HTC 2013 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

308 309

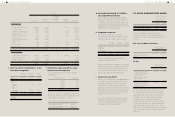

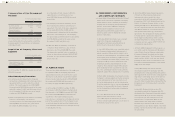

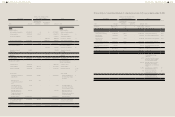

3) Reconciliation of consolidated statement of comprehensive income for the year ended December 31, 2012

ROC GAAP

Effect of the Transition from

ROC GAAP to IFRSs IFRSs

Note

Item Amount

Measurement

or Recognition

Difference

Presentation

Difference Amount Item

Revenues $289,020,175 $- $- $289,020,175 Revenues

Cost of revenues 216,095,098 (5,772) - 216,089,326 Cost of revenues d), f)

Gross profit 72,925,077 5,772 - 72,930,849 Gross profit

Operating expenses

Selling and marketing 32,387,932 (5,369) - 32,382,563 Selling and marketing d), f)

General and

administrative

6,227,469 364 - 6,227,833 General and administrative d), f)

Research and

development

15,489,969 3,170 - 15,493,139 Research and development d), f)

Total operating expenses 54,105,370 (1,835) - 54,103,535 Total operating expenses

Operating profit 18,819,707 7,607 - 18,827,314 Operating profit

Non-operating income and

expenses

630,751 - - 630,751 Non-operating income and

expenses

Profit before income tax 19,450,458 7,607 - 19,458,065 Profit before income tax

Income tax (1,861,272) 25,000 - (1,836,272) Income tax c)

Profit for the period $17,589,186 $32,607 $- 17,621,793 Profit for the period

$(1,089,693) Exchange difference

on translating foreign

operation

6,777 Unrealized valuation gains

and losses from available-

for-sale financial assets

194,052 Effective portion of gains

and losses on hedging

instruments in a cash flow

hedge

(5,382) Actuarial loss on defined

benefit pension plan

d)

915 Income tax relating to

components of other

comprehensive income

d)

(893,331) Other comprehensive

income and loss for the

period, net of income tax

$16,728,462 Total comprehensive income

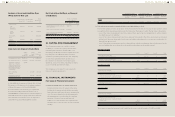

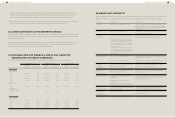

ROC GAAP

Effect of the Transition from

ROC GAAP to IFRSs IFRSs

Note

Item Amount

Measurement

or Recognition

Difference

Presentation

Difference Amount Item

Liabilities and stockholders'

equity

Liabilities and stockholders'

equity

Current liabilities Current liabilities

Note and trade payables $73,618,197 $- $- $73,618,197 Note and trade payables

Other payables 39,173,722 93,451 - 39,267,173 Other payables f)

Income tax payables 2,713,373 - - 2,713,373 Current tax liabilities

- - - 8,881,514 8,881,514 Provisions - current e)

Other current liabilities 10,669,620 - (8,881,514) 1,788,106 Other current liabilities e)

Total current liabilities 126,174,912 93,451 - 126,268,363 Total current liabilities

Non-current liabilities Non-current liabilities

- - - 647,936 647,936 Deferred tax liabilities b)

Guarantee deposits

received

59,999 - - 59,999 Guarantee deposits

received

Total non-current

liabilities

59,999 - 647,936 707,935 Total non-current

liabilities

Total liabilities 126,234,911 93,451 647,936 126,976,298 Total liabilities

Stockholders' equity Equity attributable to

owners of the parent

Common stock 8,520,521 - - 8,520,521 Common stock

Capital surplus 16,619,594 (18,037) - 16,601,557 Capital surplus i)

Retained earnings 70,148,728 (46,697) - 70,102,031 Retained earnings c), d),

f), i),

j)

Other equity Other equity

Cumulative translation

adjustments

(1,057,559) (32,134) - (1,089,693) Exchange differences

on translating foreign

operation

j)

Net losses not

recognized as pension

cost

(347) 347 - - - d)

Unrealized gains or

losses from available-

for-sale financial assets

9,716 - - 9,716 Unrealized gains or

losses from available-

for-sale financial assets

Effective portion of

gains and losses on

hedging instruments in

a cash flow hedge

194,052 - - 194,052 Effective portion of

gains and losses on

hedging instruments in

a cash flow hedge

Treasury shares (14,065,490) - - (14,065,490) Treasury shares

Total equity attributable

to stockholders of the

parent

80,369,215 (96,521) - 80,272,694 Total equity attributable

to owners of the parent

Total $206,604,126 $(3,070) $647,936 $207,248,992 Total

(Concluded)