as one of several comparative tools, together

with IFRS measurements, to assist in the evaluation of our operating performance.

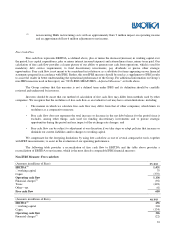

The following table provides a reconciliation of free cash flow to EBITDA and the table above provides a

reconciliation of EBITDA to net income, which is the most directly comparable IFRS financial measure:

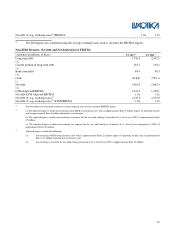

Non-IFRS Measure: Free cash flow

(Amounts in millions of Euro)

FY 2013

EBITDA

(1)

1,431

∆ working capital 75

Capex (370)

Operating cash flow

1,136

Financial charges

(2)

(92)

Taxes (428)

Other—net (6)

Free cash flow

610

(Amounts in millions of Euro)

4Q 2013

EBITDA

(1)

256

∆ working capital 204

Capex (134)

Operating cash flow

326

Financial charges

(2)

(22)