HTC 2013 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

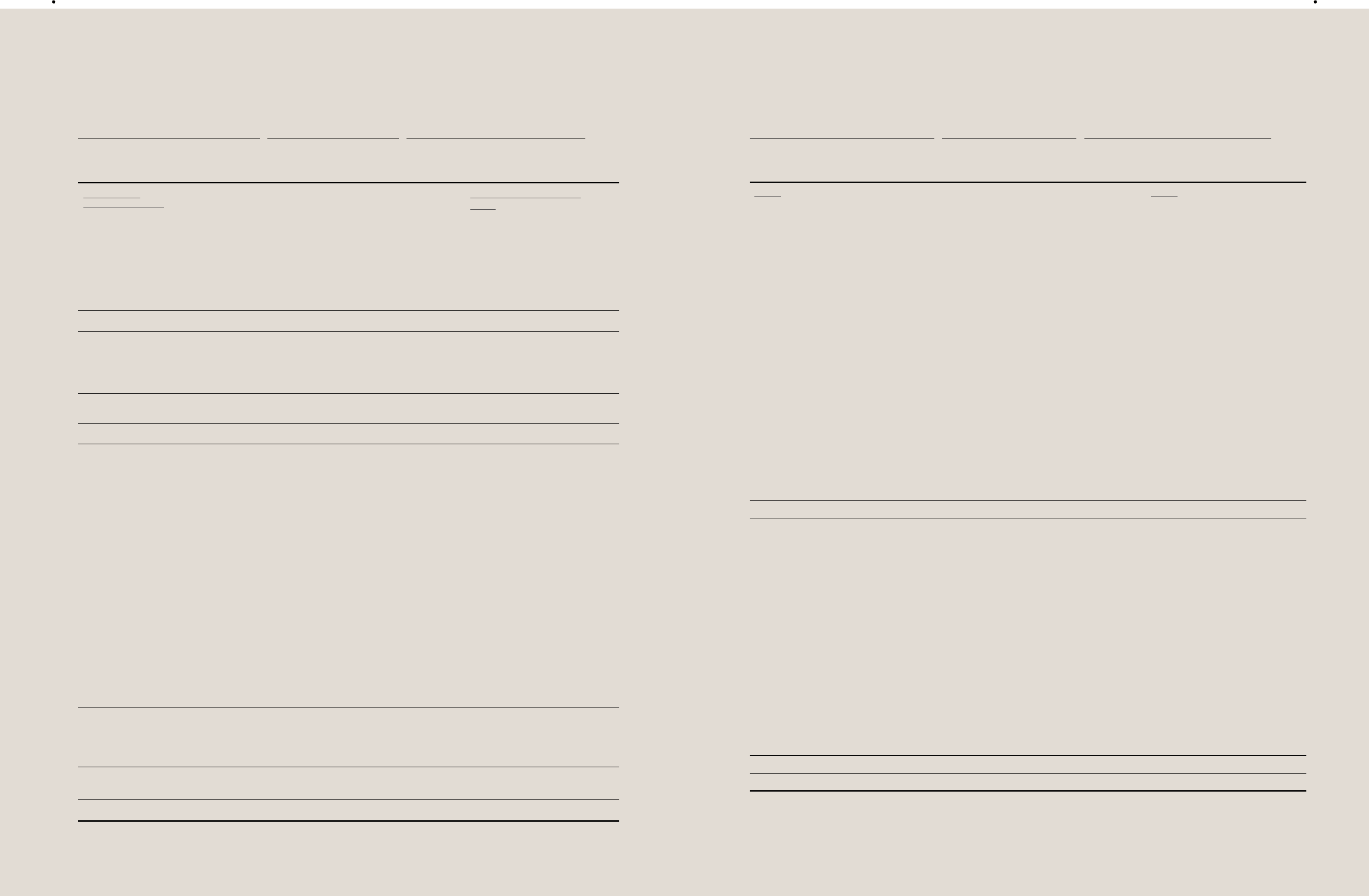

FINANCIAL INFORMATION FINANCIAL INFORMATION

306 307

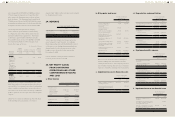

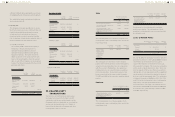

2) Reconciliation of consolidated balance sheet as of December 31, 2012

ROC GAAP

Effect of the Transition from

ROC GAAP to IFRSs IFRSs

Note

Item Amount

Measurement

or Recognition

Difference

Presentation

Difference Amount Item

Assets Assets

Current assets Current assets

Cash and cash

equivalents

$53,878,067 $- $(2,911,924) $50,966,143 Cash and cash equivalents a)

