HTC 2013 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

280 281

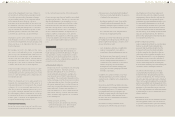

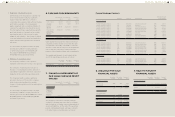

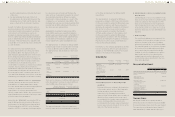

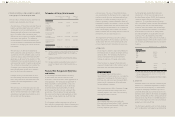

20. OTHER LIABILITIES

December 31,

2013

December 31,

2012

January 1,

2012

Other payables

Accrued

expenses

$36,999,785 $37,469,944 $46,270,611

Payables for

purchase of

equipment

815,774 1,471,529 812,240

Others 217,440 325,700 512,940

$38,032,999 $39,267,173 $47,595,791

Other current

liabilities

Advance receipts $529,470 $637,657 $574,596

Agency receipts 259,529 301,868 440,862

Others 167,128 848,581 645,682

$956,127 $1,788,106 $1,661,140

Accrued Expenses

December

31, 2013

December

31, 2012

January 1,

2012

Marketing $22,592,673 $20,872,536 $29,104,665

Salaries and

bonuses

5,757,389 5,712,741 3,532,970

Bonus to

employees

3,278,053 5,712,075 7,238,637

Services 1,780,205 1,020,609 1,324,631

Materials

and molding

expenses

1,650,934 1,904,181 1,854,932

Import, export

and freight

647,588 644,432 1,397,747

Repairs,

maintenance

and sundry

purchase

237,463 573,355 466,135

Others 1,055,480 1,030,015 1,350,894

$36,999,785 $37,469,944 $46,270,611

The Company accrued marketing expenses on the

basis of related agreements and other factors that

would significantly affect the accruals.

Other Payables - Others

Other payables - others were payables for patents,

and agreed installments payable to the original

stockholders of subsidiaries.

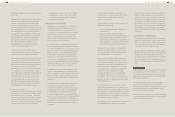

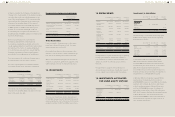

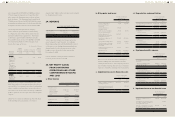

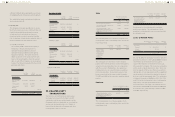

21. PROVISIONS

December 31,

2013

December 31,

2012

January 1,

2012

Warranty

provision

$7,376,035 $8,058,509 $13,080,394

Provisions for

contingent loss

on purchase

orders

832,850 823,005 2,052,881

$8,208,885 $8,881,514 $15,133,275

Movement of provisions for the years ended

December 31, 2013 and 2012 were as follows:

2013

Warranty

Provision

Provisions

for

Contingent

Loss on

Purchase

Orders Total

Balance, beginning

of the year

$8,058,509 $823,005 $8,881,514

Provisions

recognized

13,945,001 359,350 14,304,351

Amount utilized

during the year

(14,789,263) (349,505) (15,138,768)

Translation

adjustment

161,788 - 161,788

Balance, end of

the year

$7,376,035 $832,850 $8,208,885

2012

Warranty

Provision

Provisions

for

Contingent

Loss on

Purchase

Orders Total

Balance, beginning

of the year

$13,080,394 $2,052,881 $15,133,275

Provisions

recognized

10,363,279 - 10,363,279

Reversing un-

usage balances

- (751,363) (751,363)

Amount utilized

during the year

(15,156,357) (478,513) (15,634,870)

Translation

adjustment

(228,807) - (228,807)

Balance, end of

the year

$8,058,509 $823,005 $8,881,514

The Company provides warranty service for its

customers for one year to two years. The warranty

liability is estimated on the basis of evaluation

of the products under warranty, past warranty

experience, and pertinent factors.

The provision for contingent loss on purchase

orders is estimated after taking into account

the effects of changes in the product market,

evaluating the foregoing effects on inventory

management and adjusting the Company's

purchases.

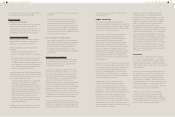

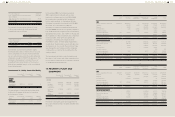

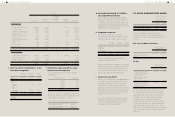

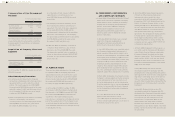

22. RETIREMENT BENEFIT PLANS

Defined Contribution Plans

The pension plan under the Labor Pension

Act (the "LPA") is a defined contribution plan.

Based on the LPA, HTC and Communication

Global Certification Inc. ("CGC") make monthly

contributions to employees' individual pension

accounts at 6% of monthly salaries and wages.

The Company has defined contribution retirement

benefit plans for all qualified employees of HTC

and CGC in Taiwan. Besides, the employees of

the Company's subsidiary are members of a

state-managed retirement benefit plan operated

by local government. The subsidiary is required

to contribute amounts calculated at a specified

percentage of payroll costs to the retirement

benefit scheme to fund the benefits. The only

obligation of the Company with respect to the

retirement benefit plan is to make the specified

contributions to the fund.

The total expenses recognized in the consolidated

statement of comprehensive income were

NT$786,658 thousand and NT$665,765 thousand,

representing the contributions payable to these

plans by the Company at the rates specified

in the plans for the years ended December 31,

2013 and 2012, respectively. As of December 31,

2013, December 31, 2012 and January 1, 2012, the

amounts of contributions payable were NT$109,323

thousand, NT$119,833 thousand and NT$123,877

thousand, respectively, the amounts were paid

subsequent to the end of the reporting period.

Defined Benefit Plans

Based on the defined benefit plan under the

Labor Standards Law ("LSL"), pension benefits are

calculated on the basis of the length of service and

average monthly salaries of the six months before

retirement. HTC and CGC contributed amounts

equal to 2% of total monthly salaries and wages

to a pension fund administered by the pension

fund monitoring committee. The pension fund is

deposited in Bank of Taiwan in the committee's

name.

The actuarial valuations of plan assets and the

present value of the defined benefit obligation

were carried out by qualifying actuaries. The

principal assumptions used for the purposes of the

actuarial valuations were as follows:

December 31,

2013

December 31,

2012

January 1,

2012

Discount rates 1.625%-

1.875%

1.250%-

1.625%

1.500%-

1.750%

Expected return

on plan assets

2.000% 1.875% 2.000%

Expected

rates of salary

increase

2.250%-

4.000%

2.250%-

4.000%

2.250%-

4.000%

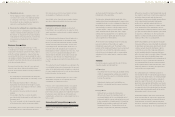

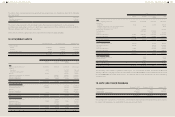

Amounts recognized in profit or loss in respect of

these defined benefit plans were as follows:

For the Year Ended December 31

2013 2012

Current service cost $4,599 $5,600

Interest cost 6,408 6,684

Expected return on

plan assets

(9,885) (9,918)

$1,122 $2,366

Operating cost $301 $644

Selling and

marketing

89 717

General and

administrative

126 262

Research and

development

606 743

$1,122 $2,366