HTC 2013 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

278 279

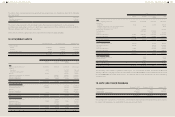

The above items of property, plant and equipment were depreciated on a straight-line basis at the following

rates per annum:

Building

Machinery and equipment

Other equipment

5-50 years

3-6 years

3-5 years

The major component parts of the buildings held by the Company included plants, electro-powering

machinery and engineering systems, etc., which were depreciated over their estimated useful lives of 40 to

50 years, 20 years and 5 to 10 years, respectively.

There were no interests capitalized for the years ended December 31, 2013 and 2012.

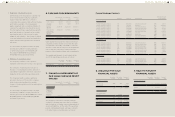

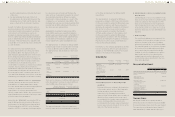

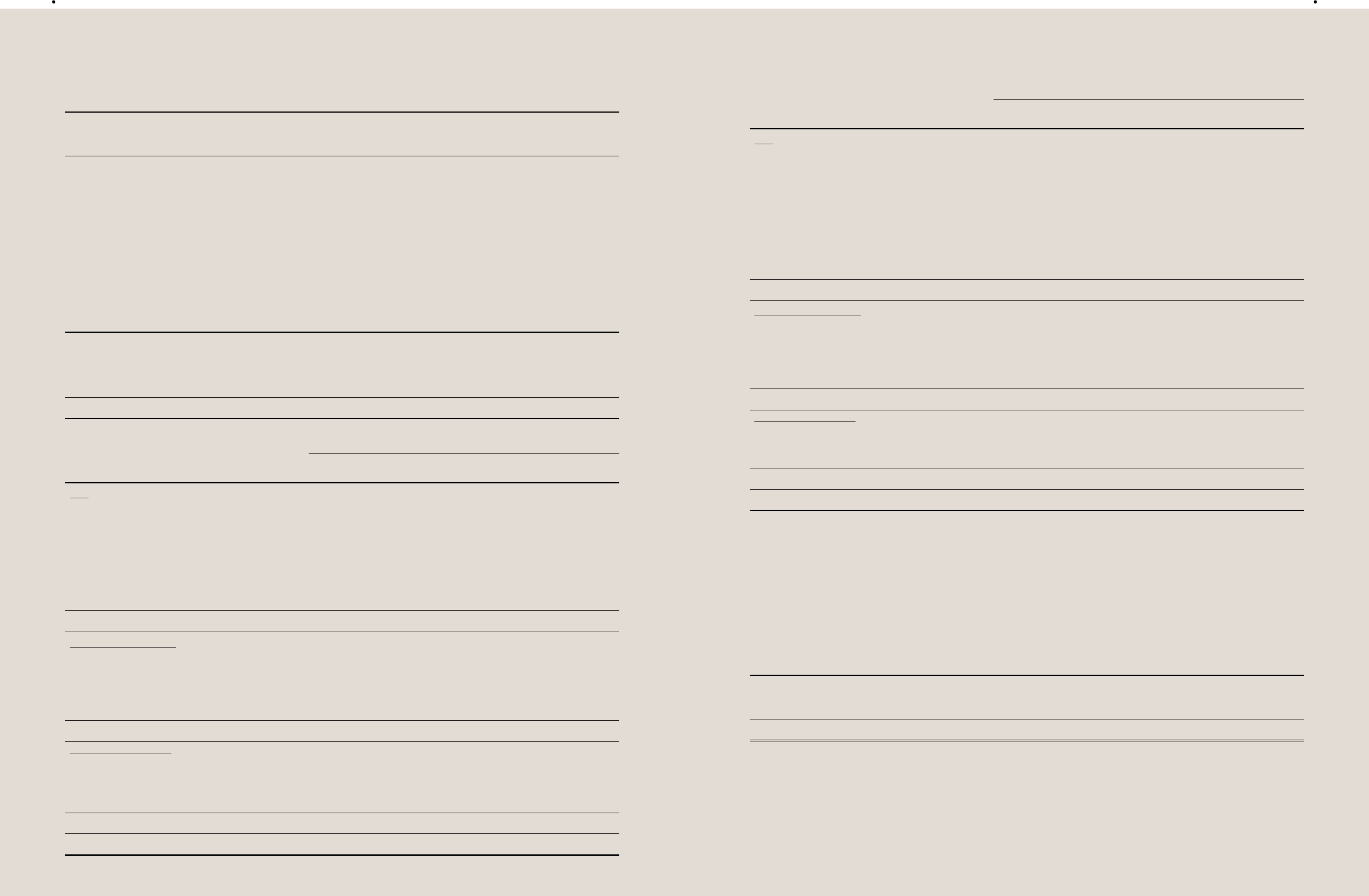

18. INTANGIBLE ASSETS

December 31, 2013 December 31, 2012 January 1, 2012

Carrying amounts

Patents $7,668,901 $9,180,674 $11,152,098

Goodwill 174,253 1,534,366 10,812,564

Other intangible assets 820,912 968,130 802,817

$8,664,066 $11,683,170 $22,767,479

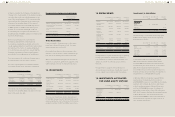

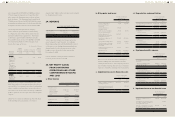

2013

Patents Goodwill Other Intangible

Assets Total

Cost

Balance, beginning of the year $11,239,554 $1,681,561 $1,603,108 $14,524,223

Additions

Acquisition 22,213 - 200,795 223,008

Transfer from prepayment - - 509,710 509,710

Disposal (6,778) - (24,709) (31,487)

Adjustment in acquisition of a subsidiary - (67,690) (39,966) (107,656)

Disposal of subsidiaries - (785,338) (608,519) (1,393,857)

Translation adjustment 241,501 46,251 49,013 336,765

Balance, end of the year 11,496,490 874,784 1,689,432 14,060,706

Accumulated amortization

Balance, beginning of the year 2,058,880 - 634,978 2,693,858

Amortization expenses 1,618,246 - 350,246 1,968,492

Disposal - - (22,372) (22,372)

Disposal of subsidiaries - - (283,487) (283,487)

Translation adjustment 39,378 - 26,314 65,692

Balance, end of the year 3,716,504 - 705,679 4,422,183

Accumulated impairment

Balance, beginning of the year - 147,195 - 147,195

Impairment losses 111,085 591,306 161,961 864,352

Disposal of subsidiaries - (45,017) - (45,017)

Translation adjustment - 7,047 880 7,927

