LensCrafters 2013 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2013 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

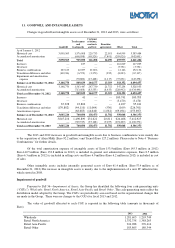

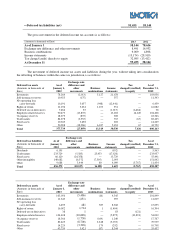

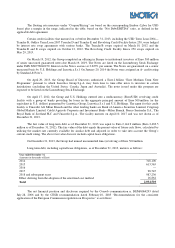

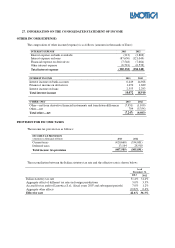

The floating rate measures under “Coupon/Pricing” are based on the corresponding Euribor (Libor for USD

loans) plus a margin in the range, indicated in the table, based on the “Net Debt/EBITDA” ratio, as defined in the

applicable debt agreement.

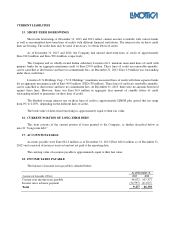

Certain credit facilities that matured on or before December 31, 2013, including the USD Term Loan 2004—

Tranche B, Oakley Term Loan 2007 Tranche D and Tranche E and Revolving Credit Facility Intesa 250, were hedged

by interest rate swap agreements with various banks. The Tranche B swaps expired on March 10, 2012 and the

Tranche D and E swaps expired on October 12, 2012. The Revolving Credit Facility Intesa 250 swaps expired on

May 29, 2013.

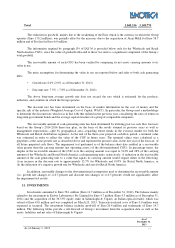

On March 19, 2012, the Group completed an offering in Europe to institutional investors of Euro 500 million

of senior unsecured guaranteed notes due March 19, 2019. The Notes are listed on the Luxembourg Stock Exchange

under ISIN XS0758640279. Interest on the Notes accrues at 3.625% per annum. The Notes are guaranteed on a senior

unsecured basis by U.S. Holdings and Luxottica S.r.l. On January 20, 2014 the Notes were assigned an A- credit rating

by Standard & Poor’s.

On April 29, 2013, the Group Board of Directors authorized a Euro 2 billion “Euro Medium Term Note

Programme” pursuant to which Luxottica Group S.p.A. may from time to time offer notes to investors in certain

jurisdictions (excluding the United States, Canada, Japan and Australia). The notes issued under this program are

expected to be listed on the Luxembourg Stock Exchange.

On April 17, 2012, the Group and U.S. Holdings entered into a multicurrency (Euro/USD) revolving credit

facility with a group of banks providing for loans in the aggregate principal amount of Euro 500 million (or the

equivalent in U.S. dollars) guaranteed by Luxottica Group, Luxottica S.r.l. and U.S. Holdings. The agent for this credit

facility is Unicredit AG Milan Branch and the other lending banks are Bank of America Securities Limited, Citigroup

Global Markets Limited, Crédit Agricole Corporate and Investment Bank—Milan Branch, Banco Santander S.A., The

Royal Bank of Scotland PLC and Unicredit S.p.A.. The facility matures on April 10, 2017 and was not drawn as of

December 31, 2013.

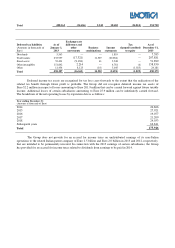

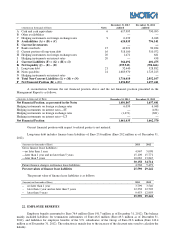

The fair value of long-term debt as of December 31, 2013 was equal to Euro 2,144.9 million (Euro 2,483.5

million as of December 31, 2012). The fair value of the debt equals the present value of future cash flows, calculated by

utilizing the market rate currently available for similar debt and adjusted in order to take into account the Group’s

current credit rating. The above fair value does not include capital lease obligations.

On December 31, 2013, the Group had unused uncommitted lines (revolving) of Euro 500 million.

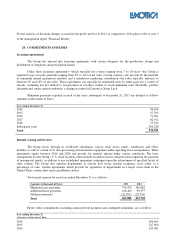

Long-term debt, including capital lease obligations, as of December 31, 2013, matures as follows:

Year ended December 31,

(Amounts in thousands of Euro)

2014 318,100

2015 613,565

2016 —

2017 98,745

2018 and subsequent years 987,236

Effect deriving from the adoption of the amortized cost method 16,864

Total 2,034,510

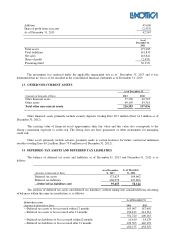

The net financial position and disclosure required by the Consob communication n. DEM/6064293 dated

July 28, 2006 and by the CESR recommendation dated February 10, 2005 “Recommendation for the consistent

application of the European Commission regulation on Prospectus” is as follows: