HTC 2013 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

274 275

a trade receivable, the Company considered any

change in the credit quality of the trade receivable

since the date credit was initially granted to the

end of the reporting period. For customers with

low credit risk, the Company has recognized an

allowance for doubtful debts of 1-5% against

receivables past due beyond 31-90 days and of

5-100% against receivables past due beyond

91 days. For customers with high credit risk,

the Company has recognized an allowance for

doubtful debts of 10-100% against receivables past

due more than 31 days.

Before accepting any new customer, the

Company's Department of Financial and

Accounting evaluates the potential customer's

credit quality and defines credit limits and scorings

by customer. The factor of overdue attributed

to customers are reviewed once a week and the

Company evaluates the financial performance

periodically for the adjustment of credit limits.

The concentration of credit risk is limited due to

the fact that the customer base is diverse.

As of the reporting date, the Company had no

receivables that are past due but not impaired.

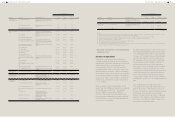

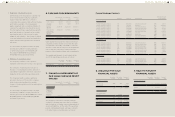

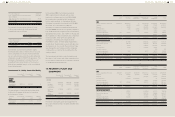

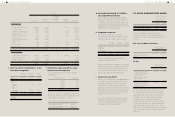

Age of impaired trade receivables

December 31,

2013

December 31,

2012

January 1,

2012

1-90 days

91-180 days

Over 181 days

$3,714,226

1,468,049

803,422

$7,700,143

1,092,164

5,651

$15,528,464

1,994,283

74,014

$5,985,697 $8,797,958 $17,596,761

The above was shown after deducting the

allowance for doubtful debts and analyzed on the

basis of the past due date.

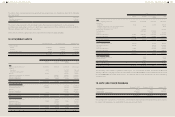

15. PREPAYMENTS

December 31,

2013

December 31,

2012

January 1,

2012

Royalty $12,007,756 $9,936,609 $12,521,985

Prepayments to

suppliers

2,492,197 2,976,231 3,256,082

Net input VAT 1,918,462 434,521 320,544

Molding

expenses

304,411 96,859 188,242

Prepaid

equipment

194,200 232,011 207,061

Software and

hardware

maintenance

139,958 716,695 311,416

Land use right 138,376 134,074 139,707

Service 113,661 171,440 55,192

Others 234,123 144,126 162,413

$17,543,144 $14,842,566 $17,162,642

Current $5,803,744 $4,965,814 $6,507,516

Non-current 11,739,400 9,876,752 10,655,126

$17,543,144 $14,842,566 $17,162,642

Prepayments for royalty were primarily for getting

royalty right and were classified as current or

non-current in accordance with their nature. For

details of content of contracts, please refer to

Note 38.

Prepayments to suppliers were primarily for

discount purposes and were classified as current

or non-current in accordance with their nature.

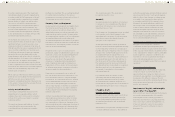

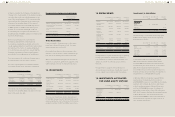

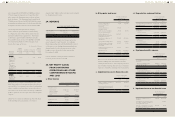

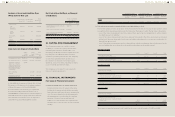

16. INVESTMENTS ACCOUNTED

FOR USING EQUITY METHOD

December 31,

2013

December 31,

2012

January 1,

2012

Investment in

subsidiaries

$- $5,650,859 $71,732

Investment

in jointly

controlled

entity

227,504 241,309 -

$227,504 $5,892,168 $71,732

Movement in the allowances for doubtful debts

For the Year Ended

December 31

2013 2012

Balance, beginning of the year $2,086,085 $1,555,008

Impairment losses recognized

on receivables

1,010,405 531,364

Amounts written off during the

year

(13,943) (401)

Disposal of subsidiary (32,453) -

Translation adjustment 813 114

Balance, end of the year $3,050,907 $2,086,085

Other Receivables

Loan receivables - fluctuation rate is the short-

term loan to Beats Electronics, LLC. For more

details, please refer to Note 33.

Receivable from disposal of investments is the

amount of sale of shares of Saffron Media Group

Ltd. For more details, please refer to Note 30.

Others were primarily prepayments on behalf of

vendors or customers, grants from suppliers and

withholding income tax of employees' bonuses.

14. INVENTORIES

December 31,

2013

December 31,

2012

January 1,

2012

Finished goods $3,487,921 $2,275,082 $1,471,690

Work-in-

process

521,423 1,902,733 4,320,763

Semi-finished

goods

8,244,216 4,960,060 4,382,760

Raw materials 11,074,773 14,374,714 18,134,048

Inventory in

transit

271,225 296,788 121,329

$23,599,558 $23,809,377 $28,430,590

The losses on inventories decline amounting to

NT$417,166 thousand and NT$2,154,419 thousand

were recognized as cost of revenues for the years

ended December 31, 2013 and 2012, respectively.

Investments in Subsidiaries

December 31,

2013

December 31,

2012

January 1,

2012

Unlisted equity

investments

Beats

Electronics, LLC

$- $5,650,859 $-

SYNCTV

Corporation

- - 71,732

$- $5,650,859 $71,732

The percentage of ownership and voting rights

held by the Company at the end of reporting

period were as follows:

December 31,

2013

December 31,

2012

January 1,

2012

Beats

Electronics, LLC

100.00% 100.00% 100.00%

Ownership - 25.14% 50.14%

Voting right - 25.57% 51.00%

SYNCTV

Corporation

20.00% 20.00% 20.00%

In September 2011, the Company acquired

20% equity interest in SYNCTV Corporation

for US$2,500 thousand and accounted for this

investment by the equity method. In December

2012, the Company determined that the

recoverable amount of this investment was less

than its carrying amount and thus recognized an

impairment loss of NT$56,687 thousand.

In October 2011, the Company acquired 50.14%

equity interest in Beats Electronics, LLC for

US$300,000 thousand. In July 2012, the Company

sold back 25% of Beats Electronics, LLC shares

to the founding members of Beats Electronics,

LLC for US$150,000 thousand. For details of

transaction, please refer to Note 30. In October,

2013, the Company sold back its remaining interest

in Beats Electronics, LLC to Beats Electronics,

LLC for US$265,000 thousand. This transaction

resulted in the recognition of a gain in profit or

loss, calculated as follows: