HTC 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

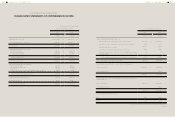

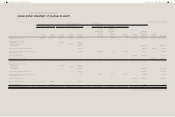

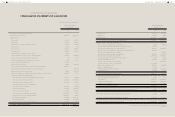

FINANCIAL INFORMATION FINANCIAL INFORMATION

238 239

gains from intercompany transactions should

be recognized as a reduction of investments

accounted for using the equity method. Thus,

as of January 1 and December 31, 2012, the

reclassification adjustment resulted in decreases

of NT$1,151,531 thousand and NT$2,354,363

thousand, respectively, in "investments

accounted for using the equity method" and

"other current liabilities".

f. Material adjustment to statements of cash flows

Under ROC GAAP, using the indirect method, the

interests and dividends received and interests

paid were usually classified as operating cash

flows, and dividends paid were usually classified

as financial cash flows and supplemental cash

flows information is provided for interests paid.

However, under IFRS 7, cash flows from interest

and dividends received and paid shall each be

disclosed separately. Each shall be classified in

a consistent manner from period to period either

as operating, investing or financing activities.

Thus, for the year ended December 31, 2012, the

cash flows of interests received in the amount of

NT$475,053 thousand was disclosed separately.

As of January 1 and December 31, 2012, time

deposits with original maturities more than three

months amounted to NT$25,474,750 thousand

and NT$1,960,900 thousand, respectively, and not

to be classified as "cash and cash equivalents" in

accordance with Regulations since they are held

for investment purpose. For more details of this

adjustment, please refer to Note 39 section e. 1).

Except for the above, the Company's statements

of cash flows in accordance with Regulations and

ROC GAAP had no other significant differences.

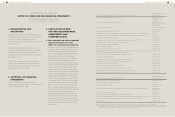

5.INDEPENDENT AUDITORS' REPORT

The Board of Directors and Stockholders

HTC Corporation

We have audited the accompanying consolidated balance sheets of HTC Corporation and its subsidiaries

(collectively referred to as the "Company") as of December 31, 2013, December 31, 2012 and January 1, 2012,

and the related consolidated statements of comprehensive income, changes in equity and cash flows for

the years ended December 31, 2013 and 2012. These consolidated financial statements are the responsibility

of the Company's management. Our responsibility is to express an opinion on these consolidated financial

statements based on our audits.

We conducted our audits in accordance with the Rules Governing the Audit of Financial Statements by

Certified Public Accountants and auditing standards generally accepted in the Republic of China. Those

rules and standards require that we plan and perform the audit to obtain reasonable assurance about

whether the consolidated financial statements are free of material misstatement. An audit includes

examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial

statements. An audit also includes assessing the accounting principles used and significant estimates made

by management, as well as evaluating the overall consolidated financial statement presentation. We believe

that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects,

the consolidated financial position of the Company as of December 31, 2013, December 31, 2012 and

January 1, 2012, and their consolidated financial performance and their consolidated cash flows for the years

ended 2013 and 2012, in conformity with the Regulations Governing the Preparation of Financial Reports by

Securities Issuers and International Financial Reporting Standards endorsed by the Financial Supervisory

Commission of the Republic of China.

We have also audited the parent company only financial statements of HTC Corporation as of and for the

years ended December 31, 2013 and 2012 on which we have issued an unqualified report.

February 28, 2014

Notice to Readers

The accompanying consolidated financial statements are intended only to present the consolidated financial position, financial performance and cash flows

in accordance with accounting principles and practices generally accepted in the Republic of China and not those of any other jurisdictions. The standards,

procedures and practices to audit such consolidated financial statements are those generally applied in the Republic of China.

For the convenience of readers, the independent auditors' report and the accompanying consolidated financial statements have been translated into English from

the original Chinese version prepared and used in the Republic of China. If there is any conflict between the English version and the original Chinese version or

any difference in the interpretation of the two versions, the Chinese-language independent auditors' report and consolidated financial statements shall prevail.

Also, as stated in Note 4 to the consolidated financial statements, the additional footnote disclosures that are not required under accounting principles and

practices generally applied in the Republic of China were not translated into English.