HTC 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

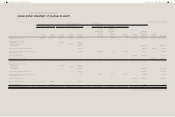

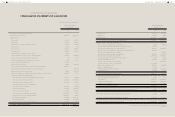

FINANCIAL INFORMATION FINANCIAL INFORMATION

248 249

HTC CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

YEARS ENDED DECEMBER 31, 2013 AND 2012

(In Thousands of New Taiwan Dollars, Unless Stated Otherwise)

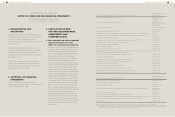

1. ORGANIZATION AND

OPERATIONS

HTC Corporation ("HTC") was incorporated on May

15, 1997 under the Company Law of the Republic

of China to design, manufacture, assemble,

process, and sell smart mobile devices and provide

after-sales service.

In March 2002, HTC had its stock listed on the

Taiwan Stock Exchange. On November 19, 2003,

HTC listed some of its shares of stock on the

Luxembourg Stock Exchange in the form of global

depositary receipts.

The functional currency of HTC is New Taiwan

dollars. The consolidated financial statements are

presented in New Taiwan dollars since HTC is the

ultimate parent of the Company.

2. APPROVAL OF FINANCIAL

STATEMENTS

The consolidated financial statements were

approved by the board of directors and authorized

for issue on February 28, 2014.

3. APPLICATION OF NEW

AND REVISED STANDARDS,

AMENDMENTS AND

INTERPRETATIONS

a. New, amended and revised standards

and interpretations (the "New

IFRSs") in issue but not yet effective

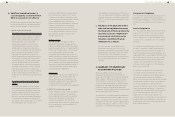

HTC and its entire controlled subsidiaries (the

"Company") have not applied the International

Financial Reporting Standards, International

Accounting Standards, International Financial

Reporting Interpretations, and Standing

Interpretations that have been issued by the

IASB. On January 28, 2014, the Financial

Supervisory Commission (FSC) announced the

framework for the adoption of updated IFRSs

version in the ROC. Under this framework,

starting January 1, 2015, the previous version

of IFRSs endorsed by the FSC (the 2010 IFRSs

version) currently applied by companies with

shares listed on the Taiwan Stock Exchange or

traded on the Taiwan GreTai Securities Market

or Emerging Stock Market will be replaced by

the updated IFRSs without IFRS 9 (the 2013

IFRSs version). However, as of the date that

the consolidated financial statements were

authorized for issue, the FSC has not endorsed

the following new, amended and revised

standards and interpretations issued by the

IASB (the "New IFRSs") included in the 2013

IFRSs version. Furthermore, the FSC has not

announced the effective date for the following

New IFRSs that are not included in the 2013

IFRSs version.

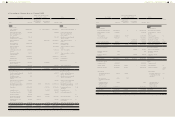

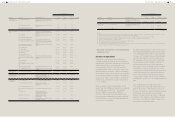

The New IFRSs Included in the 2013 IFRSs Version Not Yet Endorsed by the FSC

Effective Date Announced

by IASB (Note 1)

Improvements to IFRSs (2009) - amendment to IAS 39 January 1, 2009 and

January 1, 2010, as

appropriate

Amendment to IAS 39 "Embedded Derivatives" Effective for annual

periods ending on or after

June 30, 2009

Improvements to IFRSs (2010) July 1, 2010 and January 1,

2011, as appropriate

Annual Improvements to IFRSs 2009-2011 Cycle January 1, 2013

Amendment to IFRS 1 "Limited Exemption from Comparative IFRS 7 Disclosures for First-Time Adopters" July 1, 2010

Amendment to IFRS 1 "Severe Hyperinflation and Removal of Fixed Dates for First-Time Adopters" July 1, 2011

Amendment to IFRS 1 "Government Loans" January 1, 2013

Amendment to IFRS 7 "Disclosure - Offsetting Financial Assets and Financial Liabilities" January 1, 2013

Amendment to IFRS 7 "Disclosure - Transfer of Financial Assets" July 1, 2011

IFRS 10 "Consolidated Financial Statements" January 1, 2013

IFRS 11 "Joint Arrangements" January 1, 2013

IFRS 12 "Disclosure of Interests in Other Entities" January 1, 2013

Amendments to IFRS 10, IFRS 11 and IFRS 12 "Consolidated Financial Statements, Joint Arrangements and

Disclosure of Interests in Other Entities: Transition Guidance"

January 1, 2013

Amendments to IFRS 10 and IFRS 12 and IAS 27 "Investment Entities" January 1, 2014

IFRS 13 "Fair Value Measurement" January 1, 2013

Amendment to IAS 1 "Presentation of Other Comprehensive Income" July 1, 2012

Amendment to IAS 12 "Deferred tax: Recovery of Underlying Assets" January 1, 2012

IAS 19 (Revised 2011) "Employee Benefits" January 1, 2013

IAS 27 (Revised 2011) "Separate Financial Statements" January 1, 2013

IAS 28 (Revised 2011) "Investments in Associates and Joint Ventures" January 1, 2013

Amendment to IAS 32 "Offsetting Financial Assets and Financial Liabilities" January 1, 2014

IFRIC 20 "Stripping Costs in Production Phase of a Surface Mine" January 1, 2013

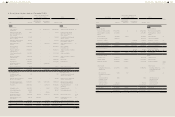

The New IFRSs Not Included in the 2013 IFRSs Version

Effective Date Announced

by IASB (Note 1)

Annual Improvements to IFRSs 2010-2012 Cycle July 1, 2014 (Note 2)

Annual Improvements to IFRSs 2011-2013 Cycle July 1, 2014

IFRS 9 "Financial Instruments" Effective date not

determined

Amendments to IFRS 9 and IFRS 7 "Mandatory Effective Date of IFRS 9 and Transition Disclosures" Effective date not

determined

IFRS 14 "Regulatory Deferral Accounts" January 1, 2016

Amendment to IAS 19 "Defined Benefit Plans: Employee Contributions" July 1, 2014

Amendment to IAS 36 "Impairment of Assets: Recoverable Amount Disclosures for Non-Financial Assets" January 1, 2014

Amendment to IAS 39 "Novation of Derivatives and Continuation of Hedge Accounting" January 1, 2014

IFRIC 21 "Levies" January 1, 2014

Note 1 : Unless stated otherwise, the above New IFRSs are effective for annual periods beginning on or after the respective effective dates.

Note 2: The amendment to IFRS 2 applies to share-based payment transactions for which the grant date is on or after 1 July 2014; the amendment to IFRS

3 applies to business combinations for which the acquisition date is on or after 1 July 2014; the amendment to IFRS 13 is effective immediately; the

remaining amendments are effective for annual periods beginning on or after July 1, 2014.