HTC 2013 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

276 277

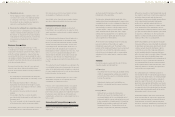

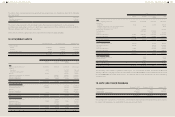

Proceeds of disposal $7,883,326

Less: Carrying amount of investment at the

date of disposal

(5,285,537)

Add: Share of other comprehensive income

of the associate

39,884

Gain recognized $2,637,673

The amount of unrecognized share of losses

of those associates, both for the period and

cumulatively, was as follows:

For the Year Ended December 31

2013 2012

Unrecognized share of

losses of associates

For the period $9,455 $3,606

Accumulated $13,061 $3,606

Investments accounted for using the equity

method and the share of net income or loss and

other comprehensive income from investments

are accounted for based on the audited financial

statements except for SYNCTV Corporation. The

Company's management considers the use of

unaudited financial statements of the investee

did not have material impact on its consolidated

financial statements.

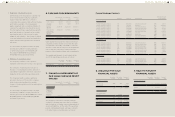

Investments in Jointly Controlled Entity

December 31,

2013

December 31,

2012

January 1,

2012

Unlisted

equity

investments

Huada Digital

Corporation

$227,504 $241,309 $-

The percentage of ownership and voting rights

held by the Company at the end of reporting

period were as follows:

Company

Name

December 31,

2013

December 31,

2012

January 1,

2012

Huada Digital

Corporation

50.00% 50.00% 50.00%

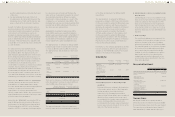

In December 2009, the Company acquired

100% equity interest in Huada, whose main

business is software services, for NT$245,000

thousand and accounted for this investment

by the equity method. In September 2011, the

Company increased its investment by NT$5,000

thousand. As of December 31, 2012, the

Company's investment in Huada had amounted

to NT$250,000 thousand. In September 2011, the

Fair Trade Commission approved an investment by

Chunghwa Telecom Co., Ltd. ("CHT") in Huada and

the registration of this investment was completed

in October 2011. After CHT's investment, the

Company's ownership percentage declined

from 100% to 50%. In March 2012, Huada held a

stockholders' meeting and re-elected its directors

and supervisors. As a result, the investment type

was changed to joint venture and the Company

continued to account for this investment by the

equity method.

The investments in jointly controlled entity and

the share of net income and other comprehensive

income from investments are accounted for based

on audited financial statements.

