HTC 2013 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

270 271

f. Realization of deferred tax assets

Deferred tax assets should be recognized only

to the extent that the entity has sufficient

taxable temporary differences or there is

convincing other evidence that sufficient taxable

profit will be available. The management

applies judgment and accounting estimates to

evaluate the realization of deferred tax assets.

The management takes expected sales growth,

profit rate, duration of exemption, tax credits,

tax planning and etc. into account to make

judgment and estimates. Any change in global

economy, industry environment and regulations

might cause material adjustments to deferred

tax assets.

As of December 31, 2013, December 31, 2012

and January 1, 2012, the carrying amounts

of deferred tax assets were NT$8,665,235

thousand, NT$8,689,842 thousand and

NT$6,319,978 thousand, respectively.

g. Estimates of warranty provision

The Company estimates cost of product

warranties at the time the revenue is recognized.

The estimates of warranty provision are on

the basis of sold products and the amount of

expenditure required for settlement of present

obligation at the end of the reporting period.

The Company might recognize additional

provisions because of the possible complex

intellectual product malfunctions and the

change of local regulations, articles and industry

environment.

As of December 31, 2013, December 31, 2012

and January 1, 2012, the carrying amounts of

warranty provision were NT$7,376,035 thousand,

NT$8,058,509 thousand and NT$13,080,394

thousand, respectively.

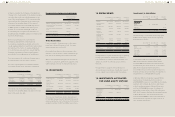

6. CASH AND CASH EQUIVALENTS

December 31,

2013

December 31,

2012

January 1,

2012

Cash on hand $2,479 $15,433 $6,436

Checking

accounts

15,209 12,134 9,709

Demand

deposits

28,639,014 36,224,664 28,197,300

Time deposits

(with original

maturities less

than three

months)

24,642,239 14,713,912 33,813,313

$53,298,941 $50,966,143 $62,026,758

Cash equivalents include time deposits that have

a maturity of three months or less from the date

of acquisition, are readily convertible to a known

amount of cash, and are subject to an insignificant

risk of change in value; these were held for the

purpose of meeting short-term cash commitments.

The market rate intervals of cash in bank at the

end of the reporting period were as follows:

December

31, 2013

December

31, 2012

January 1,

2012

Bank deposits 0.2%~0.85% 0.2%~1.05% 0.15%~1%

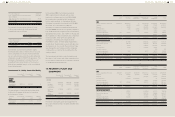

7. FINANCIAL INSTRUMENTS AT

FAIR VALUE THROUGH PROFIT

OR LOSS

December 31,

2013

December 31,

2012

January 1,

2012

Financial assets

held for trading

Derivatives (not

designated

as hedging

instruments)

Exchange

contracts $162,297 $6,950 $256,868

The Company entered into forward exchange

contracts to manage exposures due to exchange

rate fluctuations of foreign currency denominated

assets and liabilities. At the end of the reporting

period, outstanding forward exchange contracts

not under hedge accounting were as follows:

Forward Exchange Contracts

Buy/Sell Currency Maturity Date

Notional Amount

(In Thousands)

December 31, 2013

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Sell

Sell

Sell

Sell

Sell

Buy

Buy

Buy

Buy

Buy

EUR/USD

JPY/USD

GBP/USD

USD/NTD

CAD/USD

USD/RMB

CAD/USD

RMB/USD

EUR/USD

GBP/USD

2014.01.02-2014.01.29

2014.03.31

2014.01.15-2014.01.22

2014.01.06-2014.02.05

2014.01.13-2014.01.29

2014.01.08-2014.01.22

2014.01.13

2014.01.08

2014.01.15-2014.01.22

2014.01.15-2014.01.22

EUR 61,000

JPY 3,755,090

GBP 12,000

USD 391,700

CAD 5,500

USD 100,600

CAD 4,000

RMB 11,000

EUR 18,000

GBP 2,000

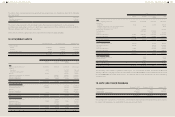

December 31, 2012

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Sell

Sell

Sell

Sell

Buy

Buy

Buy

Buy

EUR/USD

GBP/USD

USD/NTD

USD/RMB

USD/RMB

USD/JPY

USD/CAD

USD/NTD

2013.01.11-2013.03.27

2013.01.09-2013.03.20

2013.01.17-2013.02.20

2013.01.09-2013.01.30

2013.01.09-2013.01.30

2013.01.09-2013.03.08

2013.01.09-2013.02.22

2013.01.07-2013.02.21

EUR 146,000

GBP 20,700

USD 70,000

USD 78,000

USD 106,000

USD 97,437

USD 22,158

USD 270,000

January 1, 2012

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Foreign exchange contracts

Buy

Buy

Sell

Sell

USD/CAD

USD/RMB

EUR/USD

GBP/USD

2012.01.11-2012.02.22

2012.01.04-2012.01.31

2012.01.04-2012.03.30

2012.01.11-2012.02.22

USD 28,010

USD 105,000

EUR 339,000

GBP 17,100

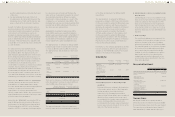

8. AVAILABLE-FOR-SALE

FINANCIAL ASSETS

December

31, 2013

December

31, 2012

January 1,

2012

Domestic investments

Listed stocks

Mutual funds

$239

-

$197

-

$279

736,031

239 197 736,310

Foreign investments

Listed depositary

receipts - 37,902 -

$239 $38,099 $736,310

Current

Non-current

$-

239

$37,902

197

$736,031

279

$239 $38,099 $736,310

9. HELD-TO-MATURITY

FINANCIAL ASSETS

December

31, 2013

December

31, 2012

January 1,

2012

Domestic investments

Bonds $- $101,459 $204,597

Current

Non-current

$-

-

$101,459

-

$-

204,597

$- $101,459 $204,597