HTC 2013 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

298 299

sufficient collateral, where appropriate, as a means

of mitigating the risk of financial loss from defaults.

The credit risk information of trade receivables are

disclosed in the Note 13.

c. Liquidity risk

The Company manages liquidity risk to ensure

that the Company possesses sufficient financial

flexibility by maintaining adequate reserves

of cash and cash equivalents and reserve

financing facilities, and also monitor liquidity

risk of shortage of funds by the maturity date of

financial instruments and financial assets.

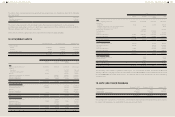

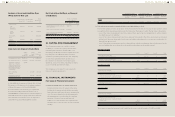

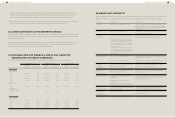

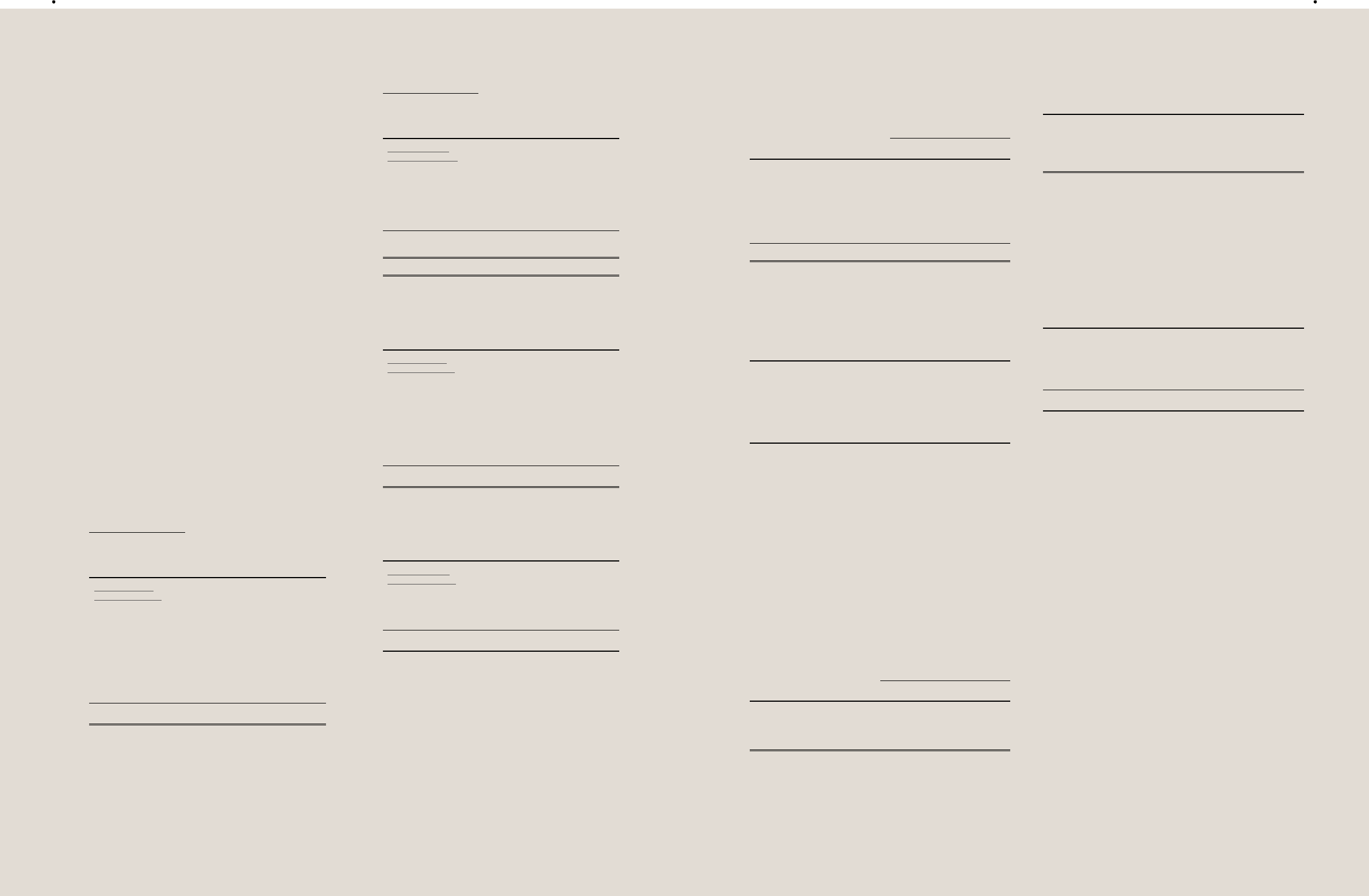

1) Liquidity risk tables

The following tables detail the Company's

remaining contractual maturity for its

derivative financial liabilities and non-

derivative financial liabilities with agreed

repayment periods. The tables had been

drawn up based on the undiscounted cash

flows of financial liabilities from the earliest

date on which the Company can be required

to pay. The tables included both interest and

principal cash flows.

