HTC 2013 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

286 287

price ranged from NT$140 to NT$290 per share.

If the Company's share price is lower than this

price range, the Company may continue to buy

back its shares. The Company had bought back

7,789 thousand shares for NT$1,033,846 thousand

during the repurchase period, which retired by the

Company's board of directors in November 2013.

The Company had repurchased company

shares from the open market for transferring

to employees and some of them had not been

transferred before the expiry time. The Board

of Directors approved the retirement of 1,912

thousand treasury stocks on September 27, 2013.

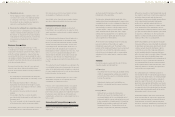

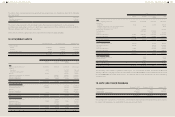

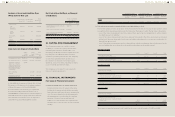

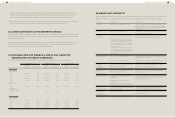

The related information on the treasury stock

transactions was as follows:

(In Thousands of Shares)

Reason to

Reacquire

Number

of Shares,

Beginning

of Year

Addition

During the

Year

Reduction

During the

Year

Number

of Shares,

End of

Year

For 2013

To transfer

shares to the

Company's

employees

20,825 - 1,912 18,913

To maintain

the

Company's

credibility and

stockholders'

interest

- 7,789 7,789 -

20,825 7,789 9,701 18,913

For 2012

To transfer

shares to the

Company's

employees

14,011 6,814 - 20,825

Based on the Securities and Exchange Act of the

ROC, the number of reacquired shares should not

exceed 10% of a company's issued and outstanding

shares, and the total purchase amount should not

exceed the sum of the retained earnings, additional

paid-in capital in excess of par and realized capital

surplus.

Under the Securities and Exchange Act, HTC shall

neither pledge treasury shares nor exercise

shareholders' rights on these shares, such as rights

to dividends and to vote.

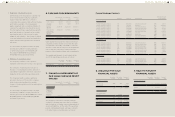

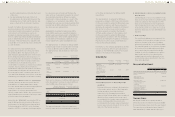

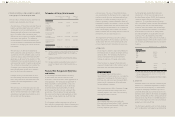

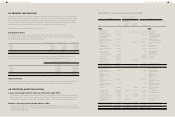

24. REVENUE

For the Year Ended December 31

2013 2012

Sale of goods $200,208,038 $282,914,686

Other operating

income

3,194,610 6,105,489

$203,402,648 $289,020,175

Some sales denominated in foreign currencies

were hedged for cash flow risk. Accordingly,

the Company transferred NT$262,648 thousand

of the gain on the hedging instrument that was

determined to be the effective portion of the

hedge to sales of goods for the year ended

December 31, 2013.

For the analysis of main products and other

revenue, please refer to Note 39.

25. NET PROFIT (LOSS)

FROM CONTINUING

OPERATIONS AND OTHER

COMPREHENSIVE INCOME

AND LOSS

a. Other income

For the Year Ended December 31

2013 2012

Interest income

Cash in bank $342,422 $533,898

Held-to-maturity

financial assets

794 1,710

Loan 211,139 82,027

554,355 617,635

Dividend income 16,282 22,441

Others 594,311 528,456

$1,164,948 $1,168,532

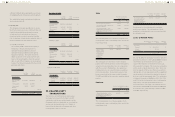

b. Other gains and losses

For the Year Ended

December 31

2013 2012

Losses on disposal of

property, plant and

equipment

$(58) $(6,395)

Gain on disposal of

intangible assets

108,265 -

Gains on sale of available-

for-sale financial assets

29,735 49,084

Gain on disposal of

investments accounted for

using equity method

2,637,673 -

Gain (loss) on disposal of

subsidiaries

175,435 (214,268)

Net foreign exchange gains 109,960 666,883

Valuation gains on financial

liabilities classified as held

for trading

162,297 6,950

Hedge ineffective portion on

cash flow hedges

151,305 10,467

Impairment loss (864,352) (1,313,353)

Other losses (88,994) (122,912)

$2,421,266 $(923,544)

Gain or loss on financial assets and liabilities

held for trading was derived from forward

exchange transactions. The Company entered

into forward exchange transactions to manage

exposures related to exchange rate fluctuations.

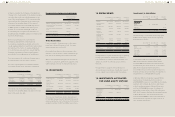

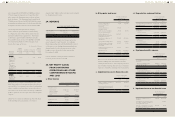

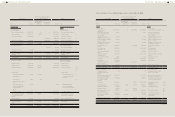

c. Impairment losses on financial assets

For the Year Ended

December 31

2013 2012

Trade receivables (included in

operating expense)

$1,010,405 $531,364

Financial assets measured at

cost (included in other gains

and losses)

- 1,199,045

$1,010,405 $1,730,409

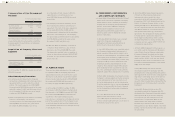

d. Depreciation and amortization

For the Year Ended

December 31

2013 2012

Property, plant and equipment $2,916,699 $2,463,017

Intangible assets 1,968,492 2,047,681

$4,885,191 $4,510,698

Classification of depreciation -

by function

Cost of revenues $1,538,825 $1,322,730

Operating expenses 1,377,874 1,140,287

$2,916,699 $2,463,017

Classification of amortization

- by function

Cost of revenues $6,841 $6,833

Operating expenses 1,961,651 2,040,848

$1,968,492 $2,047,681

e. Employee benefits expense

For the Year Ended

December 31

2013 2012

Post-employment benefits

(Note 22)

Defined contribution plans $786,658 $665,765

Defined benefit plans 1,122 2,366

787,780 668,131

Share-based payments

Equity-settled share-based

payments

26,742 -

Other employee benefits 17,517,784 21,055,551

Total employee benefits expense $18,332,306 $21,723,682

Classification - by function

Cost of revenues $6,539,452 $6,241,376

Operating expenses 11,792,854 15,482,306

$18,332,306 $21,723,682

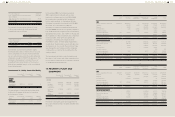

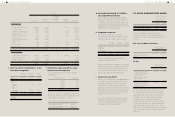

f. Impairment losses on non-financial assets

For the Year Ended

December 31

2013 2012

Inventories (included in cost of

revenues)

$417,166 $2,154,419

Investments accounted for by

the equity method (included in

other gains and losses)

- 56,687

O t h e r i n t a n g i b l e a s s e t s

(including goodwill) (included

in other gains and losses)

864,352 57,621

$1,281,518 $2,268,727