HTC 2013 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

288 289

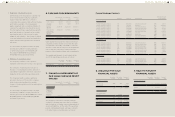

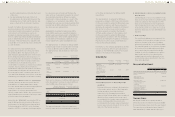

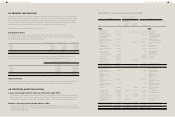

g. Items that were reclassified to other

comprehensive income

For the Year Ended

December 31

2013 2012

Exchange differences on

translating foreign operations

Exchange differences

arising during the year

$1,680,660 $(1,089,693)

Reclassification

adjustments relating

to foreign operations

disposed of in the year

(31,248) -

$1,649,412 $(1,089,693)

Available-for-sale financial

assets

Net fair value gain on

available-for-sale financial

assets during the year

$42 $11,408

Reclassification

adjustments relating to

available-for-sale financial

assets disposed of in the

year

(11,779) (4,631)

$(11,737) $6,777

Cash flow hedges

Fair value gains arising

during the year

$- $204,519

Reclassification

adjustments for amounts

recognized in profit or loss

(194,052) (10,467)

$(194,052) $194,052

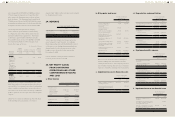

26. INCOME TAXES RELATING TO

CONTINUING OPERATIONS

a. Income tax recognized in profit or loss

For the Year Ended

December 31

2013 2012

Current tax

In respect of the current

period

$1,432,715 $3,948,447

In respect of the prior

periods

85,656 (151,465)

1,518,371 3,796,982

Deferred tax

In respect of the current

period

(390,230) (662,607)

Adjustments to deferred

tax attributable to changes

in tax rates and laws

- (1,298,103)

(390,230) (1,960,710)

Income tax recognized in

profit or loss

$1,128,141 $1,836,272

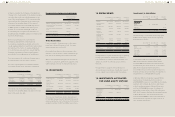

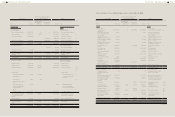

b. Income tax recognized in other comprehensive income

For the Year Ended December 31

2013 2012

Deferred tax

Recognized in current year

Actuarial gain and loss (tax benefit) $(1,794) $(915)

c. Current tax assets and liabilities

December

31, 2013

December

31, 2012

January 1,

2012

Current tax assets

Tax refund receivable $238,085 $61,532 $263,116

Current tax liabilities

Income tax payable $1,040,128 $2,713,373 $10,570,682

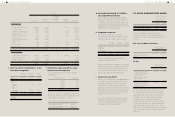

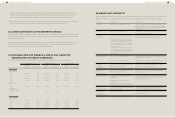

d. Deferred tax balances

The movements of deferred tax assets and deferred tax liabilities for the years ended December 31, 2013

and 2012 were as follows:

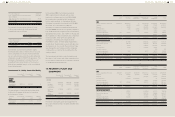

2013

Opening

Balance

Recognized in

Profit or Loss

Recognized

in Other

Comprehensive

Income

Disposal of

Subsidiaries

Translation

Adjustment

Closing

Balance

Deferred tax assets

Temporary differences

Unrealized royalties $2,985,884 $(556,451) $- $- $- $2,429,433

Unrealized marketing expenses 2,336,469 (57,711) - - 60,145 2,338,903

Unrealized warranty expense 859,853 (162,739) - - 15,320 712,434

Allowance for loss on decline in

value of inventory

756,462 (220,526) - - 16,100 552,036

Unrealized profit 365,524 (63,257) - - - 302,267

Unrealized salary and welfare 357,322 8,236 - (1,416) 10,783 374,925

Unrealized contingent losses on

purchase orders

70,779 29,166 - - - 99,945

Others 294,018 158,624 (915) (3,295) (42,758) 405,674

Loss carryforwards 484 1,449,272 - (508) 370 1,449,618

Investment credits 663,047 (663,047) - - - -

$8,689,842 $(78,433) $(915) $(5,219) $59,960 $8,665,235

Deferred tax liabilities

Temporary differences

Unrealized gain on investments $470,743 $(407,873) $- $- $16,580 $79,450

Financial assets at FVTPL 2,961 16,515 - - - 19,476

Defined benefit plans 35,034 (17,227) (2,709) - - 15,098

Others 139,198 (60,078) - (2,622) (39,400) 37,098

$647,936 $(468,663) $(2,709) $(2,622) $(22,820) $151,122

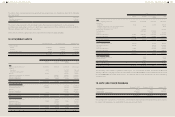

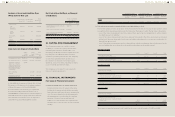

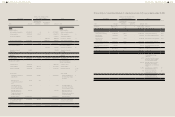

The income tax for the years ended December

31, 2013 and 2012 can be reconciled to the

accounting profit as follows:

For the Year Ended

December 31

2013 2012

(Loss) profit before income

tax

$(195,644) $19,458,065

Income tax calculated at 17% - 3,307,871

Effect of expenses that

were not deductible in

determining taxable profit

210,430 398,686

Effect of temporary

differences

(152,462) (2,052,711)

Effect of investment tax

credits

(1,126,249) (1,351,783)

Effect of loss carryforward (2,298) (6,695)

Effect of income that is

exempt from taxation

(501) (314,340)

Additional income tax under

the Alternative Minimum Tax

Act

- 46,334

Additional 10% income tax

on unappropriated earnings

1,126,249 2,315,062

Effect of Alternative

Minimum Tax rate changes

from 10% to 12% on deferred

income tax (effective in

2013)

- (1,298,103)

Effect of different tax rates

of subsidiaries operating in

other jurisdictions

987,316 943,416

Adjustments for prior years'

tax

85,656 (151,465)

Income tax recognized in

profit or loss

$1,128,141 $1,836,272