HTC 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

210 211

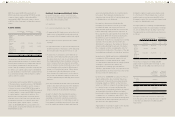

The Company expects to make a contribution of

NT$22,751 thousand to the defined benefit pension

plan within one year from December 31, 2013.

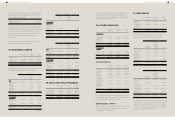

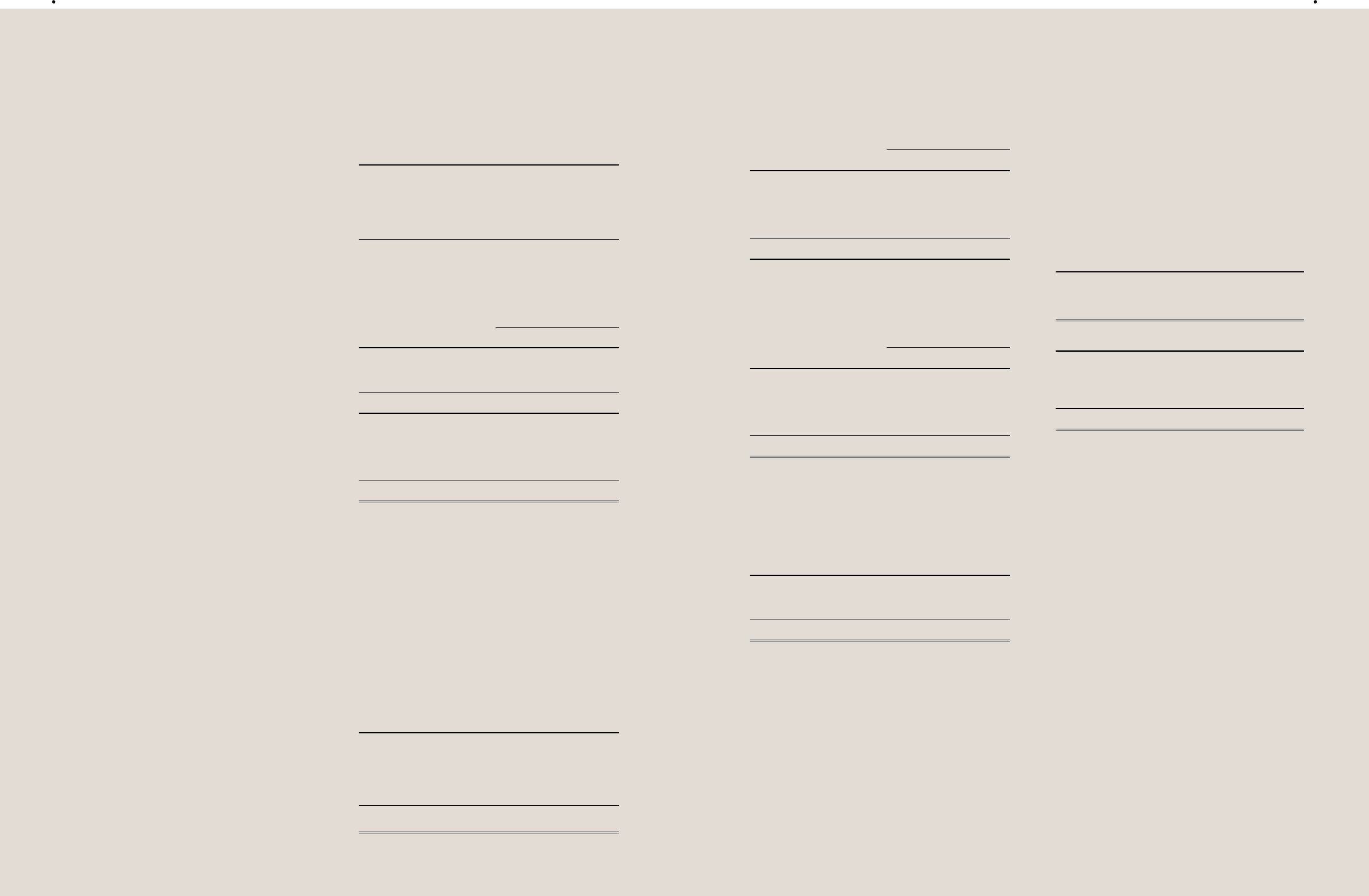

23. EQUITY

Share Capital

a. Common stock

December 31,

2013

December 31,

2012

January 1,

2012

Authorized

shares (in

thousands of

shares)

1,000,000 1,000,000 1,000,000

Authorized

capital

$10,000,000 $10,000,000 $10,000,000

Issued and

fully paid

shares (in

thousands of

shares)

842,351 852,052 852,052

Issued capital $8,423,505 $8,520,521 $8,520,521

Fully paid ordinary shares, which have a par

value of $10, carry one vote per share and carry

a right to dividends.

16,000 thousand shares of the Company's

shares authorized were reserved for the issuance

of employee share options, respectively.

b. Global depositary receipts

In November 2003, the Company issued 14,400

thousand common shares corresponding to 3,600

thousand units of Global Depositary Receipts

("GDRs"). For this GDR issuance, the Company's

stockholders, including Via Technologies, Inc.,

also issued 12,878.4 thousand common shares,

corresponding to 3,219.6 thousand GDR units.

