HTC 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

200 201

The estimates and underlying assumptions are

reviewed on an ongoing basis. Revisions to

accounting estimates are recognized in the period

in which the estimate is revised if the revision affects

only that period, or in the period of the revision and

future periods if the revision affects both current and

future periods.

The following are the key assumptions concerning

the future, and other key sources of estimation

uncertainty at the end of the reporting period,

that have a significant risk of causing a material

adjustment to the carrying amounts of assets and

liabilities within the next financial year.

a. Accrued marketing and advertising

expenses

The Company recognizes sale of goods as the

conditions are met. For information on the

principles of revenue recognition, please refer to

Note 4 "revenue recognition" section. The related

marketing and advertising expenses recognized as

reduction of sales amount or as current expenses

are estimated on the basis of agreement, past

experience and any known factors. The Company

reviews the reasonableness of the estimation

periodically.

As of December 31, 2013, December 31, 2012 and

January 1, 2012, the carrying amounts of accrued

marketing and advertising expenses were

NT$19,328,804 thousand, NT$15,531,875 thousand

and NT$25,556,956 thousand, respectively.

b. Allowances for doubtful debts

Receivables are assessed for impairment at the

end of each reporting period and considered

impaired when there is objective evidence that,

as a result of one or more events that occurred

after the initial recognition of the receivables, the

estimated future cash flows of the asset have

been affected.

As of December 31, 2013, December 31, 2012

and January 1, 2012, the carrying amounts of

As of December 31, 2013, December 31, 2012

and January 1, 2012, the carrying amounts of

inventories were NT$18,463,656 thousand,

NT$20,521,967 thousand and NT$25,389,320

thousand, respectively.

f. Realization of deferred tax assets

Deferred tax assets should be recognized only to

the extent that the entity has sufficient taxable

temporary differences or there is convincing other

evidence that sufficient taxable profit will be

available. The management applies judgment and

accounting estimates to evaluate the realization

of deferred tax assets. The management takes

expected sales growth, profit rate, duration of

exemption, tax credits, tax planning and etc. into

account to make judgment and estimates. Any

change in global economy, industry environment

and regulations might cause material adjustments

to deferred tax assets.

As of December 31, 2013, December 31, 2012

and January 1, 2012, the carrying amounts of

deferred tax assets were NT$6,475,936 thousand,

NT$6,545,718 thousand and NT$5,359,291

thousand, respectively.

g. Estimates of warranty provision

The Company estimates cost of product

warranties at the time the revenue is recognized.

The estimates of warranty provision are on

the basis of sold products and the amount of

expenditure required for settlement of present

obligation at the end of the reporting period.

The Company might recognize additional provisions

because of the possible complex intellectual

product malfunctions and the change of local

regulations, articles and industry environment.

As of December 31, 2013, December 31, 2012

and January 1, 2012, the carrying amounts of

warranty provision were NT$6,391,787 thousand,

NT$6,780,712 thousand and NT$12,755,264

thousand, respectively.

allowances for doubtful debts were NT$3,050,907

thousand, NT$2,059,086 thousand and

NT$1,554,008 thousand, respectively.

c. Impairment of tangible and intangible

assets other than goodwill

The Company measures the useful life of individual

assets and the probable future economic benefits

in a specific asset group, which depends on

subjective judgment, asset characteristics and

industry, during the impairment testing process.

Any change in accounting estimates due to

economic circumstances and business strategies

might cause material impairment in the future.

The recoverable amount of intangible assets is

less than its carrying amount. The Company

recognized impairment loss on intangible assets

other than goodwill for NT$111,085 thousand for

the year ended December 31, 2013.

d. Impairment of goodwill

Test of impairment on goodwill depends on

the subjective judgment of management. The

management uses subjective judgment to

identify cash-generating units, allocates assets

and liabilities to cash-generating units, allocates

goodwill to cash-generating units, and determines

recoverable amount of a cash-generating unit.

The Company determined that the recoverable

amount of goodwill in 2012 was less than

its carrying amount and thus recognized an

impairment loss on goodwill for NT$45,017

thousand for the year ended December 31, 2012.

e. Valuation of inventories

Inventories are measured at the lower of cost or

net realizable value. Judgment and estimation

are applied in the determination of net realizable

value at the end of reporting period.

Inventories are usually written down to net

realizable value item by item if those inventories

are damaged, have become wholly or partially

obsolete, or if their selling prices have declined.

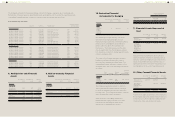

6. CASH AND CASH EQUIVALENTS

December 31,

2013

December 31,

2012

January 1,

2012

Cash on hand $1,010 $1,010 $1,000

Checking

accounts

15,209 4,562 7,903

Demand

deposits

9,305,095 29,544,930 21,844,352

Time deposits

(with original

maturities less

than three

months)

23,713,190 12,995,427 31,544,315

$33,034,504 $42,545,929 $53,397,570

Cash equivalents include time deposits that have a

maturity of three months or less from the date of

acquisition, are readily convertible to a known amount

of cash, and are subject to an insignificant risk of

change in value; these were held for the purpose of

meeting short-term cash commitments.

The market rate intervals of cash in bank at the end of

the reporting period were as follows:

December 31,

2013

December 31,

2012

January 1,

2012

Bank deposits 0.20%-0.85% 0.20%-1.05% 0.15%-1%

7. FINANCIAL INSTRUMENTS AT

FAIR VALUE THROUGH PROFIT

OR LOSS

December 31,

2013

December 31,

2012

January 1,

2012

Financial assets

held for trading

Derivatives (not

designated

as hedging

instruments)

Exchange

contracts

$162,297 $6,950 $256,868