HTC 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

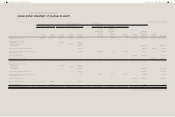

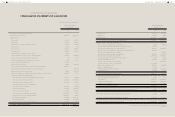

FINANCIAL INFORMATION FINANCIAL INFORMATION

250 251

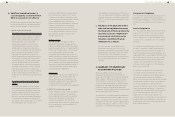

b. Significant impending changes in

accounting policy resulted from New

IFRSs in issue but not yet effective

Except for the following, the initial application of

the above New IFRSs has not had any material

impact on the Company's accounting policies:

1. IFRS 9 "Financial Instruments"

Recognition and measurement of financial assets

With regards to financial assets, all recognized

financial assets that are within the scope of

IAS 39 "Financial Instruments: Recognition

and Measurement" are subsequently

measured at amortized cost or fair value.

Specifically, financial assets that are held

within a business model whose objective is

to collect the contractual cash flows, and that

have contractual cash flows that are solely

payments of principal and interest on the

principal outstanding are generally measured

at amortized cost at the end of subsequent

accounting periods. All other financial assets

are measured at their fair values at the end

of reporting period. However, the Company

may make an irrevocable election to present

subsequent changes in the fair value of an

equity investment (that is not held for trading)

in other comprehensive income, with only

dividend income generally recognized in profit

or loss.

Recognition and measurement of financial

liabilities

As for financial liabilities, the main changes

in the classification and measurement relate

to the subsequent measurement of financial

liabilities designated as at fair value through

profit or loss. The amount of change in the

fair value of such financial liability attributable

to changes in the credit risk of that liability is

presented in other comprehensive income and

the remaining amount of change in the

fair value of that liability is presented in profit

or loss, unless the recognition of the effects

of changes in the liability's credit risk in other

comprehensive income would create or enlarge

an accounting mismatch in profit or loss.

Changes in fair value attributable to a financial

liability's credit risk are not subsequently

reclassified to profit or loss. If the above

accounting treatment would create or enlarge

an accounting mismatch in profit or loss, the

Group presents all gains or losses on that

liability in profit or loss.

Hedge accounting

The main changes in hedge accounting

amended the application requirements for

hedge accounting to better reflect the entity's

risk management activities. Compared with IAS

39, the main changes include: (1) enhancing

types of transactions eligible for hedge

accounting, specifically broadening the risk

eligible for hedge accounting of non-financial

items; (2) changing the way hedging derivative

instruments are accounted for to reduce profit

or loss volatility; and (3) replacing retrospective

effectiveness assessment with the principle of

economic relationship between the hedging

instrument and the hedged item.

Effective date

The mandatory effective date of IFRS 9, which

was previously set at January 1, 2015, was

removed and will be reconsidered once the

standard is complete with a new impairment

model and finalization of any limited

amendments to classification and measurement.

2. IFRS 13 "Fair Value Measurement"

IFRS 13 establishes a single source of guidance

for fair value measurements. It defines fair

value, establishes a framework for measuring

fair value, and requires disclosures about

fair value measurements. The disclosure

requirements in IFRS 13 are more extensive than

those required in the current standards. For

example, quantitative

and qualitative disclosures based on the three-

level fair value hierarchy currently required for

financial instruments only will be extended by

IFRS 13 to cover all assets and liabilities within

its scope.

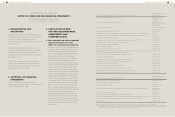

c. The impact of the application of New

IFRSs and the Regulations Governing

the Preparation of Financial Reports by

Securities Issuers (the "Regulations")

in issue but not yet effective on the

Company's consolidated financial

statements was as follows:

As of the date the consolidated financial

statements were authorized for issue, the

Company is continuingly assessing the possible

impact that the application of the above New

IFRSs will have on the Company's financial

position and operating result, and will disclose

the relevant impact when the assessment is

complete.

4. SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

On May 14, 2009, the FSC announced the

"Framework for the Adoption of IFRSs by the

Companies in the ROC." In this framework, starting

2013, companies with shares listed on the Taiwan

Stock Exchange or traded on the Taiwan GreTai

Securities Market or Emerging Stock Market should

prepare their consolidated financial statements in

accordance with the Regulations Governing the

Preparation of Financial Reports by Securities Issuers

and the IFRSs approved by the FSC.

The Company's consolidated financial statements

for the years ended December 31, 2013 is its first

IFRS consolidated financial statements. The date

of transition to IFRSs was January 1, 2012. Refer to

Note 40 for the impact of IFRS conversion on the

Company's consolidated financial statements.

Statement of Compliance

The consolidated financial statements have been

prepared in accordance with the Regulations

Governing the Preparation of Financial Reports by

Securities Issuers and IFRSs as endorsed by the

FSC.

Basis of Preparation

The consolidated financial statements have been

prepared on the historical cost basis except for

financial instruments that are measured at fair

values. Historical cost is generally based on the

fair value of the consideration given in exchange

for assets.

The opening consolidated balance sheet as of

the date of transition to IFRSs was prepared in

accordance with IFRS 1 - First-time Adoption of

International Financial Reporting Standards. The

applicable IFRSs have been applied retrospectively

by the Company except for some aspects where

other IFRS 1 prohibits retrospective application

or grants optional exemptions to this general

principle. For the exemptions of the Company,

please refer to Note 40.

For readers' convenience, the accompanying

consolidated financial statements have been

translated into English from the original Chinese

version prepared and used in the Republic of

China. If inconsistencies arise between the English

version and the Chinese version or if differences

arise in the interpretations between the two

versions, the Chinese version of the consolidated

financial statements shall prevail. However, the

accompanying consolidated financial statements

do not include the English translation of the

additional footnote disclosures that are not

required under accounting principles and practices

generally applied in the Republic of China but are

required by the Securities and Futures Bureau for

their oversight purposes.