HTC 2013 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

282 283

Fully paid ordinary shares, which have a par

value of $10, carry one vote per share and carry

a right to dividends.

16,000 thousand shares of the Company's

shares authorized were reserved for the

issuance of employee share options.

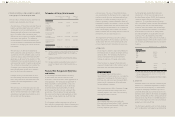

b. Global depositary receipts

In November 2003, HTC issued 14,400 thousand

common shares corresponding to 3,600 thousand

units of Global Depositary Receipts ("GDRs").

For this GDR issuance, HTC's stockholders,

including Via Technologies, Inc., also issued

12,878.4 thousand common shares, corresponding

to 3,219.6 thousand GDR units. Thus, the entire

offering consisted of 6,819.6 thousand GDR units.

Taking into account the effect of stock dividends,

the GDRs increased to 8,782.1 thousand units

(36,060.5 thousand shares). The holders of

these GDRs requested HTC to redeem the GDRs

to get HTC's common shares. As of December

31, 2013, there were 8,289.9 thousand units of

GDRs redeemed, representing 33,159.8 thousand

common shares, and the outstanding GDRs

represented 2,900.7 thousand common shares or

0.35% of HTC's outstanding common shares.

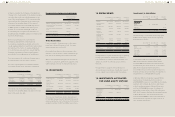

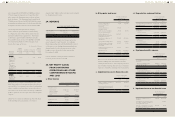

Capital Surplus

December 31,

2013

December 31,

2012

January 1,

2012

Additional

paid-in

capital -

issuance of

shares in

excess of par

$14,640,983 $14,809,608 $14,809,608

Treasury

shares

631,791 1,730,458 1,730,458

Merger 24,145 24,423 24,423

Employee

share options

26,742 - -

Expired stock

options

36,646 37,068 37,068

$15,360,307 $16,601,557 $16,601,557

The premium from shares issued in excess of par

(share premium from issuance of common shares,

treasury shares transactions, merger and expired

stock options) and donations may be used to

The amounts of actuarial losses recognized in

other comprehensive income were NT$17,106

thousand and NT$5,382 thousand for the years

ended December 31, 2013 and 2012, respectively.

As of December 31, 2013 and 2012, the amounts of

actuarial losses recognized in accumulated other

comprehensive income were NT$22,488 thousand

and NT$5,382 thousand, respectively.

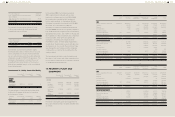

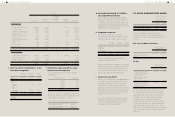

The amounts included in the consolidated balance

sheets in respect of the obligation on HTC and CGC

under the defined benefit plans were as follows:

December 31,

2013

December 31,

2012

January 1,

2012

Present value

of funded

defined benefit

obligation

$(413,220) $(394,681) $(382,134)

Fair value of

plan assets

538,935 513,954 482,785

Defined benefit

assets

$125,715 $119,273 $100,651

Movements in the present value of the defined

benefit obligations were as follows:

For the Year Ended December 31

2013 2012

Opening defined

benefit obligation

$394,681 $382,134

Current service

cost

4,599 5,601

Interest cost 6,408 6,684

Actuarial losses 13,851 262

Benefits paid (6,319) -

Closing defined

benefit obligation

$413,220 $394,681

Movements in the present value of the plan assets

in the current year were as follows:

For the Year Ended December 31

2013 2012

Opening fair value

of plan assets

$513,954 $482,786

Expected return on

plan assets

9,885 9,918

Actuarial losses (3,255) (5,120)

Contributions from

the employer

24,670 26,370

Benefits paid (6,319) -

Closing fair value of

plan assets

$538,935 $513,954

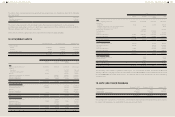

The major categories of plan assets at the end

of the reporting period for each category were

disclosed based on the information announced by

Labor Pension Fund Supervisory Committee.:

December 31,

2013

December 31,

2012

January 1,

2012

Equity

instruments

44.77% 37.43% 40.75%

Debt

instruments

54.44% 61.78% 59.12%

Others 0.79% 0.79% 0.13%

100.00% 100.00% 100.00%

100.00% 100.00% 100.00%

The expected overall rate of return is the weighted

average of the expected returns of the various

categories of plan assets held. The Actuary's

assessment of the expected returns is based on

historical return trends and analysts' predictions of

the market for the asset over the life of the related

obligation, after taking into account the minimum

return rate which no lower than the interest rate

for two-years' time deposit.

The Company expects to make a contribution

of NT$22,944 thousand to the defined benefit

pension plan within one year from December 31,

2013.

23. EQUITY

Share Capital

a. Common stock

December 31,

2013

December 31,

2012

January 1,

2012

Authorized

shares (in

thousands of

shares)

1,000,000 1,000,000 1,000,000

Authorized

capital

$10,000,000 $10,000,000 $10,000,000

Issued and

fully paid

shares (in

thousands of

shares)

842,351 852,052 852,052

Issued capital $8,423,505 $8,520,521 $8,520,521

offset a deficit; in addition, when the Company has

no deficit, such capital surplus may be distributed

as cash dividends or transferred to capital (limited

to a certain percentage of the Company's capital

surplus and once a year).

In September and November 2013, the retirement

of treasury shares caused decreases of NT$168,625

thousand in additional paid-in capital - issuance

of shares in excess of par, NT$9,727 thousand in

capital surplus - treasury shares, NT$278 thousand

in capital surplus - merger and NT$422 thousand

in capital surplus - expired stock options. The

difference the carrying value of treasury shares

retired in excess of the sum of its par value and

premium from issuance of common share was

firstly offset against capital surplus - treasury

shares by NT$1,088,940 thousand, and the rest

offset against accumulated earnings amounting to

NT$814,170 thousand.

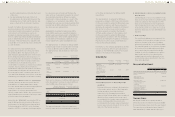

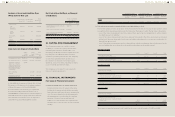

Retained Earnings and Dividend Policy

Under HTC's Articles of Incorporation, HTC should

make appropriations from its net income in the

following order:

a. To pay taxes.

b. To cover accumulated losses, if any.

c. To appropriate 10% legal reserve unless the total

legal reserve accumulated has already reached

the amount of HTC's authorized capital.

d. To recognize or reverse special reserve return

earnings.

e. To pay remuneration to directors and

supervisors at 0.3% maximum of the balance

after deducting the amounts under the above

items (a) to (d).

f. To pay bonus to employees at 5% minimum of

the balance after deducting the amounts under

the above items (a) to (d), or such balance plus

the unappropriated retained earnings of previous

years. However, the bonus may not exceed the

limits on employee bonus distributions as set out

in the Regulations Governing the Offering and

Issuance of Securities by Issuers. Where bonus

to employees is allocated by means of new share

issuance, the employees to receive bonus may

include the affiliates' employees who meet