HTC 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 HTC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FINANCIAL INFORMATION FINANCIAL INFORMATION

204 205

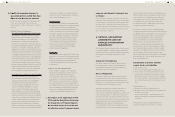

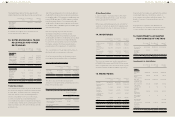

The market interest rates of the time deposits with

original maturity more than three months were as follows:

December 31,

2013

December 31,

2012

January 1,

2012

Time deposits

with original

maturities

more than

three months

- 0.39%~1.10% 0.39%~1.345%

For details of pledged other current financial

assets, please refer to Note 34.

13. NOTES RECEIVABLE, TRADE

RECEIVABLES AND OTHER

RECEIVABLES

December 31,

2013

December 31,

2012

January 1,

2012

Note and trade

receivables

Note receivables $- $- $755,450

Trade receivables 17,017,529 21,816,781 32,852,266

Trade receivables

- related parties

13,203,577 19,468,130 32,977,269

Less: Allowances

for doubtful debts

(3,050,907) (2,073,018) (1,567,940)

$27,170,199 $39,211,893 $65,017,045

Other receivables

Loan receivables -

fluctuation rate

$- $6,554,025 $-

VAT refund

receivables

102,407 210,066 558,279

Interest

receivables

7,344 52,806 19,927

Others 1,746,645 1,117,226 1,115,915

$1,856,396 $7,934,123 $1,694,121

Trade Receivables

The credit period on sales of goods is 30-75 days.

No interest is charged on trade receivables before

the due date. Thereafter, interest is charged at

1-18% per annum on the outstanding balance,

which is considered to be non-controversial,

to some of customers. In determining the

recoverability of a trade receivable, the Company

considered any change in the credit quality of the

trade receivable since the date credit was initially

granted to the

Other Receivables

Loan receivables - fluctuation rate is the short-

term loan to Beats Electronics, LLC. For more

details, please refer to Note 33.

Others were primarily prepayments on behalf of

vendors or customers, grants from suppliers and

withholding income tax of employees' bonuses.

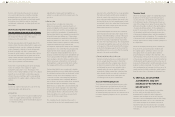

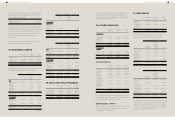

14. INVENTORIES

December 31,

2013

December 31,

2012

January 1,

2012

Finished goods $1,246,743 $764,667 $675,712

Work-in-

process

528,331 1,940,584 3,766,461

Semi-finished

goods

6,525,186 3,954,056 4,083,050

Raw materials 9,885,652 13,652,134 16,788,114

Inventory in

transit

277,744 210,526 75,983

$18,463,656 $20,521,967 $25,389,320

The losses on inventories decline amounting to

NT$439,139 thousand and NT$1,211,554 thousand

were recognized as cost of revenues for the years

ended December 31, 2013 and 2012, respectively.

15. PREPAYMENTS

December 31,

2013

December 31,

2012

January 1,

2012

Royalty $10,425,441 $8,238,869 $10,736,178

Prepayments to

suppliers

2,484,795 2,974,176 3,206,046

Molding

expenses

302,385 96,859 188,242

Prepaid

equipment

146,783 208,750 103,745

Software and

hardware

maintenance

130,087 673,703 263,211

Service 16,241 61,171 548,480

Others 105,299 67,134 72,862

$13,611,031 $12,320,662 $15,118,764

Current

Non-current

$3,596,806

10,014,225

$4,154,949

8,165,713

$6,473,372

8,645,392

$13,611,031 $12,320,662 $15,118,764

end of the reporting period. For customers with low

credit risk, the Company has recognized an allowance

for doubtful debts of 1-5% against receivables past due

beyond 31-90 days and of 5-100% against receivables

past due beyond 91 days. For customers with high

credit risk, the Company has recognized an allowance

for doubtful debts of 10-100% against receivables past

due more than 31 days.

Before accepting any new customer, the

Company's Department of Financial and

Accounting evaluates the potential customer's

credit quality and defines credit limits and scorings

by customer. The factor of overdue attributed

to customers are reviewed once a week and the

Company evaluates the financial performance

periodically for the adjustment of credit limits.

The concentration of credit risk is limited due to

the fact that the customer base is diverse.

As of the reporting date, the Company had no

receivables that are past due but not impaired.

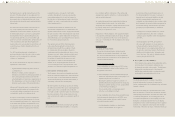

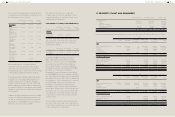

Age of impaired trade receivables

December 31,

2013

December 31,

2012

January 1,

2012

1-90 days

91-180 days

Over 181 days

$10,471,140

406,751

-

$5,775,662

164,250

-

$11,039,103

408,378

60,724

$10,877,891 $5,939,912 $11,508,205

The above was shown after deducting the

allowance for doubtful debts and analyzed on the

basis of the past due date.

Movement in the allowances for doubtful debts

For the Year Ended

December 31

2013 2012

Balance, beginning of the year $2,073,018 $1,567,940

Impairment losses recognized

on receivables

991,821 505,078

Amounts written off as

uncollectible

(13,932) -

Balance, end of the year $3,050,907 $2,073,018

Prepayments for royalty were primarily for getting

royalty right and were classified as current or

non-current in accordance with their nature. For

details of content of contracts, please refer to

Note 38.

Prepayments to suppliers were primarily for

discount purposes and were classified as current

or non-current in accordance with their nature.

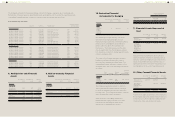

16. INVESTMENTS ACCOUNTED

FOR USING EQUITY METHOD

December 31,

2013

December 31,

2012

January 1,

2012

Investment in

subsidiaries

$41,902,845 $39,539,940 $35,904,924

Investment

in jointly

controlled

entity

227,504 241,309 -

$42,130,349 $39,781,249 $35,904,924

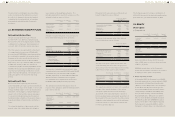

Investments in Subsidiaries

December 31,

2013

December 31,

2012

January 1,

2012

Unlisted

companies

H.T.C. (B.V.I.)

Corp.

$2,985,327 $2,853,189 $2,885,514

Communication

Global

Certification Inc.

566,965 563,998 463,312

High Tech

Computer Asia

Pacific Pte. Ltd.

29,477,842 26,446,634 22,094,532

HTC Investment

Corporation

303,556 303,889 301,332

PT. High Tech

Computer

Indonesia

62 62 62

HTC I

Investment

Corporation

298,654 300,106 295,902

HTC Holding

Cooperatief

U.A.

13 13 13

Huada Digital

Corporation

- - 250,689

HTC Investment

One (BVI)

Corporation

8,270,426 9,072,019 9,613,568

FunStream

Corporation

- 30 -

$41,902,845 $39,539,940 $35,904,924