HTC 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

208 209

The above items of property, plant and equipment

were depreciated on a straight-line basis at the

following rates per annum:

Building

Machinery and equipment

Other equipment

5-50 years

3-6 years

3-5 years

The major component parts of the buildings held

by the Company included plants, electro-powering

machinery and engineering systems, etc., which

were depreciated over their estimated useful lives

of 40 to 50 years, 20 years and 5 to 10 years,

respectively.

There were no interests capitalized for the years

ended December 31, 2013 and 2012.

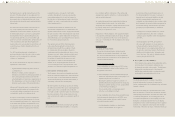

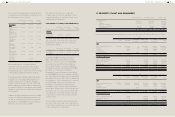

18. INTANGIBLE ASSETS

December 31,

2013

December 31,

2012

January 1,

2012

Carrying amounts

Patents

Other intangible

assets

$1,027,295

623,596

$1,625,340

91,810

$2,120,948

120,593

$1,650,891 $1,717,150 $2,241,541

Movements of intangible assets for the years ended

December 31, 2013 and 2012 were as follows:

2013

Patents

Other

Intangible

Assets

Total

Cost

Balance, beginning

of the year

$2,500,854 $141,128 $2,641,982

Additions

Acquisition 22,214 171,312 193,526

Transfer from

prepayment

- 509,710 509,710

Disposal (6,778) - (6,778)

Balance, end of

the year

2,516,290 822,150 3,338,440

Accumulated

amortization

Balance,

beginning of the

year

875,514 49,318 924,832

Amortization

expenses

502,396 149,236 651,632

Balance, end of

the year

1,377,910 198,554 1,576,464

(Continued)

The average term of payment is four months. The

Company has financial risk management policies

in place to ensure that all payables are paid within

the pre-agreed credit terms.

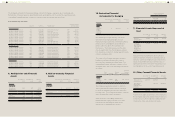

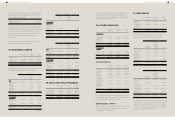

20. OTHER LIABILITIES

December

31, 2013

December

31, 2012

January 1,

2012

Other payables

Accrued expenses

Payables for

purchase of

equipment

Others

$33,004,452

340,961

217,440

$30,873,737

1,119,058

218,468

$42,895,879

348,772

276,802

$33,562,853 $32,211,263 $43,521,453

Other current

liabilities

Advance receipts

Agency receipts

Others

$221,342

173,221

138,242

$86,700

270,073

830,283

$134,748

388,885

630,563

$532,805 $1,187,056 $1,154,196

Accrued Expenses

December

31, 2013

December

31, 2012

January 1,

2012

Marketing $19,328,804 $15,531,875 $25,556,956

Salaries and

bonuses

4,037,445 3,545,320 2,599,569

Services 3,340,826 2,429,101 2,760,164

Bonus to

employees

3,278,053 5,712,075 7,238,637

Materials

and molding

expenses

1,650,849 1,900,218 1,848,332

Import, export

and freight

620,775 443,604 1,197,075

Repairs,

maintenance

and sundry

purchase

176,361 391,726 264,044

Others 571,339 919,818 1,431,102

$33,004,452 $30,873,737 $42,895,879

The Company accrued marketing expenses on the

basis of related agreements and other factors that

would significantly affect the accruals.

Other Payables - Others

Other payables - others were payables for patents,

and agreed installments payable to the original

stockholders of subsidiaries.

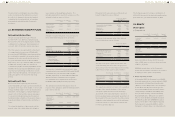

2013

Patents

Other

Intangible

Assets

Total

Accumulated

impairment

Balance,

beginning of the

year

- - -

Impairment

losses

111,085 - 111,085

Balance, end of

the year

111,085 - 111,085

Net book value,

end of the year

$1,027,295 $623,596 $1,650,891

(Concluded)

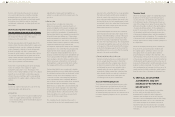

2012

Patents

Other

Intangible

Assets

Total

Cost

Balance, beginning

of the year

$2,500,854 $178,133 $2,678,987

Disposal - (37,005) (37,005)

Balance, end of

the year

2,500,854 141,128 2,641,982

Accumulated

amortization

Balance,

beginning of the

year

$379,906 $57,540 $437,446

Amortization

expenses

495,608 28,783 524,391

Disposal - (37,005) (37,005)

Balance, end of

the year

875,514 49,318 924,832

Net book value,

end of the year

$1,625,340 $91,810 $1,717,150

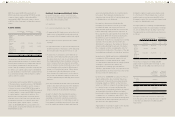

19. NOTE AND TRADE PAYABLES

December 31,

2013

December 31,

2012

January 1,

2012

Note payables

Trade payables

Trade payables

- related parties

$1,355

42,787,368

5,622,019

$294

71,227,290

2,902,985

$3,779

72,851,595

3,639,231

$48,410,742 $74,130,569 $76,494,605

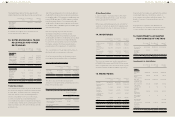

21. PROVISIONS

December 31,

2013

December 31,

2012

January 1,

2012

Warranty

provision

$6,391,787 $6,780,712 $12,755,264

Provisions for

contingent loss

on purchase

orders

832,850 823,005 2,052,881

$7,224,637 $7,603,717 $14,808,145

Movement of provisions for the years ended

December 31, 2013 and 2012 were as follows:

2013

Warranty

Provision

Provisions

for

Contingent

Loss on

Purchase

Orders Total

Balance, beginning

of the year

$6,780,712 $823,005 $7,603,717

Provisions

recognized

12,186,568 359,350 12,545,918

Amount utilized

during the year

(12,679,039) (349,505) (13,028,544)

Translation

adjustment

103,546 - 103,546

Balance, end of

the year

$6,391,787 $832,850 $7,224,637

2012

Warranty

Provision

Provisions

for

Contingent

Loss on

Purchase

Orders Total

Balance, beginning

of the year

$12,755,264 $2,052,881 $14,808,145

Provisions

recognized

8,497,459 - 8,497,459

Reversing un-

usage balances

- (751,363) (751,363)

Amount utilized

during the year

(14,248,587) (478,513) (14,727,100)

Translation

adjustment

(223,424) - (223,424)

Balance, end of

the year

$6,780,712 $823,005 $7,603,717

The Company provides warranty service for its

customers for one year to two years. The warranty

liability is estimated on the basis of evaluation

of the products under warranty, past warranty

experience, and pertinent factors.