HTC 2013 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

272 273

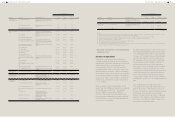

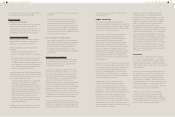

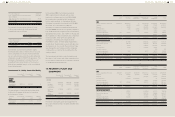

10. DERIVATIVE FINANCIAL

INSTRUMENTS FOR HEDGING

December 31,

2013

December 31,

2012

January 1,

2012

Hedging

derivative

assets

Cash flow

hedge -

forward

exchange

contracts

$- $204,519 $-

The Company's foreign-currency cash flows

derived from the highly probable forecast

transaction may lead to risks on foreign-currency

financial assets and liabilities and estimated

future cash flows due to the exchange rate

fluctuations. The Company assesses the risks

may be significant; thus, the Company entered

into derivative contracts to hedge against foreign-

currency exchange risks.

The terms of the forward exchange contracts had

been negotiated to match the terms of the respective

designated hedged items. The outstanding forward

exchange contracts of the Company at the end of the

reporting period were as follows:

Buy/

Sell Currenc

Maturity

Date

Notional

Amount

(In

Thousands)

December 31,

2012

Foreign

exchange

contracts

Buy USD/JPY 2013.

03.28

USD 95,356

The Company supplied products to clients in

Japan and signed forward exchange contracts

to avoid its exchange rate exposure due to the

forecast sales. Those forward exchange contracts

were designated as cash flow hedges.

Gains and losses of hedging instruments

transferred from equity to profit or loss were

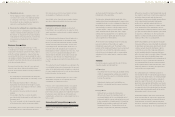

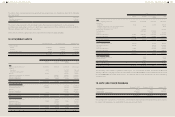

12. OTHER CURRENT FINANCIAL

ASSETS

December 31,

2013

December 31,

2012

January 1,

2012

Trust assets for

employee benefit

$2,359,041 $3,645,820 $-

Time deposits with

original maturities

more than three

months

411,982 2,915,624 25,543,450

$2,771,023 $6,561,444 $25,543,450

To protect the rights and interests of its employees,

the Company deposited unpaid employee bonus in

a new trust account in September 2012 and were

classified as other current financial assets.

The market interest rates of the time deposits with

original maturity more than three months were as

follows:

December 31,

2013

December 31,

2012

January 1,

2012

Time deposits

with original

maturities

more than

three months

2.45%~3.08% 0.39%~3.30% 0.39%~3.30%

For details of pledged other current financial

assets, please refer to Note 34.

included in the following line items in the

consolidated statements of comprehensive income:

For the Year Ended December 31

2013 2012

Revenues

Other gains and losses

$262,648

151,305

$-

10,467

$413,953 $10,467

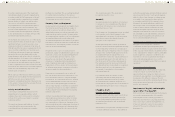

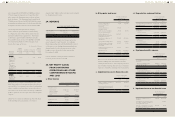

11. FINANCIAL ASSETS

MEASURED AT COST

December

31, 2013

December

31, 2012

January 1,

2012

Domestic

unlisted equity

investment

$698,861 $698,861 $698,861

Overseas

unlisted equity

investment

1,830,694 1,781,514 2,065,876

Overseas unlisted

mutual funds

2,073,506 1,824,532 643,917

$ 4,603,061 $ 4,304,907 $ 3,408,654

Classified

according to

financial asset

measurement

categories

Available-for-

sale financial

assets

$4,603,061 $4,304,907 $3,408,654

Management believed that the above unlisted

equity investments and mutual funds held by the

Company, whose fair value cannot be reliably

measured due to the range of reasonable fair value

estimates was so significant; therefore, they were

measured at cost less impairment at the end of

reporting period.

The Company made a overseas unlisted equity

investment in OnLive, Inc. In August 2012, OnLive,

Inc. declared to have an asset restructuring due

to the lack of operating cash and an inability to

raise new capital. The Company assessed that

its investment could not be recovered and thus

recognized an impairment loss of NT$1,199,045

thousand.

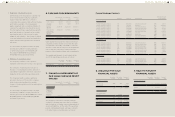

13. NOTES RECEIVABLE, TRADE

RECEIVABLES AND OTHER

RECEIVABLES

December 31,

2013

December 31,

2012

January 1,

2012

Note and trade

receivables

Note

receivables

$- $- $755,450

Trade

receivables

26,420,770 43,118,861 65,518,876

Trade

receivables -

related parties

1,309 221,050 473

Less:

Allowances for

doubtful debts

(3,050,907) (2,086,085) (1,555,008)

$23,371,172 $41,253,826 $64,719,791

Other receivables

Loan

receivables -

fluctuation rate

$- $6,554,025 $-

Receivables

from disposal of

investments

1,182,393 4,369,350 -

VAT refund

receivables

355,442 391,276 792,364

Interest

receivables

10,878 54,135 23,261

Others 1,771,333 1,124,926 1,133,006

$3,320,046 $12,493,712 $1,948,631

Current - other

receivables

$2,137,653 $8,124,362 $1,948,631

Non-current -

other receivables

1,182,393 4,369,350 -

$3,320,046 $12,493,712 $1,948,631

Trade Receivables

The credit period on sales of goods is 30-75 days.

No interest is charged on trade receivables before

the due date. Thereafter, interest is charged at

1-18% per annum on the outstanding balance,

which is considered to be non-controversial,

to some of customers. In determining the

recoverability of