HTC 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

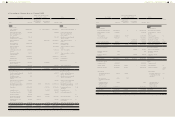

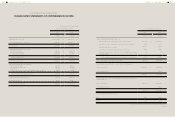

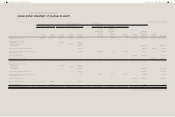

FINANCIAL INFORMATION FINANCIAL INFORMATION

236 237

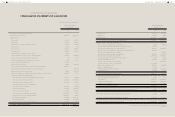

reporting. However, a deferred income tax

assetor liability that is not related to an asset

or liability for financial reporting should be

classified as current or noncurrent on the basis of

the expected length of time before it is realized

or settled. By contrast, under the Regulations,

a deferred income tax asset or liability is always

classified as noncurrent. Thus, as of January

1 and December 31, 2012, the reclassification

adjustment resulted in decreases of NT$1,517,302

thousand and NT$1,948,496 thousand,

respectively, in "deferred income tax asset -

current" and increases by the same amounts in

"deferred income tax assets - non-current."

Under ROC GAAP, deferred tax assets are

recognized in full but are reduced by a valuation

allowance account if there is evidence showing

that a portion of or all the deferred tax assets will

not be realized. However, under the Regulations,

an entity recognizes only to the extent that it

is highly probable that taxable profits will be

available against which the deferred tax assets

can be used; thus, a valuation allowance account

is not used. Thus, as of January 1 and December

31, 2012, the reclassification adjustment resulted

in decreases of NT$10,962,549 thousand

and NT$6,265,293 thousand, respectively,

in "deferred income tax assets" and in the

valuation allowance account. Also, as of January

1 and December 31, 2012, the reclassification

adjustment resulted in increases of NT$187,469

thousand and NT$150,534 thousand, respectively,

in "deferred income tax assets" and "deferred

income tax liabilities".

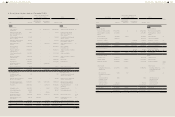

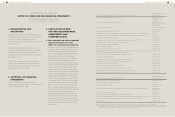

3) Under ROC GAAP, deferred income tax assets or

liabilities from intergroup sales are recognized for

the change in tax basis using the tax rate of ROC.

However, under the Regulations, the buyer's tax

rates are used instead. Thus, the Regulations

adjustment as of January 1, 2012 resulted in

increases of NT$58,000 thousand each in

"deferred income tax assets" and "accumulated

earnings." In addition, the evaluation adjustment

made on December 31, 2012 resulted in increases

of NT$83,000 thousand in "deferred income

tax assets" and in "accumulated earnings"

and a decrease in "income tax" by NT$25,000

thousand.

4) Under the Regulations, the Company elected to

recognize all cumulative actuarial gains and of

NT$83,687 thousand in "accumulated earnings"

due to decreases in "investments accounted

for using equity method" by NT$593 thousand,

"defined benefit assets" by NT$82,801 thousand

and "net loss not recognized as pension cost" by

NT$293 thousand.

As of December 31, 2012, the IFRS adjustment

resulted in a decrease in "accumulated earnings"

by NT$86,417 thousand due to decreases

in "Investments accounted for using equity

method" by NT$484 thousand, "defined benefit

assets" by NT$86,489 thousand and "net loss

not recognized as pension cost" by NT$347

thousand and increase in "deferred income tax

assets" by NT$903 thousand. In addition, this

adjustment resulted in decreases in "cost of

revenues" by NT$422 thousand, "selling and

marketing expenses" by NT$505 thousand,

"general and administrative expenses" by NT$171

thousand, "research and developing expenses"

by NT$524 thousand and an increase in "share of

the profit or loss of subsidiaries, associates and

joint ventures" by NT$115 thousand.

5) Under ROC GAAP, if an obligation is probable

(i.e., likely to occur) and the amount could be

reasonably estimated, it is a contingent liability

and should be accrued for, but under which

account is not clearly defined. However, under

the Regulations, it defines "provisions" as

obligations that are probable (i.e., more likely

than not) and the amount could be reasonably

estimated. Thus, as of January 1 and December

31, 2012, the reclassification adjustment resulted

in decreases of NT$14,808,145 thousand and

NT$7,603,717 thousand, respectively, in "other

current liabilities" and increases by the same

amounts in "provisions - current."

6) Accumulated compensated absences are not

addressed in existing ROC GAAP; thus, the

Company has not recognized the expected cost

of employee benefits in the form of accumulated

compensated absences at the end of reporting

periods. However, under the Regulations, when

the employees render services that increase their

entitlement to future compensated absences,

an entity should recognize the expected cost

of employee benefits at the end of reporting

periods. Thus, as of January 1, 2012 resulted in

an increase in "accrued expenses" by NT$99,321

thousand and a decrease by thesame amount in

"accumulated earnings".

In addition, the evaluation adjustment made on

December 31, 2012 resulted in (a) a decrease in

"accumulated earnings" by NT$93,451 thousand

due to an increase of "accrued expenses"; (b)

decreases in "cost of revenues" by NT$5,299

thousand and "selling and marketing expenses"

by NT$4,843 thousand and (c) increases in

"general and administrative expenses" by

NT$557 thousand and "research and developing

expenses" by NT$3,715 thousand.

7) Under ROC GAAP, deferred charges are classified

under other assets. Transition to Regulations,

deferred charges are classified under "other

intangible assets" according to the nature. Thus,

as of January 1 and December 31, 2012, the

Company reclassified NT$120,593 thousand and

NT$91,810 thousand, respectively, of "deferred

charges" to "other intangible assets."

8) The Company purchased fixed assets and

made prepayments, pursuant to the "Rules

Governing the Preparation of Financial

Statements by Securities Issuers." Such

prepayments are presented as "properties".

Transition to Regulations, the prepayments are

classified under "other assets - other". Thus,

as of January 1 and December 31, 2012, the

Company reclassified NT$103,745 thousand

and NT$208,750 thousand, respectively, of

"property, plant and equipment" to "other assets

- other."

9) Under ROC GAAP, if an investee issues new

shares and an investor does not purchase new

shares proportionately, capital surplus and the

long-term equity investment accounts should

be adjusted for the change in the investor's

holding percentage and interest in the investee's

net assets. By contrast, under the Regulations,

a reduction of investor's ownership interest

that results in loss of significant influence on

or control over an investee would be treated

as a deemed disposal, with the related gain or

loss recognized in profit or loss. An entity may

elect not to adjust the difference retrospectively,

and the Companyelected to use the exemption

from retrospective application. The Regulations

adjustment resulted in a decrease of capital

surplus - long-term equity investments of

NT$18,037 thousand and a corresponding

increase of accumulated earnings by related

rules.

10) The Company elected to reset the accumulated

balances of exchange differences resulting from

translating foreign operation to zero at the date

of transition, and the reversal has been used

to adjust accumulated earnings as of January

1, 2012. The gain or loss on any subsequent

disposals of any foreign operations should

exclude accumulated balances of exchange

differences resulting from translating foreign

operation that arose before the date of transition.

Therefore, the Regulations adjustment resulted in

a decrease in accumulated balances of exchange

differences resulting from translating foreign

operation and an increase in accumulated

earnings by NT$32,134 thousand each.

11) Under ROC GAAP, for the downstream

transactions between an investor company

and an investee company, the elimination of

unrealized gains from intercompany transactions

was shown as a deferred credit under liabilities.

Under Regulations, the elimination of unrealized