HTC 2013 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

304 305

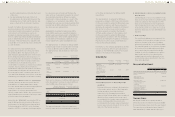

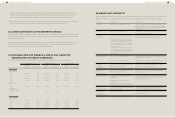

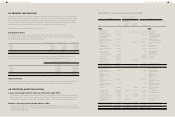

39. SEGMENT INFORMATION

Information reported to the chief operating decision maker for the purposes of resource allocation and

assessment of segment performance focuses on types of goods or services delivered or provided. Under

IFRS 8 - "Operating Segments," the Company is organized and managed as a single reportable business

segment. The Company's operations are mainly in the research, design, manufacture and sale of smart

mobile devices and the operating revenue is more than 90 percent of the total revenue.

Operating segment financial information was as follows:

Geographical Areas

The Company's non-current assets (other than financial instruments, deferred tax assets and post-

employment benefit assets) located in Taiwan and in single foreign country as of December 31, 2013,

December 31, 2012 and January 1, 2012 were as follows:

December 31, 2013 December 31, 2012 January 1, 2012

Taiwan

Country Y

Country Z

Others

$31,928,554

4,808,349

411,746

8,816,216

$30,004,905

5,077,921

1,249,807

11,218,055

$26,579,662

5,236,960

10,271,855

13,049,761

$45,964,865 $47,550,688 $55,138,238

The Company's revenues from Taiwan and from single foreign country that were 10 percent or more of

consolidated total revenues for the years ended December 31, 2013 and 2012 were as follows:

For the Year Ended December 31

2013 2012

Taiwan

Country Y

Country Z

Others

$19,882,726

33,008,560

48,673,014

101,838,348

$20,403,572

53,557,704

68,200,497

146,858,402

$203,402,648 $289,020,175

Major Customers

The Company did not have transactions with single external customers whose revenues amounted to 10

percent or more of the Company's total revenues for the years ended December 31, 2013 and 2012.

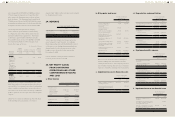

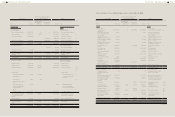

40. FIRST-TIME ADOPTION OF IFRSs

a. Basis of the preparation for financial information under IFRSs

The Company's consolidated financial statements for the year ended December 31, 2013 were the first IFRS

financial statements. The Company not only follows the significant accounting policies stated in Note 4 but

also applies the requirements under IFRS 1 "First-time Adoption of IFRS" as the basis for the preparation.

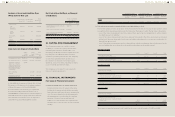

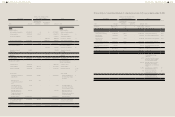

b. Effect of the transition from ROC GAAP to IFRSs

After transition to IFRSs, the effect on the Company's consolidated balance sheets as of December 31, and

January 1, 2012 as well as the consolidated statements of comprehensive income for the year endedDecember

31, 2012, was stated as follows:

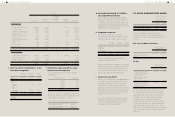

1) Reconciliation of consolidated balance sheet as of January 1, 2012

ROC GAAP

Effect of the Transition from

ROC GAAP to IFRSs IFRSs

Note

Item Amount

Measurement

or

Recognition

Difference

Presentation

Difference Amount Item

Assets Assets

Current assets Current assets

Cash and cash

equivalents

$87,501,508 $- $(25,474,750) $62,026,758 Cash and cash

equivalents

Financial assets at fair

value through profit or

loss - current

256,868 - - 256,868 Financial assets at fair

value through profit or

loss - current

Available-for-sale

financial assets - current

736,031 - - 736,031 Available-for-sale

financial assets - current

Restricted assets -

current

68,700 - 25,474,750 25,543,450 Other current financial

assets

Note and trade

receivables, net

64,719,791 - - 64,719,791 Note and trade

receivables, net

Other current financial

assets

1,947,665 - - 1,947,665 Other receivables

Other receivables -

related parties

966 - - 966 Other receivables -

related parties

Income tax receivables 263,116 - - 263,116 Current tax assets

Inventories 28,430,590 - - 28,430,590 Inventories

Prepayments 6,507,516 - - 6,507,516 Prepayments

Deferred income tax

assets - current

2,246,196 - (2,246,196) - -

Other current assets 249,644 - - 249,644 Other current assets

Total current assets 192,928,591 - (2,246,196) 190,682,395 Total current assets

Non-current assets Non-current assets

Held-to-maturity

financial assets - non-

current

204,597 - - 204,597 Held-to-maturity

financial assets - non-

current

Available-for-sale

financial assets - non-

current

279 - - 279 Available-for-sale

financial assets - non-

current

Financial assets

measured at cost - non-

current

3,408,654 - - 3,408,654 Financial assets

measured at cost - non-

current

Investments accounted

for using the equity

method

71,732 - - 71,732 Investments accounted

for using the equity

method

Properties 21,512,478 - 203,155 21,715,633 Property, plant and

equipment

Intangible assets 22,560,788 (342) 207,033 22,767,479 Intangible assets

Refundable deposits 185,306 - - 185,306 Refundable deposits

Deferred charges 763,516 - (763,516) - -

Deferred income assets

tax - non-current

3,675,521 58,000 2,586,457 6,319,978 Deferred tax assets

Prepaid pension cost -

non-current

183,703 (83,052) - 100,651 Prepaid pension cost -

non-current

Other non-current assets 10,301,798 - 353,328 10,655,126 Other non-current assets

Total non-current assets 62,868,372 (25,394) 2,586,457 65,429,435 Total non-current assets

Total $255,796,963 $(25,394) $340,261 $256,111,830 Total

(Continued)