HTC 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

226 227

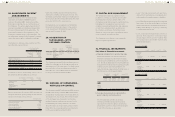

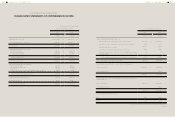

Acquisition of Property, Plant and

Equipment

For the Year Ended

December 31

2013 2012

Subsidiaries $175,444 $23,421

Other related parties - other

related parties' chairperson or

its significant stockholder, is the

Company's chairperson

3,238 61,155

$178,682 $84,576

As of December 31, 2013 and 2012, the unpaid

amounts were NT$175,931 and NT$25,548

thousand, respectively.

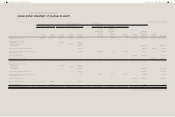

Other Related-party Transactions

a. To enhance product diversity, the Company

entered into a trademark and technology license

agreement with subsidiaries, associate of subsidiary

and other related parties. The royalty expense was

NT$222,760 thousand and NT$292,321 thousand

for the years ended December 31, 2013 and 2012,

respectively. As of December 31, 2012 the amounts

of unpaid royalty was NT$130,960 thousand. As of

December 31, 2013 and 2012 the amounts of prepaid

royalty were NT$55,311 thousand and NT$28,999

thousand, respectively.

b. Subsidiaries and other related parties assisted

the Company to expand business overseas and

render design, research and development support,

consulting services and after-sales services. The

Company recognized related expenses amounting

to NT$9,815,920 thousand and NT$14,359,973

thousand for the years ended December 31, 2013

and 2012, respectively. The unpaid amount were

NT$2,440,229 thousand, NT$2,196,174 thousand and

NT$3,459,293 thousand as of December 31, 2013,

December 31, 2012 and January 1, 2012, respectively.

c. The Company leased staff dormitory owned by a

related party under an operating lease agreement.

The term of the lease agreement is from April 2012

to March 2015 and the rental payment is determined

at the prevailing rates in the surrounding area. The

Company recognized and paid rental expenses

amounting to NT$5,209 thousand for the years

ended December 31, 2013 and 2012, each.

In October 2010, IPCom filed a new complaint

against the Company alleging patent

infringement of patent owned by IPCom in

District Court of Dusseldorf, Germany.

In June 2011, IPCom filed a new complaint

against the Company alleging patent

infringement of patent owned by IPCom

with the High Court in London, the United

Kingdom. In September 2011, the Company

filed declaratory judgment action for non-

infringement and invalidity in Milan, Italy. Legal

proceedings in above-mentioned courts in

Germany and the United Kingdom are still

ongoing. The Company evaluated the lawsuits

and considered the risk of patents-in-suits are

low. Also, preliminary injunction and summary

judgment against the Company are very

unlikely.

In March 2012, Washington Court granted on

the Company's summary judgment motion and

ruled on non-infringement of two of patents-

in-suit. As for the third patents-in-suit, the

Washington Court has granted a stay on case

pending appeal decision. In January 2014, the

Court of Appeal for the Federal Circuit affirmed

the Washington Court's decision.

As of the date that the board of directors

approved and authorized for issuing parent

company only financial statements, there had

been no critical hearing nor had a court decision

been made, except for the above.

b. From May 2011 onwards, Nokia Corporation

("Nokia") and the Company filed patent

infringement actions against the other

respectively in the U.S. International

TradeCommission ("ITC"), U.S. District Court for

the District of Delaware, German district courts,

and English High Court. On February 8, 2014,

the two companies reached a settlement that

included the dismissal of all current lawsuits

and a patent and technology collaboration

agreement. The Company will make payments

to Nokia and the collaboration will involve

the Company's LTE patent portfolio, further

strengthening Nokia's licensing offering. The

d. In 2013, the Company increased investment of

NT$1,048,593 thousand in HTC Investment One

(BVI) Corporation and retained 100% ownership.

In 2012, the Company increased investment of

NT$1,181,915 thousand in H.T.C. (B.V.I.) Corp.,

NT$3,403,451 thousand in High Tech Computer

Asia Pacific Pte. Ltd. and NT$956,002 thousand

in HTC Investment One (BVI) Corporation,

respectively. After these investments, the

Company retained 100% ownership in each

subsidiary.

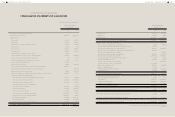

34. PLEDGED ASSETS

To protect the rights and interests of its employees,

in September 2012, the Company deposited unpaid

employee bonus in a new trust account. The trust

account, which is under other current financial

assets, had amounted to NT$2,359,041 thousand

and NT$3,645,820 thousand as of December 31,

2013 and 2012, respectively.

As of January 1, 2012 the Company had provided

time deposits of NT$63,900 thousand had

been classified as other current financial assets,

respectively, as part of the requirements for the

Company to get a certificate from the National Tax

Administration of the Northern Taiwan Province

stating that it had no pending income tax.

35. COMMITMENTS,

CONTINGENCIES AND

SIGNIFICANT CONTRACTS

a. In April 2008, IPCom GMBH & CO., KG ("IPCom")

filed a multi-claim lawsuit against the Company

with the District Court of Mannheim, Germany,

alleging that the Company infringed IPCom's

patents. In November 2008, the Company

filed declaratory judgment action for non-

infringement and invalidity against three of

IPCom's patents with the Washington Court,

District of Columbia.

companies will also explore future technology

collaboration opportunities.

c. In March 2008, Flashpoint Technology, Inc., a

U.S. entity, sued the Company with 10 patents

in the District Court of Delaware alleging the

Company infringed its patents and seeking

damage compensation. The Company filed re-

exams and the district court case was stayed

pending the result of the re-examination from

U.S. Patent and Trademark Office in November

2009, and is still stayed.

In May 2010, Flashpoint filed the first ITC

investigation against the Company with ITC

alleging that the Company infringed its patents

and requested ITC to prevent the Company from

importing to and selling devices in the United

States. In November 2011, the ITC Committee

issued its Final Determination and ruled that the

Company does not infringe patents owned by

Flashpoint.

In May 2012, Flashpoint filed another ITC

investigation against the Company with ITC

alleging that the Company infringed its patents

and requested ITC to prevent the Company

from importing to and selling devices in the

United States. In September 2013, the ITC

Administrative Law Judge made an Initial

Determination that favors the Company on

two of the three patents in suit. On the matter

of the third patent, only two End-of-Life HTC

device models are potentially impacted. The

Company believes the Committee will made a

final determination that favors the Company;

the final determination will be granted in March

14, 2014. Meanwhile, the Company has also

worked on design around solution for all future

products to ensure no business disruption in the

US market.

d. On the basis of its past experience and

consultations with its legal counsel, the

Company has measured the possible effects

of the contingent lawsuits on its business and

financial condition.