HTC 2013 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

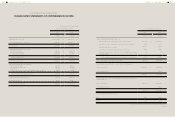

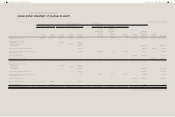

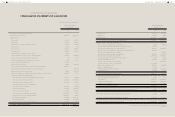

FINANCIAL INFORMATION FINANCIAL INFORMATION

258 259

the entire carrying amount of the investment

(including goodwill) is tested for impairment in

accordance with IAS 36 "Impairment of Assets"

as a single asset by comparing its recoverable

amount (higher of value in use and fair value

less costs to sell) with its carrying amount.

Any impairment loss recognized forms part of

the carrying amount of the investment. Any

reversal of that impairment loss is recognized in

accordance with IAS 36 "Impairment of Assets"

to the extent that the recoverable amount of the

investment subsequently increases.

The Company discontinues the use of the equity

method from the date on which it ceases to have

significant influence over the associate. Any

retained investment is measured at fair value at

that date and the fair value is regarded as its fair

value on initial recognition as a financial asset.

The difference between the previous carrying

amount of the associate attributable to the

retained interest and its fair value is included in

the determination of the gain or loss on disposal

of the associate. In addition, the Company

accounts for all amounts previously recognized

in other comprehensive income in relation to that

associate on the same basis as would be required

if that associate had directly disposed of the

related assets or liabilities.

When a group entity transacts with its associate,

profits and losses resulting from the transactions

with the associate are recognized in the

Company' consolidated financial statements only

to the extent of interests in the associate that are

not related to the Company.

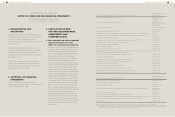

Jointly controlled entities

Joint venture arrangements that involve the

establishment of a separate entity in which

venturers have joint control over the economic

activity of the entity are referred to as jointly

controlled entities.

The results and assets and liabilities of jointly

controlled entities are incorporated in the

consolidated financial statements using the

equity

method of accounting. The accounting treatment

for jointly controlled entities is the same as

investments in associates (please refer to Note 4

"Investments in associates" section).

Property, Plant and Equipment

Property, plant and equipment are tangible items

that held for use in the production, supply of

goods or services, for rental to others, or for

administrative purposes, and are expected to be

used more than twelve months. Property, plant

and equipment are stated at cost, less subsequent

accumulated depreciation and subsequent

accumulated impairment loss when it is probable

that future economic benefits associated with the

item will flow to the Company and the cost of the

item can be measured reliably.

Properties in the course of construction for

production, supply or administrative purposes are

carried at cost, less any recognized impairment

loss. Cost includes professional fees. Such

properties are classified to the appropriate

categories of property, plant and equipment

when completed and ready for intended use.

Depreciation of these assets, on the same basis

as other property assets, commences when the

assets are ready for their intended use.

Depreciation is recognized so as to write off

the cost of assets less their residual values over

their estimated useful lives, using the straight-

line method. The estimated useful lives, residual

values and depreciation method are reviewed

at the end of each reporting period, with the

effect of any changes in estimate accounted for

on a prospective basis in accordance with IAS

8 "Accounting Policies, Changes in Accounting

Estimates and Errors".

An item of property, plant and equipment is

derecognized upon disposal or when no future

economic benefits are expected to arise from

the continued use of the asset. Any gain or loss

arising on the disposal or retirement of an item of

property, plant and equipment is determined as

the difference between the sales proceeds and

the carrying amount of the asset and is

recognized in profit or loss.

Goodwill

Goodwill arising on an acquisition of a business

is carried at cost as established at the date of

acquisition of the business less accumulated

impairment losses, if any.

For the purposes of impairment testing, goodwill

is allocated to each of the Company's cash-

generating units (or groups of cash-generating

units) that is expected to benefit from the

synergies of the combination.

A cash-generating unit to which goodwill has

been allocated is tested for impairment annually,

or more frequently when there is an indication

that the unit may be impaired. If the recoverable

amount of the cash-generating unit is less than

its carrying amount, the impairment loss is

allocated first to reduce the carrying amount of

any goodwill allocated to the unit and then to

the other assets of the unit pro rata based on

the carrying amount of each asset in the unit.

Any impairment loss for goodwill is recognized

directly in profit or loss. An impairment loss

recognized for goodwill is not reversed in

subsequent periods.

If goodwill has been allocated to a cash-

generating unit and the entity disposes of

an operation within that unit, the goodwill

associated with the operation disposed of is

included in the carrying amount of the operation

when determining the gain or loss on disposal.

Intangible Assets

Intangible assets acquired separately

Intangible assets with finite useful lives that are

acquired separately are initially measured at

cost and subsequently measured at cost less

accumulated amortization and accumulated

impairment loss.

Amortization is recognized on a straight-line basis

over their estimated useful lives. The estimated

useful life, residual value, and amortization method

are reviewed at the end of each reporting period,

with the effect of any changes in estimate being

accounted for on a prospective basis which is

in accordance with IAS 8 "Accounting Policies,

Changes in Accounting Estimates and Errors".

The residual value of an intangible asset with

a finite useful life shall be assumed to be zero

unless the Company expects to dispose of the

intangible asset before the end of its economic

life. Intangible assets with indefinite useful lives

that are acquired separately are carried at cost

less accumulated impairment losses.

Intangible assets acquired in a business combination

Intangible assets acquired in a business

combination and recognized separately from

goodwill are initially recognized at their fair value

at the acquisition date (which is regarded as their

cost). Subsequent to initial recognition, intangible

assets acquired in a business combination are

reported at cost less accumulated amortization

and accumulated impairment losses, on the

same basis as intangible assets that are acquired

separately.

Derecognition of intangible assets

An intangible asset is derecognized on disposal,

or when no future economic benefits are

expected from use or disposal. Gains or losses

arising from derecognition of an intangible asset,

measured as the difference between the net

disposal proceeds and the carrying amount of the

asset, are recognized in profit or loss when the

asset is derecognized.

Impairment of Tangible and Intangible

Assets Other Than Goodwill

At the end of each reporting period, the Company

reviews the carrying amounts of its tangible

and intangible assets, excluding goodwill, to

determine whether there is any indication that

those assets have suffered an impairment loss.

If any such indication exists, the recoverable

amount of the asset is estimated in order to

determine the