HTC 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

202 203

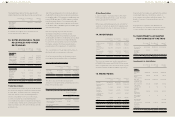

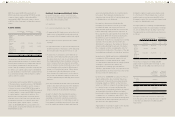

8. Available-for-sale Financial

Assets

December 31,

2013

December 31,

2012

January 1,

2012

Domestic

investments

Listed stocks

Mutual funds

$239

-

$197

-

$279

736,031

$239 $197 $736,310

Current

Non-current

$-

239

$-

197

$736,031

279

$239 $197 $736,310

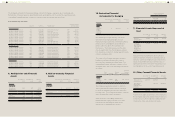

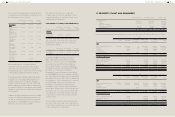

10. Derivative Financial

Instruments for Hedging

December 31,

2013

December 31,

2012

January 1,

2012

Hedging

derivative

assets

Cash flow

hedge -

forward

exchange

contracts

$- $204,519 $-

The Company's foreign-currency cash flows

derived from the highly probable forecast

transaction may lead to risks on foreign-currency

financial assets and liabilities and estimated

future cash flows due to the exchange rate

fluctuations. The Company assesses the risks

may be significant; thus, the Company entered

into derivative contracts to hedge against foreign-

currency exchange risks.

The terms of the forward exchange contracts

had been negotiated to match the terms of

the respective designated hedged items. The

outstanding forward exchange contracts of the

Company at the end of the reporting period were

as follows:

Buy/

Sell Currency

Maturity

Date

Notional

Amount

(In Thousands)

December

31, 2012

Foreign

exchange

contracts

Buy USD/JPY 2013.

03.28

USD 95,356

The Company supplied products to clients in

Japan and signed forward exchange contracts

to avoid its exchange rate exposure due to the

forecast sales. Those forward exchange contracts

were designated as cash flow hedges.

Gains and losses of hedging instruments

transferred from equity to profit or loss were

included in the following line items in the

statements of comprehensive income:

9. Held-to-maturity Financial

Assets

December 31,

2013

December 31,

2012

January 1,

2012

Domestic

investment

Bonds $- $101,459 $204,597

Current

Non-current

$-

-

$101,459

-

$-

204,597

$- $101,459 $204,597

For the Year Ended

December 31

2013 2012

Revenues

Other gains and losses

$262,648

151,305

$-

10,467

$413,953 $10,467

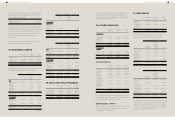

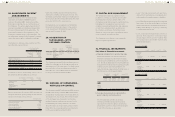

11. Financial Assets Measured at

Cost

December 31,

2013

December 31,

2012

January 1,

2012

Domestic

unlisted equity

investment

$515,861 $515,861 $515,861

Classified

according to

financial asset

measurement

categories

Available-for-

sale financial

assets

$515,861 $515,861 $515,861

Management believed that the above unlisted

equity investments held by the Company, whose

fair value cannot be reliably measured due to the

range of reasonable fair value estimates was so

significant; therefore, they were measured at cost

less impairment at the end of reporting period.

12. Other Current Financial Assets

December 31,

2013

December 31,

2012

January 1,

2012

Trust assets for

employee benefit

$2,359,041 $3,645,820 $-

Time deposits

with original

maturities more

than three

months

- 1,960,900 25,538,650

$2,359,041 $5,606,720 $25,538,650

To protect the rights and interests of its employees,

the Company deposited unpaid employee bonus in

a new trust account in September 2012 and were

classified as other current financial assets.

The Company entered into forward exchange contracts to manage exposures due to exchange rate

fluctuations of foreign currency denominated assets and liabilities. At the end of the reporting period,

outstanding forward exchange contracts not under hedge accounting were as follows:

Forward Exchange Contracts

Buy/Sell Currency Maturity Date

Notional Amount

(In Thousands)

December 31, 2013

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Sell

Sell

Sell

Sell

Sell

Buy

Buy

Buy

Buy

Buy

EUR/USD

JPY/USD

GBP/USD

USD/NTD

CAD/USD

USD/RMB

CAD/USD

RMB/USD

EUR/USD

GBP/USD

2014.01.02-2014.01.29

2014.03.31

2014.01.15-2014.01.22

2014.01.06-2014.02.05

2014.01.13-2014.01.29

2014.01.08-2014.01.22

2014.01.13

2014.01.08

2014.01.15-2014.01.22

2014.01.15-2014.01.22

EUR 61,000

JPY 3,755,090

GBP 12,000

USD 391,700

CAD 5,500

USD 100,600

CAD 4,000

RMB 11,000

EUR 18,000

GBP 2,000

December 31, 2012

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Sell

Sell

Sell

Sell

Buy

Buy

Buy

Buy

EUR/USD

GBP/USD

USD/NTD

USD/RMB

USD/RMB

USD/JPY

USD/CAD

USD/NTD

2013.01.11-2013.03.27

2013.01.09-2013.03.20

2013.01.17-2013.02.20

2013.01.09-2013.01.30

2013.01.09-2013.01.30

2013.01.09-2013.03.08

2013.01.09-2013.02.22

2013.01.07-2013.02.21

EUR 146,000

GBP 20,700

USD 70,000

USD 78,000

USD 106,000

USD 97,437

USD 22,158

USD 270,000

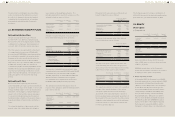

January 1, 2012

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Buy

Buy

Sell

Sell

USD/CAD

USD/RMB

EUR/USD

GBP/USD

2012.01.11-2012.02.22

2012.01.04-2012.01.31

2012.01.04-2012.03.30

2012.01.11-2012.02.22

USD 28,010

USD 105,000

EUR 339,000

GBP 17,100