Balance, end of the year 111,085 700,531 162,841 974,457

Net book value, end of the year $7,668,901 $174,253 $820,912 $8,664,066

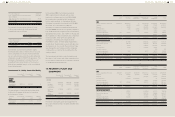

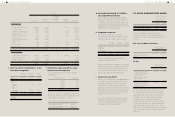

2012

Patents Goodwill Other Intangible

Assets Total

Cost

Balance, beginning of the year $11,608,540 $10,905,878 $1,203,368 $23,717,786

Additions

Acquisition 11,464 - 545,117 556,581

Difference between the cost of investments and the

Company's share in investees' net assets

- 45,017 - 45,017

Adjustments of acquisition cost - (26,226) - (26,226)

Reclassification - (5,717,960) 5,717,960 -

Disposal - - (64,719) (64,719)

Disposal of subsidiaries (35,323) (3,485,380) (5,713,752) (9,234,455)

Translation adjustment (345,127) (39,768) (84,866) (469,761)

Balance, end of the year 11,239,554 1,681,561 1,603,108 14,524,223

Accumulated amortization

Balance, beginning of the year 456,442 - 400,551 856,993

Amortization expenses 1,625,124 - 422,557 2,047,681

Disposal - - (64,719) (64,719)

Disposal of subsidiaries (1,893) - (115,699) (117,592)

Translation adjustment (20,793) - (7,712) (28,505)

Balance, end of the year 2,058,880 - 634,978 2,693,858

Accumulated impairment

Balance, beginning of the year - 93,314 - 93,314

Impairment losses - 57,621 - 57,621

Translation adjustment - (3,740) - (3,740)

Balance, end of the year - 147,195 - 147,195

Net book value, end of the year $9,180,674 $1,534,366 $968,130 $11,683,170

The Company owns patents of graphics technologies. As of December 31, 2013, December 31, 2012 and

January 1, 2012, the carrying amounts of such patents were NT$6,641,606 thousand, NT$7,555,334 thousand

and NT$9,008,002 thousand, respectively. The patents will be fully amortized over their remaining

economic lives.

19. NOTE AND TRADE PAYABLES

December 31, 2013 December 31, 2012 January 1, 2012

Note payables

Trade payables

Trade payables - related parties

$1,355

46,266,193

8,303

$294

73,598,634

19,269

$3,779

78,469,351

-

$46,275,851 $73,618,197 $78,473,130

The average term of payment is four months. The Company has financial risk management policies in place

to ensure that all payables are paid within the pre-agreed credit terms.