Financial assets at fair

value through profit or

loss - current

6,950 - - 6,950 Financial assets at fair

value through profit or

loss - current

Available-for-sale

financial assets - current

37,902 - - 37,902 Available-for-sale financial

assets - current

Held-to-maturity financial

assets - current

101,459 - - 101,459 Held-to-maturity financial

assets - current

Derivative financial assets

for hedging - current

204,519 - - 204,519 Derivative financial assets

for hedging - current

Restricted assets -

current

3,649,520 - 2,911,924 6,561,444 Other current financial

assets

a)

Note and trade

receivables, net

41,253,826 - - 41,253,826 Note and trade

receivables, net

Other current financial

assets

1,524,269 - - 1,524,269 Other receivables

Other receivables -

related parties

6,600,093 - - 6,600,093 Other receivables - related

parties

Income tax receivables 61,532 - - 61,532 Current tax assets

Inventories 23,809,377 - - 23,809,377 Inventories

Prepayments 4,965,814 - - 4,965,814 Prepayments

Deferred income tax

assets - current

3,530,215 - (3,530,215) - - b)

Other current assets 39,097 - - 39,097 Other current assets

Total current assets 139,662,640 - (3,530,215) 136,132,425 Total current assets

Non-current assets Non-current assets

Available-for-sale

financial assets - non-

current

197 - - 197 Available-for-sale financial

assets - non-current

Financial assets measured

at cost - non-current

4,304,907 - - 4,304,907 Financial assets measured

at cost - non-current

Investments accounted

for using the equity

method

5,892,168 - - 5,892,168 Investments accounted for

using the equity method

Properties 25,651,292 - 339,474 25,990,766 Property, plant and

equipment

g), h)

Intangible assets 11,520,674 (269) 162,765 11,683,170 Intangible assets d), g)

Refundable deposits 190,142 - - 190,142 Refundable deposits

Deferred charges 897,164 - (897,164) - - g)

Deferred income assets

tax - non-current

4,427,776 83,915 4,178,151 8,689,842 Deferred tax assets b), c),

d)

Long-term receivables 4,369,350 - - 4,369,350 Long-term receivables

Prepaid pension cost -

non-current

205,989 (86,716) - 119,273 Prepaid pension cost -

non-current

d)

Other non-current assets 9,481,827 394,925 9,876,752 Other non-current assets g), h)

Total non-current assets 66,941,486 (3,070) 4,178,151 71,116,567 Total non-current assets

Total $206,604,126 $(3,070) $647,936 $207,248,992 Total

(Continued)

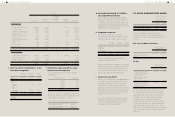

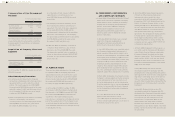

ROC GAAP

Effect of the Transition from

ROC GAAP to IFRSs IFRSs

Note

Item Amount

Measurement

or Recognition

Difference

Presentation

Difference Amount Item

Liabilities and

stockholders' equity

Liabilities and stockholders'

equity

Current liabilities Current liabilities

Note and trade payables $78,473,130 $- $- $78,473,130 Note and trade payables

Other payables 47,496,470 99,321 - 47,595,791 Other payables f)

Income tax payables 10,570,682 - - 10,570,682 Current tax liabilities

- - - 15,133,275 15,133,275 Provisions - current e)

Other current liabilities 16,794,415 - (15,133,275) 1,661,140 Other current liabilities e)

Total current liabilities 153,334,697 99,321 - 153,434,018 Total current liabilities

Non-current liabilities Non-current liabilities

- - - 340,261 340,261 Deferred tax liabilities b)

Guarantee deposits

received

42,946 - - 42,946 Guarantee deposits

received

Total non-current

liabilities

42,946 - 340,261 383,207 Total non-current

liabilities

Total liabilities 153,377,643 99,321 340,261 153,817,225 Total liabilities

Stockholders' equity Equity attributable to

owners of the parent

Common stock 8,520,521 - - 8,520,521 Common stock

Capital surplus 16,619,594 (18,037) - 16,601,557 Capital surplus i)

Retained earnings 86,616,845 (74,837) - 86,542,008 Retained earnings c), d),

f), i),

j)

Other equity Other equity

Cumulative translation

adjustments

32,134 (32,134) - - Exchange differences

on translating foreign

operation

j)

Net losses not

recognized as pension

cost

(293) 293 - - - d)

Unrealized gains or

losses from available-

for-sale financial

assets

2,939 - - 2,939 Unrealized gains or

losses from available-

for-sale financial assets

Treasury shares (10,365,144) - - (10,365,144) Treasury shares

Total equity attributable

to stockholders of the

parent

101,426,596 (124,715) - 101,301,881 Total equity attributable

to owners of the parent

Minority interest 992,724 - - 992,724 Non-controlling interest

Total stockholders'

equity

102,419,320 (124,715) - 102,294,605 Total equity

Total $255,796,963 $(25,394) $340,261 $256,111,830 Total

(Concluded)