HTC 2013 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

166 167

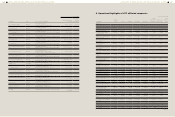

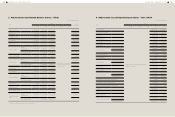

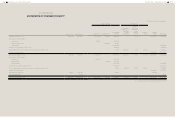

(2) Financial Analysis – ROC GAAP

Item

Year

2013 2012 2011 2010 2009

Capital

Structure

Analysis

Debt Ratio(%)

Financial analysis was

based on IFRSs

59 59 45

Long-term Fund to Fixed Assets Ratio(%) 658 683 790

Liquidity

Analysis

Current Ratio(%) 123 144 188

Quick Ratio(%) 100 120 171

Debt Services Coverage Ratio(%) 6,806 967,203 192,463

Operating

Performance

Analysis

Average Collection Turnover(Times)6.95 5.92 4.92

Days Sales Outstanding 53 62 74

Average Inventory Turnover ( Times)12.11 11.77 11.71

Average Payment Turnover ( Times)4.85 4.59 3.72

Average Inventory Turnover Days 30 31 31

Fixed Assets Turnover(Times)29.51 25.14 17.43

Total Assets Turnover ( Times)1.83 1.49 1.21

Profitability

Analysis

Return on Total Assets(%) 29 26 22

Return on Equity(%) 70 56 37

Paid-in Capital Ratio(%)

Operating Income 761 517 306

Pre-tax Income 820 544 320

Net Margin(%) 14 14 16

Basic Earnings Per Share(NT$)73.32 46.18 26.04

Cash Flow

Cash Flow Ratio(%) 58 37 51

Cash Flow Adequacy Ratio(%) 163 157 201

Cash Flow Reinvestment Ratio(%) 52 26 11

Leverage

Operating Leverage 1.35 1.43 1.54

Financial Leverage 1 1 1

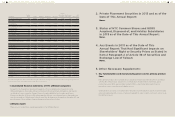

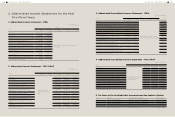

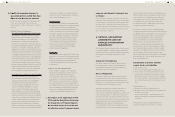

(3) Consolidated Financial Analysis - IFRSs

Item

Year As of

2014.03.31

2013 2012 2011 2010 2009

Capital

Structure

Analysis

Debt Ratio(%) 55 61

Financial analysis was based on

ROC GAAP

54

Long-term Fund to Fixed Assets Ratio(%) 304 309 307

Liquidity

Analysis

Current Ratio(%) 118 108 117

Quick Ratio(%) 87 85 81

Debt Services Coverage Ratio(%) (22) 11,347 (386)

Operating

Performance

Analysis

Average Collection Turnover(Times)5.83 5.27 5.06

Days Sales Outstanding 63 69 72

Average Inventory Turnover(Times)5.81 6.96 3.81

Average Payment Turnover(Times)2.69 2.84 2.34

Average Inventory Turnover Days 63 52 96

Fixed Assets Turnover(Times)7.96 11.12 5.32

Total Assets Turnover(Times)1.18 1.39 0.80

Profitability

Analysis

Return on Total Assets(%) (0.69) 7.61 (1.11)

Return on Equity(%) (1.68) 19.30 (2.44)

Paid-in Capital Ratio(%)

Operating Income (47.14) 220.96 (24.37)

Pre-tax Income (2.32) 228.37 (22.39)

Net Margin(%) (0.65) 6.10 (5.68)

Basic Earnings Per Share(NT$)(1.60) 20.21 (2.28)

Cash Flow

Cash Flow Ratio(%) (17.17) 18.69 (13.01)

Cash Flow Adequacy Ratio(%) 109.71 126.39 96.82

Cash Flow Reinvestment Ratio(%) (19.78) (10.66) (12.81)

Leverage

Operating Leverage (5.87) 2.37 (2.01)

Financial Leverage 1 1 1