December 31, 2013

Less Than

3 Months

3 to 12

Months Over 1 Year

Non-derivative

financial liabilities

Note and trade

payables

$13,087,630 $33,188,221 $-

Other payables 14,813,806 23,219,193 -

Other current

liabilities

74,952 184,577 -

Guarantee

deposits received

- - 256,415

$27,976,388 $56,591,991 $256,415

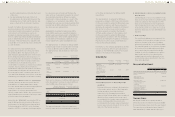

December 31, 2012

Less Than

3 Months

3 to 12

Months Over 1 Year

Non-derivative

financial liabilities

Note and trade

payables

$25,172,364 $48,445,833 $-

Other payables 16,036,617 23,230,556 -

Other current

liabilities

270,073 31,795 -

Guarantee

deposits received

- - 59,999

$41,479,054 $71,708,184 $59,999

January 1, 2012

Less Than

3 Months

3 to 12

Months Over 1 Year

Non-derivative

financial liabilities

Note and trade

payables

$33,234,316 $45,238,814 $-

Other payables 15,945,336 31,650,455 -

Other current

liabilities

274,995 165,867 -

Guarantee

deposits received

- - 42,946

$49,454,647 $77,055,136 $42,946

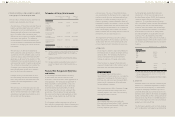

2) Bank credit limit

December

31, 2013

December

31, 2012

January 1,

2012

Unsecured bank

general credit limit

Amount used $1,697,088 $1,572,461 $1,892,407

Amount

unused

45,647,802 45,104,312 10,899,663

$47,344,890 $46,676,773 $12,792,070

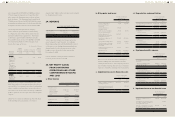

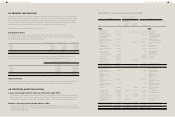

33. RELATED-PARTY

TRANSACTIONS

Transactions, account balances and revenue

and expense between the Company and its

subsidiaries, which were related parties of the

Company, had been eliminated on consolidation

and are not disclosed in this note. Details of

transactions between the Company and other

related parties were as follows:

Sales

For the Year Ended

December 31

2013 2012

Key management personnel $2,002 $-

Other related parties - Employees'

Welfare Committee

23,454 220,037

Other related parties - other

related parties' chairperson or its

significant stockholder, is HTC's

chairperson

12,439 2,242,971

$37,895 $2,463,008

The following balances of trade receivables from

related parties were outstanding at the end of the

reporting period:

December

31, 2013

December

31, 2012

January 1,

2012

Other related

parties - other

related parties'

chairperson or

its significant

stockholder,

is HTC's

chairperson

$1,309 $221,050 $473

The selling prices for products sold to related

parties were lower than those sold to third parties,

except some related parties have no comparison

with those sold to third parties. No guarantees

had been given or received for trade receivables

from related parties. No bad debt expense had

been recognized for the years ended December

31, 2013 and 2012 for the amounts owed by related

parties.

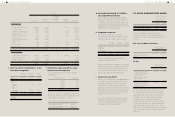

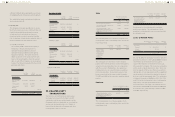

Purchase

For the Year Ended December

31

2013 2012

Other related parties - other

related parties' chairperson or

its significant stockholder, is

HTC's chairperson

$62,030 $63,675

The following balances of trade payables from

related parties were outstanding at the end of the

reporting period:

December

31, 2013

December

31, 2012

January 1,

2012

Other related parties -

other related parties'

chairperson or its

significant stockholder,

is HTC's chairperson

$8,303 $19,269 $-

Purchase prices for related parties and third

parties were similar. The outstanding of trade

payables to related parties are unsecured and will

be settled in cash.

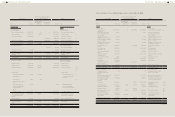

Loans to Related Parties

December 31,

2013

December 31,

2012

January 1,

2012

Associates

Principal $- $6,554,025 $-

Interest

receivables

- 46,068 -

$- $6,600,093 $-

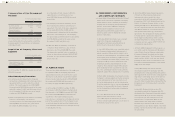

On July 19, 2012, the Company's board of directors

passed a resolution to offer US$225,000 thousand

short-term loan to Beats Electronics, LLC to

support the transition of Beats Electronics, LLC

into a product company. This loan was secured by

all the assets of Beats Electronics, LLC. Term loan

must be repaid in full no later than one year from

signing date of loan agreement and the repayment

can be made in full at any time during the term of

the loan or at the repayment date. The calculation

of interest is based on LIBOR plus 1.5%, 3.5%, 5.5%

and 7.5% for the first quarter to the fourth quarter,

respectively. The principal and interest were

received in full in June 2013. The interest income

amounted to NT$211,139 thousand and NT$82,027

thousand for the years ended December 31, 2013

and 2012, respectively.