HTC 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

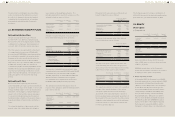

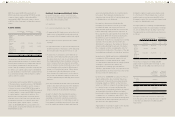

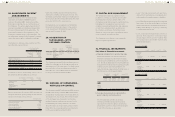

FINANCIAL INFORMATION FINANCIAL INFORMATION

230 231

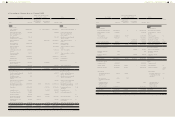

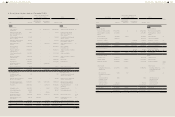

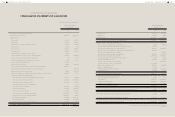

a. Reconciliation of balance sheet as of January 1, 2012

ROC GAAP

Effect of the Transition from

ROC GAAP to IFRSs IFRSs

Note

Item Amount

Measurement

or Recognition

Difference

Presentation

Difference Amount Item

Assets Assets

Current assets Current assets

Cash and cash

equivalents

$78,872,320 $- $(25,474,750) $53,397,570 Cash and cash equivalents 1)

Financial assets at fair

value through profit or

loss - current

256,868 - - 256,868 Financial assets at fair

value through profit or

loss - current

Available-for-sale

financial assets - current

736,031 - - 736,031 Available-for-sale financial

assets - current

Restricted assets -

current

63,900 - 25,474,750 25,538,650 Other financial assets -

current

1)

Note and trade

receivables, net

32,039,776 - - 32,039,776 Note and trade

receivables, net

Trade receivables -

related parties

32,977,269 - - 32,977,269 Trade receivables - related

parties

Other financial assets -

current

1,615,044 - - 1,615,044 Other receivables

Other receivables -

related parties

79,077 - - 79,077 Other receivables - related

parties

Inventories 25,389,320 - - 25,389,320 Inventories

Prepayments 6,473,372 - - 6,473,372 Prepayments

Current assets Current assets

Deferred income tax

assets - current

1,517,302 - (1,517,302) - - 2)

Other current assets 248,085 - - 248,085 Other current assets

Total current assets 180,268,364 - (1,517,302) 178,751,062 Total current assets

Non-current assets Non-current assets

Held-to-maturity financial

assets - non-current

204,597 - - 204,597 Held-to-maturity financial

assets - non-current

Available-for-sale

financial assets - non-

current

279 - - 279 Available-for-sale financial

assets - non-current

Financial assets measured

at cost - non-current

515,861 - - 515,861 Financial assets measured

at cost - non-current

Investments accounted

for using equity method

37,057,048 (593) (1,151,531) 35,904,924 Investments accounted

for using equity method

4), 11)

Properties 15,422,345 - (103,745) 15,318,600 Property, plant and

equipment

7), 8)

Intangible assets 2,120,948 - 120,593 2,241,541 Intangible assets 7)

Refundable deposits 78,894 - - 78,894 Refundable deposits

Deferred charges 120,593 - (120,593) - - 7)

Deferred income tax

assets - non-current

3,596,520 58,000 1,704,771 5,359,291 Deferred tax assets 2), 3)

Prepaid pension cost -

non-current

183,827 (82,801) - 101,026 Prepaid pension cost -

non-current

4)

Other non-current assets 8,541,647 - 103,745 8,645,392 Other non-current assets 7), 8)

Total non-current assets 67,842,559 (25,394) 553,240 68,370,405 Total non-current assets

Total $248,110,923 $(25,394) $(964,062) $247,121,467 Total

(Continued)

ROC GAAP

Effect of the Transition from

ROC GAAP to IFRSs IFRSs

Note

Item Amount

Measurement

or Recognition

Difference

Presentation

Difference Amount Item

Liabilities and stockholders'

equity

Liabilities and stockholders'

equity

Current liabilities Current liabilities

Note and trade payables $72,855,374 $- $- $72,855,374 Note and trade payables

Trade payables - related

parties

3,639,231 - - 3,639,231 Trade payables - related

parties

Other payables 43,422,132 99,321 - 43,521,453 Other payables 6)

Income tax payable 9,653,090 - - 9,653,090 Current tax liabilities

- - - 14,808,145 14,808,145 Provisions - current 5)

Other current liabilities 17,113,872 - (15,959,676) 1,154,196 Other current liabilities 5), 11)

Total current liabilities 146,683,699 99,321 (1,151,531) 145,631,489 Total current liabilities

Non-current liabilities Non-current liabilities

- - - 187,469 187,469 Deferred tax liabilities 2)

Guarantee deposits

received

628 - - 628 Guarantee deposits

received

Total non-current

liabilities

628 - 187,469 188,097 Total non-current

liabilities

Total liabilities 146,684,327 99,321 (964,062) 145,819,586 Total liabilities

Stockholders' equity Equity

Common stock 8,520,521 - - 8,520,521 Common stock

Capital surplus 16,619,594 (18,037) - 16,601,557 Capital surplus 9)

Retained earnings 86,616,845 (74,837) - 86,542,008 Retained earnings 3), 4),

6), 9),

10)

Other equity Other equity

Cumulative translation

adjustments

32,134 (32,134) - - Exchange differences

on translating foreign

operation

10)

Net losses not

recognized as pension

cost

(293) 293 - - - 4)

Unrealized gain on

available-for-sale

financial assets

2,939 - - 2,939 Unrealized gain on

available-for-sale

financial assets

Treasury shares (10,365,144) - - (10,365,144) Treasury shares

Total equity 101,426,596 (124,715) - 101,301,881 Total equity

Total $248,110,923 $(25,394) $(964,062) $247,121,467 Total

(Concluded)