HTC 2013 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

234 235

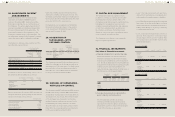

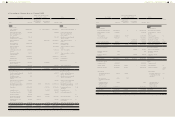

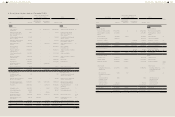

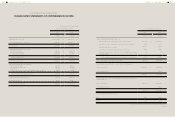

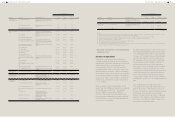

c. Reconciliation of statement of comprehensive income for the year ended December 31, 2012

ROC GAAP

Effect of the Transition from

ROC GAAP to IFRSs IFRSs

Note

Item Amount

Measurement

or Recognition

Difference

Presentation

Difference Amount Item

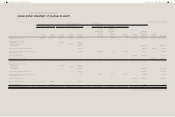

Revenues $270,701,687 $- $- $270,701,687 Revenues

Cost of revenues 213,712,615 (5,721) - 213,706,894 Cost of revenues 4), 6)

Gross profit 56,989,072 5,721 - 56,994,793 Gross profit

Unrealized intercompany

gains

(2,354,363) - - (2,354,363) Unrealized gains

Realized intercompany

gains

1,151,531 - - 1,151,531 Realized gains

Realized gross profit 55,786,240 5,721 - 55,791,961 Realized gross profit

Operating expenses Operating expenses

Selling and marketing 21,721,715 (5,348) - 21,716,367 Selling and marketing 4), 6)

General and

administrative

5,521,252 386 - 5,521,638 General and

administrative

4), 6)

Research and

development

13,780,378 3,191 - 13,783,569 Research and

development

4), 6)

Total operating expenses 41,023,345 (1,771) - 41,021,574

Operating profit 14,762,895 7,492 - 14,770,387 Operating profit

Non-operating income and

expenses

2,162,208 115 - 2,162,323 Non-operating income and

expenses

4)

Profit before income tax 16,925,103 7,607 - 16,932,710 Profit before income tax

Income tax 144,135 (25,000) - 119,135 Income tax 3)

Profit for the period $16,780,968 $32,607 $- 16,813,575 Profit for the period

(1,089,693) Exchange differences

on translating foreign

operation

6,777 Unrealized gain on

available-for-sale financial

assets

194,052 Cash flow hedge

(5,311) Actuarial gains on defined

benefit plan

4)

(59) Share of other

comprehensive income of

subsidiaries, associates and

joint ventures

903 Income tax relating to

components of other

comprehensive income

4)

(893,331) Other comprehensive

income and loss for the

period, net of income tax

$15,920,244 Total comprehensive income

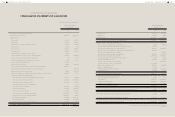

d. Exemptions

Except for optional exemptions and mandatory exceptions to retrospective application provided under the

Regulations, the Company retrospectively applied the Regulations to prepare its opening balance sheet at the date

of transition, January 1, 2012. The major optional exemptions the Company elected are summarized as follows:

1) Investments in subsidiaries, associates and joint ventures

The Company elected to measure the investments in subsidiaries, associates and joint ventures acquired before

the date of transition, at the same carrying amount as recognized under ROC GAAP as of December 31, 2011.

2) Business combinations

The Company elected not to apply IFRS 3

- Business Combination retrospectively to

business combinations that occurred before the

date of transition. Thus, in the opening balance

sheet, the amount of goodwill generated

from past business combinations remains the

same as that shown under ROC GAAP as of

December 31, 2011.

3) Goodwill arising from business combinations

and fair value adjustments

In accordance with IAS 21 - "The Effects of

Changes in Foreign Exchange Rates", any

goodwill and any fair value adjustment to the

carrying amounts of assets and liabilities arising

on the acquisition of a foreign operation should

be treated as assets and liabilities of the foreign

operation. Thus, goodwill and those fair value

adjustments should be expressed in the foreign

operation's functional currency and should

be translated at the closing rate at the end of

the reporting period. The Company elected

not to apply IAS 21 retrospectively to goodwill

and those fair value adjustments arising from

business combinations that occurred before the

date of transition. Thus, goodwill and fair value

adjustments that occurred before the date of

transition are expressed in New Taiwan dollars

using the historical exchange rates.

4) Share-based payment transactions

The Company elected to use the exemption

from the retrospective application of IFRS

2 - "Share-based Payment" to all equity

instruments that were granted and vested

before the date of transition.

5) Employee benefits

The Company elected to recognize all

cumulative actuarial gains and losses on

employee benefits in accumulated earnings as

of the date of transition.

6) Accumulated balances of exchange differences

resulting from translating the financial

statements of a foreign operation.

The Company elected to reset the accumulated

balances of exchange differences resulting

fromtranslating the financial statements of

a foreign operation to zero at the date of

transition, and the reversal has been used to

offset accumulated earnings as of December 31,

2011. Thus, the gain or loss on any subsequent

disposal of foreign operations should exclude

translation differences that arose before the

date of transition.

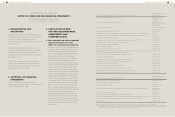

e. Explanations of significant reconciling items in

the transition to Regulations

Material differences between the accounting

policies under ROC GAAP and the accounting

policies adopted under Regulations were as

follows:

1) Under ROC GAAP, the term "cash" used in

the financial statements includes cash on

hand, demand deposits, check deposits, time

deposits that are cancellable but without any

loss of principal and negotiable certificates of

deposit that are readily salable without any loss

of principal. However, under the Regulations,

cash equivalents are short-term, highly liquid

investments that are both readily convertible

to known amounts of cash and so near their

maturity that they present insignificant risk

of changes in value. An investment normally

qualifies as a cash equivalent only when it has a

short maturity of three months or less from the

date of acquisition. Some certificates of deposit

the Company held had maturity of more than

3 months from the date of investment. Thus,

as of January 1 and December 31, 2012, the

reclassification adjustment resulted in decreases

of NT$25,474,750 thousand and NT$1,960,900

thousand, respectively, in "cash and cash

equivalents" and increases by the same amounts

in "other current financial assets."

2) Under ROC GAAP, a deferred income tax

asset or liability should be classified as

current or noncurrent in accordance with the

classification of the related asset or liability

for financial