HTC 2013 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

206 207

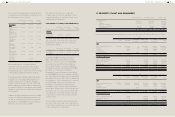

At the end of the reporting period, the proportion

of ownership and voting rights in subsidiaries held

by the Company were as follows:

December 31,

2013

December 31,

2012

January 1,

2012

H.T.C. (B.V.I.)

Corp.

100.00% 100.00% 100.00%

Communication

Global

Certification Inc.

100.00% 100.00% 100.00%

High Tech

Computer Asia

Pacific Pte. Ltd.

100.00% 100.00% 100.00%

HTC Investment

Corporation

100.00% 100.00% 100.00%

PT. High Tech

Computer

Indonesia

1.00% 1.00% 1.00%

HTC I

Investment

Corporation

100.00% 100.00% 100.00%

HTC Holding

Cooperatief

U.A.

0.01% 0.01% 0.01%

Huada Digital

Corporation

50.00% 50.00% 50.00%

HTC Investment

One (BVI)

Corporation

100.00% 100.00% 100.00%

FunStream

Corporation

- 100.00% -

Refer to Note 29 to the consolidated financial

statements for the year ended December 31, 2013

for the disclosures of the Company's acquisitions of

FunStream Corporation. Refer to Note 4 for the details

of the subsidiaries indirectly held by the Company.

The Company and its subsidiary, High Tech Computer

Asia Pacific Pte. Ltd., acquired equity interests of 1%

and 99%, respectively, in PT. High Tech Computer

Indonesia and acquired equity interests of 0.01% and

99.99%, respectively, in HTC Holding Cooperatief U.A.

As a result, PT. High Tech Computer Indonesia and HTC

Holding Cooperatief U.A. are considered as subsidiaries

of the Company.

In 2012, the Company determined that the recoverable

amount of investment in FunStream Corporation was

less than its carrying amount and thus recognized an

impairment loss of NT$45,017 thousand. FunStream

Corporation was dissolved in June 2013.

The share of net income or loss and other

comprehensive income from subsidiaries under

equity method were accounted for based on the

audited financial statements.

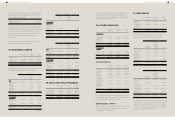

Investments in Jointly Controlled Entity

December 31,

2013

December 31,

2012

January 1,

2012

Unlisted

companies

Huada Digital

Corporation

$227,504 $241,309 $-

The percentage of ownership and voting rights

held by the Company at the end of reporting

period were as follows:

Company Name

December 31,

2013

December 31,

2012

January 1,

2012

Huada Digital

Corporation

50.00% 50.00% 50.00%

In December 2009, the Company acquired

100% equity interest in Huada, whose main

business is software services, for NT$245,000

thousand and accounted for this investment

by the equity method. In September 2011, the

Company increased its investment by NT$5,000

thousand. As of December 31, 2012, the

Company's investment in Huada had amounted

to NT$250,000 thousand. In September 2011, the

Fair Trade Commission approved an investment by

Chunghwa Telecom Co., Ltd. ("CHT") in Huada and

the registration of this investment was completed

in October 2011. After CHT's investment, the

Company's ownership percentage declined

from 100% to 50%. In March 2012, Huada held a

stockholders' meeting and re-elected its directors

and supervisors. As a result, the investment type

was changed to joint venture and the Company

continued to account for this investment by the

equity method.

The investments in jointly controlled entity and

the share of net income and other comprehensive

income from investments are accounted for based

on the audited financial statements.

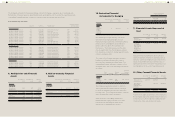

17. PROPERTY, PLANT AND EQUIPMENT

December 31, 2013 December 31, 2012 January 1, 2012

Carrying amounts

Land

Buildings

Property in construction

Machinery and equipment

Other equipment

$7,462,489

8,245,062

-

3,529,270

536,787

$7,462,489

8,330,607

-

3,573,566

360,174

$7,462,281

2,742,684

1,923,875

2,887,919

301,841

$19,773,608 $19,726,836 $15,318,600

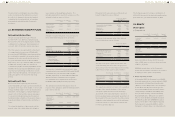

Movement of property, plant and equipment for the years ended December 31, 2013 and 2012 were as follows:

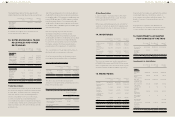

2013

Land Buildings Property in

Construction

Machinery and

Equipment

Other

Equipment Total

Cost

Balance, beginning of the year

Additions

Disposal

Reclassification

Transfer to expense

$7,462,489

-

-

-

-

$9,520,993

270,787

(5,995)

18,726

-

$-

1,581

-

-

(1,581)

$8,732,565

1,069,092

(56,518)

(1,664)

-

$969,180

309,839

(64,456)

(17,062)

-

$26,685,227

1,651,299

(126,969)

-

(1,581)

Balance, end of the year 7,462,489 9,804,511 - 9,743,475 1,197,501 28,207,976

Accumulated depreciation

Balance, beginning of the year

Depreciation expenses

Disposal

Reclassification

-

-

-

-

1,190,386

356,332

(5,995)

18,726

-

-

-

-

5,158,999

1,113,388

(56,518)

(1,664)

609,006

133,226

(64,456)

(17,062)

6,958,391

1,602,946

(126,969)

-

Balance, end of the year - 1,559,449 - 6,214,205 660,714 8,434,368

Net book value, end of the year $7,462,489 $8,245,062 $- $3,529,270 $536,787 $19,773,608

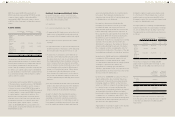

2012

Land Buildings Property in

Construction

Machinery and

Equipment

Other

Equipment Total

Cost

Balance, beginning of the year

Additions

Disposal

Transfer to expense

Reclassification

$7,462,281

208

-

-

-

$3,680,608

224,427

-

-

5,615,958

$1,923,875

3,916,746

-

(5,912)

(5,834,709)

$7,272,704

1,632,493

(172,632)

-

-

$829,193

151,859

(11,987)

-

115

$21,168,661

5,925,733

(184,619)

(5,912)

(218,636)

Balance, end of the year 7,462,489 9,520,993 - 8,732,565 969,180 26,685,227

Accumulated depreciation

Balance, beginning of the year

Depreciation expenses

Disposal

-

-

-

937,924

252,462

-

-

-

-

4,384,785

946,846

(172,632)

527,352

93,641

(11,987)

5,850,061

1,292,949

(184,619)

Balance, end of the year - 1,190,386 - 5,158,999 609,006 6,958,391

Net book value, end of the year $7,462,489 $8,330,607 $- $3,573,566 $360,174 $19,726,836