HTC 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

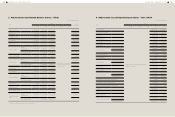

FINANCIAL INFORMATION FINANCIAL INFORMATION

164 165

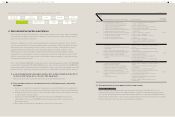

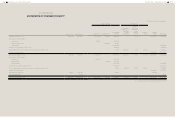

3. Financial Analysis for the Past Five Fiscal Years

(1) Financial Analysis - IFRSs

Item

Year

2013 2012 2011 2010 2009

Capital

Structure

Analysis

Debt Ratio(%) 54 59

Financial analysis was based on ROC

GAAP

Long-term Fund to Fixed Assets Ratio(%) 393 407

Liquidity

Analysis

Current Ratio(%) 97 103

Quick Ratio(%) 72 82

Debt Services Coverage Ratio(%) (195) 52,916

Operating

Performance

Analysis

Average Collection Turnover(Times)5.43 5.02

Days Sales Outstanding 67 73

Average Inventory Turnover ( Times)7.12 7.85

Average Payment Turnover ( Times)2.62 2.84

Average Inventory Turnover Days 51 46

Fixed Assets Turnover(Times)9.83 13.72

Total Assets Turnover ( Times)1.16 1.37

Profitability

Analysis

Return on Total Assets(%) (0.72) 7.57

Return on Equity(%) (1.68) 18.52

Paid-in Capital Ratio(%)

Operating Income (19.43) 173.35

Pre-tax Income (15.26) 198.73

Net Margin(%) (0.68) 6.21

Basic (Loss) Earnings Per Share(NT$)(1.60) 20.21

Cash Flow

Cash Flow Ratio(%) (14.76) 19.50

Cash Flow Adequacy Ratio(%) 113.13 128.67

Cash Flow Reinvestment Ratio(%) (17.28) (12.04)

Leverage

Operating Leverage (5.87) 2.37

Financial Leverage 1 1

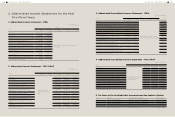

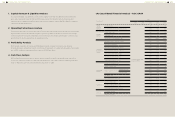

1. Capital Structure & Liquidity Analyses

As of year-end 2013, our debt ratio stood at 54% lower than last year level and current and quick

ratios were both lower at 97% and 72%, respectively. This situation reflected declines in revenue while

distributing dividends which caused net cash outflow to lower current and quick ratio compare to

previous year.

2. Operating Performance Analysis

Due to decline in revenue, fixed asset turnover, total asset turnover, and average collection turnover

were all lower than the previous year. Operation cost also lowered, inventory and account payable items

also decreased, causing inventory turnover days and payment turnover days to be lowered compared to

the previous year.

3. Profitability Analysis

On the back of declines in revenue, profitability decreased compared to the previous year given by

intensified market competition, price competition and sustainability for branding activities. Net margin

declined to -0.68% and EPS was NT$-1.6 in 2013.

4. Cash Flow Analysis

Due to the global competition in 2013, HTC faced a decline in revenue and turned net cash flows from

operating activities to net cash outflows, which brought net cash flow ratio to -15% and the cash flow

adequacy ratio to 113%. Cash flow reinvestment reduced to -17%.