Thus, the entire offering consisted of 6,819.6

thousand GDR units. Taking into account the

effect of stock dividends, the GDRs increased

to 8,782.1 thousand units (36,060.5 thousand

shares). The holders of these GDRs requested

the Company to redeem the GDRs to get the

Company's common shares. As of December 31,

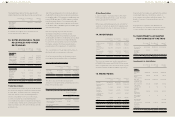

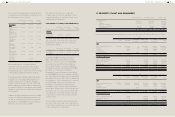

Movements in the present value of the defined

benefit obligations were as follows:

For the Year Ended

December 31

2013 2012

Opening defined benefit obligation

Current service cost

Interest cost

Actuarial losses

Benefits paid

$393,124

4,599

6,388

13,730

(6,319)

$380,659

5,601

6,661

203

-

Closing defined benefit obligation $411,522 $393,124

Movement in the present value of the defined

benefit obligations were as follows:

For the Year Ended

December 31

2013 2012

Opening fair value of plan assets

Expected return on plan assets

Actuarial losses

Contributions from the employer

Benefits paid

$512,646

9,858

(3,246)

24,476

(6,318)

$481,685

9,893

(5,107)

26,175

-

Closing fair value of plan assets $537,416 $512,646

The major categories of plan assets at the end

of the reporting period for each category were

disclosed based on the information announced by

Labor Pension Fund Supervisory Committee:

December 31,

2013

December 31,

2012

January 1,

2012

Equity instruments

Debt instruments

Others

44.77%

54.44%

0.79%

37.43%

61.78%

0.79%

40.75%

59.12%

0.13%

100.00% 100.00% 100.00%

The expected overall rate of return is the weighted

average of the expected returns of the various

categories of plan assets held. The Actuary's

assessment of the expected returns is based on

historical return trends and analysts' predictions of

the market for the asset over the life of the related

obligation, after taking into account the minimum

return rate which no lower than the interest rate

for two-years' time deposit.

The provision for contingent loss on purchase

orders is estimated after taking into account

the effects of changes in the product market,

evaluating the foregoing effects on inventory

management and adjusting the Company's

purchases.

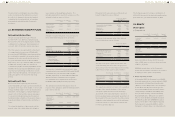

22. RETIREMENT BENEFIT PLANS

Defined Contribution Plans

The pension plan under the Labor Pension

Act (the "LPA") is a defined contribution plan.

Based on the LPA, the Company makes monthly

contributions to employees' individual pension

accounts at 6% of monthly salaries and wages.

The total expenses recognized in the statement

of comprehensive income were NT$428,469

thousand and NT$411,916 thousand, representing

the contributions payable to these plans by the

Company at the rates specified in the plans for

the years ended December 31, 2013 and 2012,

respectively. As of December 31, 2013, December

31, 2012 and January 1, 2012, the amounts of

contributions payable were NT$103,649 thousand,

NT$105,776 thousand and NT$110,560 thousand,

respectively, representing contributions not yet

paid for the reporting period. The amounts were

paid subsequent to the end of the reporting

period.

Defined Benefit Plans

Based on the defined benefit plan under the

Labor Standards Law ("LSL"), pension benefits are

calculated on the basis of the length of service and

average monthly salaries of the six months before

retirement. The Company contributed amounts

equal to 2% of total monthly salaries and wages

to a pension fund administered by the pension

fund monitoring committee. The pension fund is

deposited in Bank of Taiwan in the committee's

name.

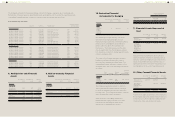

The actuarial valuations of plan assets and the

present value of the defined benefit obligation

were carried out by qualifying actuaries. The

principal assumptions used for the purposes of the

actuarial valuations were as follows:

December 31,

2013

December 31,

2012

January 1,

2012

Discount rates 1.875% 1.625% 1.75%

Expected return

on plan assets

2.000% 1.875% 2.00%

Expected

rates of salary

increase

4.000% 4.000% 4.00%

Amounts recognized in profit or loss in respect of

these defined benefit plans were as follows:

For the Year Ended

December 31

2013 2012

Service cost

Interest cost

Expected return on plan assets

$4,598

6,388

(9,858)

$5,600

6,662

(9,893)

$1,128 $2,369

An analysis by function

Cost of revenues

Selling and marketing

General and administrative

Research and development

$301

89

128

610

$616

738

249

766

$1,128 $2,369

The amounts of actuarial losses recognized in other

comprehensive income were NT$15,205 and NT$4,407

thousand for the years ended December 31, 2013

and 2012, respectively. As of December 31, 2013 and

2012, the amounts of actuarial losses recognized

in accumulated other comprehensive income were

NT$19,612 and NT$4,407 thousand, respectively.

The amounts included in the balance sheets in

respect of the obligation under the defined benefit

plans were as follows:

December 31,

2013

December 31,

2012

January 1,

2012

Present value

of funded

defined benefit

obligation

$(411,522) $(393,124) $(380,659)

Fair value of

plan assets

537,416 512,646 481,685

Defined benefit

assets

$125,894 $119,522 $101,026