LensCrafters 2013 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

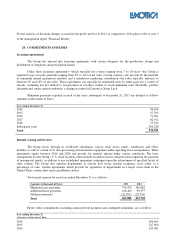

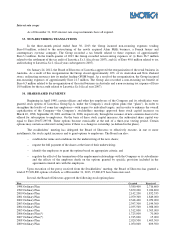

2009 Ordinary plan for citizens not resident in the U.S. 4.35

2009 Ordinary plan for citizens resident in the U.S. 4.35

2009 Plan—reassignment of 2006/2007 plans for citizens resident in the U.S. 3.25

2009 Plan—reassignment of 2006/2007 plans for citizens not resident in the U.S. 4.35

2009 Plan—reassignment of 2006 plans for citizens not resident in the U.S. 4.35

2009 Plan—reassignment of 2006 plans for citizens resident in the U.S. 4.45

2010 Ordinary Plan—for citizens not resident in the U.S. 5.33

2010 Ordinary Plan—for citizens resident in the U.S. 5.33

2011 Ordinary Plan—for citizens not resident in the U.S. 6.33

2011 Ordinary Plan—for citizens resident in the U.S. 6.33

2012 Ordinary Plan—for citizens not resident in the U.S. 7.35

2012 Ordinary Plan—for citizens resident in the U.S. 7.35

With regards to the options exercised during the course of 2013, the weighted average share price of the shares

in 2013 was equal to Euro 38.27.

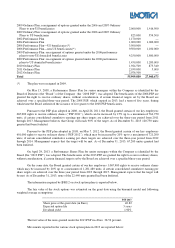

The Group has recorded an expense for the ordinary stock option plans of Euro 9.5 million and Euro 10.8

million in 2013 and 2012, respectively. For the extraordinary plan as well as for the 2009, 2010, 2011, 2012 and 2013

PSPs , the Group recorded an expense of Euro 18.7 million and Euro 30.5 million in 2013 and 2012, respectively.

The stock plans outstanding as of December 31, 2013 are conditional upon satisfying the service conditions.

The PSP plans are conditional upon satisfying service as well as performance conditions.

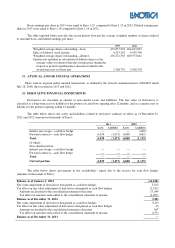

35. DIVIDENDS

In May 2013, the Company distributed aggregate dividends to its stockholders of Euro 273.7 million equal to

Euro 0.58 per ordinary share. Dividends distributed to non-controlling interests totaled Euro 3.5 million. During 2012,

the Company distributed aggregate dividends to its stockholders of Euro 227.4 million equal to Euro 0.49 per ordinary

share. Dividends distributed to non-controlling interests totaled Euro 2.3 million.

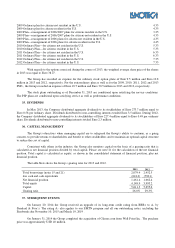

36. CAPITAL MANAGEMENT

The Group’s objectives when managing capital are to safeguard the Group’s ability to continue, as a going

concern, to provide returns to shareholders and benefit to other stockholders and to maintain an optimal capital structure

to reduce the cost of capital.

Consistent with others in the industry, the Group also monitors capital on the basis of a gearing ratio that is

calculated as net financial position divided by total capital. Please see note 21 for the calculation of the net financial

position. Total capital is calculated as equity, as shown in the consolidated statement of financial position, plus net

financial position.

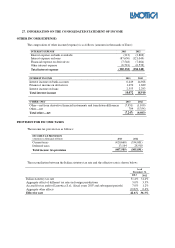

The table blow shows the Group’s gearing ratio for 2013 and 2012.

2013 2012

Total borrowings (notes 15 and 21) 2,079.4

2,452.5

less cash and cash equivalents (618.0)

(790.1)

Net financial position 1,461.4

1,662.4

Total equity 4,149.9

3,993.2

Capital 5,611.3

5,655.6

Gearing ratio 26.0%

29.3%

37. SUBSEQUENT EVENTS

On January 20, 2014 the Group received an upgrade of its long-term credit rating from BBB+ to A- by

Standard & Poor’s. The rating A- also applies to our EMTN program and all our outstanding notes, including the

Eurobonds due November 10, 2015 and March 19, 2019 .

On January 31, 2014 the Group completed the acquisition of Glasses.com from Well Point Inc.. The purchase

price was approximately USD 40 million.