HTC 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

220 221

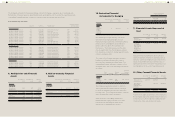

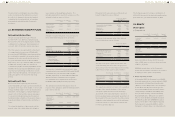

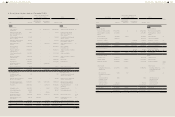

28. SHARE-BASED PAYMENT

ARRANGEMENTS

Qualified employees of the Company and its

subsidiaries were granted 15,000 thousand

options in November 2013. Each option entitles

the holder to subscribe for one common share of

the Company. The options granted are valid for 7

years and exercisable at certain percentages after

the second anniversary from the grant date. The

exercise price equals to the closing price of the

Company's common shares on the grant date. For

any subsequent changes in the Company's common

shares, the exercise price is adjusted accordingly.

Information on employee share options as of the

reporting date was as follows:

For the Year Ended

December 31

Number of

Options

(In

Thousands)

Weighted

average

Exercise

Price

(NT$)

Balance at January 1

Options granted during the year

-

15,000

$-

149

Balance at December 31 15,000

Options exercisable, end of the year $-

Weighted-average fair value of

options granted per unit (NT$) $43.603

Information about outstanding options as of

December 31, 2013 and 2012 was as follows:

December 31,

2013

December 31,

2012

January 1,

2012

Range of exercise

price (NT$)

Weighted-

average remaining

contractual life

(years)

$149

6.8 years

$-

-

$-

-

Options granted in November 2013 were priced

using the trinomial option pricing model and the

inputs to the model were as follows:

November 2013

Grant-date share price (NT$)

Exercise price (NT$)

Expected volatility

Expected life (years)

Expected dividend yield

Risk-free interest rate

$149

149

45.83%

7 years

5.00%

1.63%

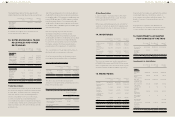

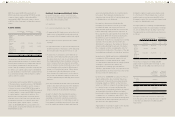

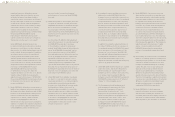

31. CAPITAL RISK MANAGEMENT

The Company manages its capital to ensure

its ability to continue as a going concern while

maximizing the returns to shareholders. The

Company periodically reviews its capital structure

by taking into consideration macroeconomic

conditions, prevailing interest rate, and adequacy

of cash flows generated from operations; as

the situation would allow, the Company pays

dividends, issues new shares, repurchases shares,

issues new debt, and redeems debt.

The Company is not subject to any externally

imposed capital requirements.

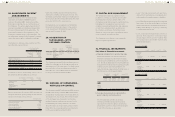

32. FINANCIAL INSTRUMENTS

Fair Value of Financial Instruments

a. Financial instruments not carried at fair value

Financial instruments not carried at fair value

held by the Company include held-to-maturity

financial assets and financial assets measured at

cost. Except as detailed in the following table, the

management considers that the carrying amounts

of financial assets and financial liabilities not

carried at fair value approximate their fair value or

the fair value are not measured reliably.

December 31,

2013

December 31,

2012

January 1, 2012

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Assets

Held-to-

maturity

investments $- $- $101,459 $101,436 $204,597 $203,783

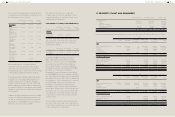

b. Fair value measurements recognized in the

parent company only balance sheet.

The following table provides an analysis

of financial instruments that are measured

subsequent to initial recognition at fair value,

grouped into Levels 1 to 3 based on the degree

to which the fair value is observable:

Expected volatility was based on the historical

share price volatility over the past one year. The

Company assumed that employees would exercise

their options after the vesting date when the share

price was 1.63 times the exercise price.

Compensation cost recognized was NT$26,742

thousand, including subsidiaries' compensation

costs amounting to NT$3,299 thousand, for the

year ended December 31, 2013.

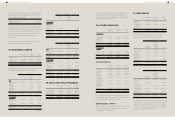

29. ACQUISITION OF

SUBSIDIARIES - WITH

OBTAINED CONTROL

Principal

Activity

Date of

Acquisition

Proportion of

Voting Equity

Interests

Acquired (%)

Consideration

Transferred

FunStream

Corporation

Design,

research and

development

of 3-D

technolog

February

2012

100.00% $45,090

The Company acquired FunStream Corporation to

obtain its techniques in the design, research and

development of 3-D technology. For details about

the acquisition of this subsidiary, please refer to

Note 29 to the consolidated financial statements

for the year ended December 31, 2013.

30. DISPOSAL OF SUBSIDIARIES -

WITH LOSS OF CONTROL

The Company and CHT each had held 50% share of

Huada, respectively. In March 2012, Huada held a

stockholders' meeting and re-elected its directors

and supervisors. As a result, the investment type

of the Company was changed to joint venture

and the Company continued to account for this

investment by the equity method. For details

about the disposal of subsidiaries, please refer to

Note 30 to the consolidated financial statements

for the year ended December 31, 2013.

‧ Level 1 fair value measurements are those

derived from quoted prices (unadjusted) in

active markets for identical assets or liabilities;

‧ Level 2 fair value measurements are those derived

from inputs other than quoted prices included

within Level 1 that are observable for the asset or

liability, either directly (i.e. as prices) or indirectly

(i.e. derived from prices); and

‧ Level 3 fair value measurements are those

derived from valuation techniques that

include inputs for the asset or liability that

are not based on observable market data

(unobservable inputs).

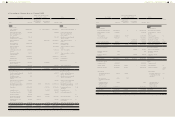

December 31, 2013

Level 1 Level 2 Level 3 Total

Financial

assets at

FVTPL

Derivative

financial

instruments

$- $162,297 $- $162,297

Available-

for-sale

financial

assets

Domestic

listed stocks

- equity

investments

$239 $- $- $239

December 31, 2012

Level 1 Level 2 Level 3 Total

Financial

assets at

FVTPL

Derivative

financial

instruments

$- $6,950 $- $6,950

Available-

for-sale

financial

assets

Domestic

listed stocks

- equity

investments

$197 $- $- $197

Hedging

derivative

assets

Derivative

financial

instruments

$- $204,519 $- $204,519