HTC 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL STATUS, OPERATING RESULTS AND RISK MANAGEMENT FINANCIAL STATUS, OPERATING RESULTS AND RISK MANAGEMENT

126 127

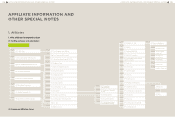

3. Cash Flows

1. Analysis of change in cash flow for the most recent fiscal year

Year

Item 2013 2012 %

Cash Flow Ratio(%) (17.17) 18.69 (192)

Cash Flow Adequacy Ratio(%) 109.71 126.39 (13)

Cash Flow Reinvestment Ratio (%) (19.78) (10.66) 86

Explanation and analysis of change:

2013 revenue was down YoY, which turned net cash flow in operating activities from net cash inflow to net

cash outflow and brought the cash flow ratio to -17%. Cash flow adequacy ratio decreases 110%. Cash flow

reinvestment ratio decreases to -19% due to the continued payment of cash dividend and cash outflow in

operating activities in 2013.

2. Cash flow analysis for the coming year

We expect our net cash flows from operating activities and ample cash on-hand can fully support capital

expenditures, cash dividends and all other cash needs in 2014.

4. The Effect on Financial Operations of Material

Capital Expenditures During the Most Recent

Fiscal Year

1. Review and analysis of material capital expenditures and funding

sources

(1) Material capital expenditure and funding sources

Unit:NT$ thousands

Planned Item

Actual or

projected

sources of

capital

Actual or

projected date

of completion

Total capital

needed

(as of FY 2013)

Actual or projected capital utilization

2011 2012 2013

Purchas and Installation

of Equipment / Facilities Working capital 2010~2013 12,558,351 3,946,634 3,374,528 1,947,341

Plant/Building

Construction Working capital 2010~2013 10,357,135 4,490,062 3,547,319 377,836

2. Anticipated benefits

New Plant / Building Construction

The new Taoyuan Headquarters campus and Taipei headquarters building are essential to expanding

production and providing HTC employees with an appropriate working environment.

New Equipment / Facilities

Replacement / upgrade of equipment and facilities is critical to enhancing productivity and meeting

rising market demand.

HTC's operation is in good condition. The capital expenditures in recent years were mainly from our

own operating capital. Therefore there is no great impact on the company's finance.

5. Investment Diversification in Recent Years

HTC's strategic investments focus on the industrial segments that will enhance HTC's core businesses and

long-term strategic developments. Project evaluation is based on industry dynamics, market competition,

founding team experience, business model, risk analysis, et cetera. The final goal is to make key strategic

investments ,whether via minority or control, in companies and industries that will strengthen HTC's product

and service offerings and its long-term competitiveness.

In 2013 HTC focuses on reallocation and disposal of existing investment portfolio; therefore there is no

strategic investment of any kind this year. HTC will focus on investments in Asia market, especially in the

Greater - China region in the future. Investments will mainly be in the area of firmware, cloud technology,

mobile Internet and related services, etc.