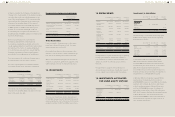

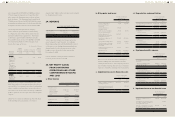

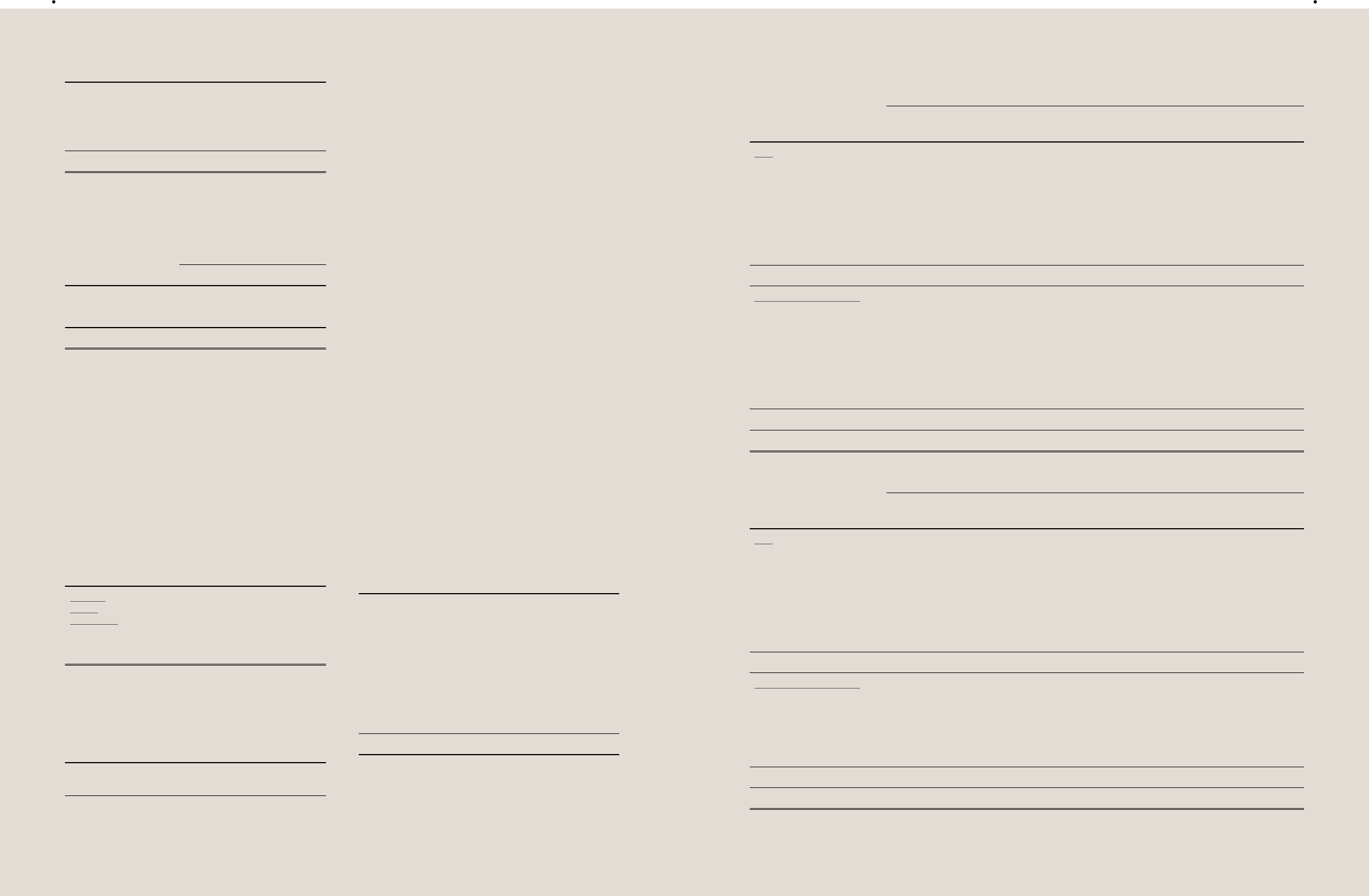

17. PROPERTY, PLANT AND

EQUIPMENT

December 31,

2013

December 31,

2012

January 1,

2012

Carrying

amounts

Land $7,623,287 $7,615,546 $7,614,167

Buildings 10,507,548 10,542,019 5,029,932

Property in

construction

145 - 1,923,876

Machinery

and

equipment

5,761,926 6,327,723 5,907,321

Other

equipment

1,668,493 1,505,478 1,240,337

$25,561,399 $25,990,766 $21,715,633

Movement of property, plant and equipment for

the years ended December 31, 2013 and 2012 were

as follows:

2013

Land Buildings Property in

Construction

Machinery and

Equipment

Other

Equipment Total

Cost

Balance, beginning of the year $7,615,546 $11,851,900 $- $13,310,647 $2,787,808 $35,565,901

Additions - 252,735 6,683 1,178,694 797,615 2,235,727

Disposal - (5,995) - (138,393) (102,601) (246,989)

Reclassification - 5,275 (4,958) (88,006) 87,689 -

Transfer to expense - - (1,581) - (1,436) (3,017)

Translation adjustment 7,741 125,676 1 217,970 87,336 438,724

Disposal of subsidiaries - - - - (91,527) (91,527)

Balance, end of the year 7,623,287 12,229,591 145 14,480,912 3,564,884 37,898,819

Accumulated depreciation

Balance, beginning of the year - 1,309,881 - 6,982,924 1,282,330 9,575,135

Depreciation expenses - 399,036 - 1,824,620 693,043 2,916,699

Disposal - (5,995) - (138,219) (100,108) (244,322)

Reclassification - 11,434 - (35,096) 23,662 -

Transfer to expense - - - - (22) (22)

Translation adjustment - 7,687 - 84,757 36,720 129,164

Disposal of subsidiaries - - - - (39,234) (39,234)

Balance, end of the year - 1,722,043 - 8,718,986 1,896,391 12,337,420

Net book value, end of the year $7,623,287 $10,507,548 $145 $5,761,926 $1,668,493 $25,561,399

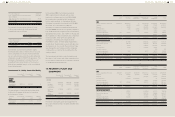

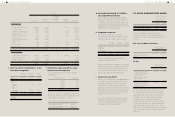

2012

Land Buildings Property in

Construction

Machinery and

Equipment

Other

Equipment Total

Cost

Balance, beginning of the year $7,614,167 $6,047,519 $1,923,876 $11,470,702 $2,040,507 $29,096,771

Additions 208 226,585 3,916,745 2,110,556 1,027,021 7,281,115

Disposal - (468) - (202,421) (72,126) (275,015)

Reclassification - 5,615,958 (5,834,709) - 115 (218,636)

Transfer to expense - - (5,912) (2,520) (6,666) (15,098)

Translation adjustment 1,171 (37,694) - (65,670) (20,807) (123,000)

Disposal of subsidiaries - - - - (180,236) (180,236)

Balance, end of the year 7,615,546 11,851,900 - 13,310,647 2,787,808 35,565,901

Accumulated depreciation

Balance, beginning of the year - 1,017,587 - 5,563,381 800,170 7,381,138

Depreciation expenses - 307,379 - 1,620,750 534,888 2,463,017

Disposal - (449) - (173,298) (55,984) (229,731)

Translation adjustment - (14,636) - (27,909) 13,964 (28,581)

Disposal of subsidiaries - - - - (10,708) (10,708)

Balance, end of the year - 1,309,881 - 6,982,924 1,282,330 9,575,135

Net book value, end of the year $7,615,546 $10,542,019 $- $6,327,723 $1,505,478 $25,990,766