HTC 2013 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

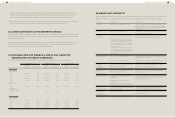

FINANCIAL INFORMATION FINANCIAL INFORMATION

312 313

account is not clearly defined. However, under

IFRSs, it defines "provisions" as obligations that

are probable (i.e., more likely than not) and

the amount could be reasonably estimated.

Thus, as of January 1 and December 31, 2012,

the reclassification adjustment resulted in

decreases of NT$15,133,275 thousand and

NT$8,881,514 thousand, respectively, in "other

current liabilities" and increases by the same

amounts in "provisions - current."

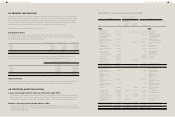

f) Accumulated compensated absences are not

addressed in existing ROC GAAP; thus, the

Company has not recognized the expected

cost of employee benefits in the form of

accumulated compensated absences at the

end of reporting periods. However, under

IFRSs, when the employees render services

that increase their entitlement to future

compensated absences, an entity should

recognize the expected cost of employee

benefits at the end of reporting periods. Thus,

as of January 1, 2012, the IFRS adjustment

resulted in an increase in "accrued expenses"

by NT$99,321 thousand and a decrease by the

same amount in "accumulated earnings." In

addition, the evaluation adjustment made on

December 31, 2012 resulted in (a) a decrease

in "accumulated earnings" by NT$93,451

thousand due to an increase of "accrued

expenses"; (b) decreases in "cost of revenues"

by NT$5,299 thousand and "selling and

marketing expenses" by NT$4,843 thousand

and (c) increases in "general and administrative

expenses" by NT$557 thousand and "research

and developing expenses" by NT$3,715

thousand.

g) Under ROC GAAP, deferred charges are

classified under other assets. Transition to IFRSs,

deferred charges are classified under "property,

plant and equipment", "other intangible assets"

and "other assets - other" according to the

nature. Thus, as of January 1 and, December

31, 2012, the Company reclassified NT$410,217

thousand and NT$571,485 thousand,

respectively, of "deferred charges" to "property,

plant and equipment"; and reclassified

NT$207,033 thousand and NT$162,765

thousand, respectively, of "deferred charges"

to "other intangible assets" and reclassified

NT$146,266 thousand and NT$162,914

thousand, respectively, of "deferred charges"

to "other assets - other".

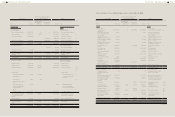

h) The Company purchased fixed assets and

made prepayments, pursuant to the "Rules

Governing the Preparation of Financial

Statements by Securities Issuers." Such

prepayments are presented as "properties".

Transition to IFRSs, the prepayments are

classified under "other assets - other". Thus,

as of January 1 and December 31, 2012, the

Company reclassified NT$207,062 thousand

and NT$232,011 thousand, respectively, of

"property, plant and equipment" to "other

assets - other".

i) Under ROC GAAP, if an investee issues new

shares and an investor does not purchase new

shares proportionately, capital surplus and the

long-term equity investment accounts should

be adjusted for the change in the investor's

holding percentage and interest in the investee's

net assets. By contrast, under IFRSs, a reduction

of investor's ownership interest that results in

loss of significant influence on or control over

an investee would be treated as a deemed

disposal, with the related gain or loss recognized

in profit or loss. An entity may elect not to

adjust the difference retrospectively, and the

Company elected to use the exemption from

retrospective application. The IFRS adjustment

resulted in a decrease of capital surplus - long-

term equity investments of NT$18,037 thousand

and a corresponding increase of accumulated

earnings by related rules.

j) The Company elected to reset the accumulated

balances of exchange differences resulting

from translating foreign operation to zero at

the date of transition to IFRSs, and the reversal

has been used to adjust accumulated earnings

as of January 1, 2012. The gain or loss on any

subsequent disposals of any foreign

operations should exclude accumulated

balances of exchange differences resulting

from translating foreign operation that

arose before the date of transition to IFRSs.

Therefore, the IFRS adjustment resulted

in a decrease in accumulated balances

of exchange differences resulting from

translating foreign operation and an increase

in accumulated earnings by NT$32,134

thousand each.

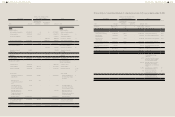

6) Material adjustment to consolidated statement

of cash flows

Under ROC GAAP, using the indirect method, the

interests and dividends received and interests

paid were usually classified as operating cash

flows, and dividends paid were usually classified

as financial cash flows and supplemental cash

flows information is provided for interests paid.

However, under IFRS 7, cash flows from interest

and dividends received and paid shall each be

disclosed separately. Each shall be classified in a

consistent manner from period to period either

as operating, investing or financing activities.

Thus, for the year ended December 31, 2012, the

cash flows of interests and dividends received

in the amount of NT$589,899 thousand and

NT$22,441 thousand were disclosed separately.

As of January 1 and December 31, 2012, time

deposits with original maturities more than three

months amounted to NT$25,474,750 thousand

and NT$2,911,924 thousand, respectively, and not

to be classified as "cash and cash equivalents"

in accordance with IFRSs since they are held for

investment purpose. For more details of this

adjustment, please refer to Note 40 section b. 5)

a).

Except for the above, the Company's

consolidated statement of cash flows in

accordance with IFRSs and ROC GAAP had no

other significant differences.