HTC 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

216 217

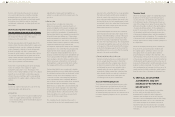

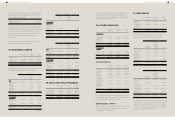

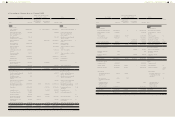

c. Impairment losses on financial assets

For the Year Ended

December 31

2013 2012

Trade receivables (included in

operating expense)

$991,821 $505,078

d. Depreciation and amortization

For the Year Ended

December 31

2013 2012

Property, plant and equipment $1,602,946 $1,292,949

Intangible assets 651,632 524,391

$2,254,578 $1,817,340

Classification of depreciation -

by function

Cost of revenues $873,928 $687,259

Operating expenses 729,018 605,690

$1,602,946 $1,292,949

Classification of amortization -

by function

Cost of revenues $- $4,300

Operating expenses 651,632 520,091

$651,632 $524,391

e. Employee benefits expense

For the Year Ended

December 31

2013 2012

Post-employment benefits (Note 23)

Defined contribution plans $428,469 $411,916

Defined benefit plans 1,128 2,369

429,597 414,285

Share-based payments

Equity-settled share-based

payments

23,443 -

Other employee benefits 10,529,260 12,021,593

Total employee benefits expense $10,982,300 $12,435,878

Classification - by function

Cost of revenues $5,625,526 $5,163,909

Operating expenses 5,356,774 7,271,969

$10,982,300 $12,435,878

f. Impairment losses on non-financial assets

For the Year Ended

December 31

2013 2012

Inventories (included in cost of

revenues)

$439,139 $1,211,554

Investments accounted for by

the equity method (included in

other gains and losses)

- 45,017

Intangible assets (including in

other gains and losses)

111,085 -

$550,224 $1,256,571

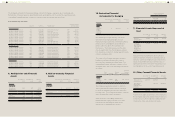

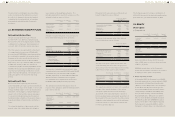

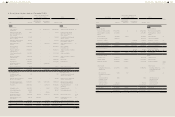

26. INCOME TAXES RELATING TO

CONTINUING OPERATIONS

a. Income tax recognized in profit or loss

For the Year Ended

December 31

2013 2012

Current tax

In respect of the current

period

$3,525 $1,341,594

Deferred tax

In respect of the current

period

35,053 75,644

Adjustments to deferred tax

attributable to changes in

tax rates and laws

- (1,298,103)

35,053 (1,222,459)

Income tax recognized in

profit or loss

$38,578 $119,135

The income tax for the years ended December

31, 2013 and 2012 can be reconciled to the

accounting profit as follows:

For the Year Ended

December 31

2013 2012

(Loss) profit before income

tax

$(1,285,207) $16,932,710

Income tax calculated at 17% - 2,878,561

Effect of expenses that were

not deductible in determining

taxable profit

Share of the profit or loss of

subsidiaries, associates and

joint ventures

29,858

182,898

26,285

(105,013)

(Continued)

For the Year Ended

December 31

2013 2012

Effect of temporary differences (177,703) (2,073,806)

Effect of investment tax credits (1,126,249) (1,351,783)

Effect of income that is exempt

from taxation

- (314,339)

Additional income tax under the

Alternative Minimum Tax Act

- 46,334

Additional 10% income tax on

unappropriated earnings

1,126,249 2,310,999

Effect of Alternative Minimum Tax

rate changes from 10% to 12% on

deferred income tax (effective in

2013)

- (1,298,103)

Overseas income tax 3,525 -

Income tax recognized in

profit or loss

$38,578 $119,135

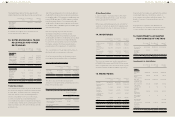

b. Income tax recognized in other

comprehensive income

For the Year Ended

December 31

2013 2012

Deferred tax

Recognized in current year

Actuarial gain and loss

(tax benefit)

$(1,771) $(903)

c. Current tax assets and liabilities

December

31, 2013

December

31, 2012

January 1,

2012

Current tax assets

Tax refund

receivable

$24,192 $- $-

Current tax

liabilities

Income tax

payable

$303 $1,424,006 $9,653,090

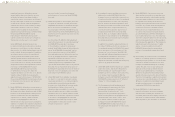

d. Deferred tax balances

The movements of deferred tax assets and deferred tax liabilities for the years ended December 31, 2013 and

2012 were as follows:

2013

Opening

Balance

Recognized in

Profit or Loss

Recognized

in Other

Comprehensive

Income Closing Balance

Deferred tax assets

Temporary differences

Allowance for loss on decline in value of inventory

Unrealized profit

Unrealized royalties

Unrealized marketing expenses

Unrealized warranty expense

Unrealized contingent losses on purchase orders

Others

$465,643

365,524

2,985,884

1,203,720

583,141

70,779

207,980

$(205,928)

(63,257)

(556,451)

426,200

(33,428)

29,166

160,438

$-

-

-

-

-

-

(903)

$259,715

302,267

2,429,433

1,629,920

549,713

99,945

367,515

Loss carryforward

Investment credit

5,882,671

-

663,047

(243,260)

837,428

(663,047)

(903)

-

-

5,638,508

837,428

-

$6,545,718 $(68,879) $(903) $6,475,936

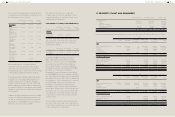

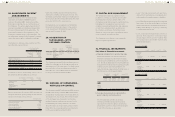

Deferred tax liabilities

Temporary differences

Defined benefit plans

Financial assets at FVTPL

Unrealized gain on investments

$35,022

2,961

112,551

$(17,240)

16,515

(33,101)

$(2,674)

-

-

$15,108

19,476

79,450

$150,534 $(33,826) $(2,674) $114,034