HP 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

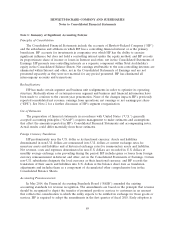

Note 1: Summary of Significant Accounting Policies (Continued)

not permitted. The amendments may be applied retrospectively to each prior period presented or

retrospectively with the cumulative effect recognized as of the date of initial application. HP is

currently evaluating the impact of these amendments and the transition alternatives on its Consolidated

Financial Statements.

In April 2014, the FASB issued guidance which changes the criteria for identifying a discontinued

operation. The guidance limits the definition of a discontinued operation to the disposal of a

component or group of components that is disposed of or is classified as held for sale and represents a

strategic shift that has, or will have, a major effect on an entity’s operations and financial results. HP is

required to adopt the guidance in the first quarter of fiscal 2016, with early adoption permitted for

transactions that have not been reported in financial statements previously issued.

In July 2013, the FASB issued a new accounting standard requiring the presentation of certain

unrecognized tax benefits as reductions to deferred tax assets rather than as liabilities in the

Consolidated Balance Sheets when a net operating loss carryforward, a similar tax loss or a tax credit

carryforward exists. HP is required to adopt this new standard on a prospective basis in the first

quarter of fiscal 2015; however, early adoption is permitted as is retrospective application. HP will

adopt the new standard in the first fiscal quarter of 2015 on a prospective basis. Adoption of the new

standard is not expected to have a material effect on HP’s Consolidated Financial Statements.

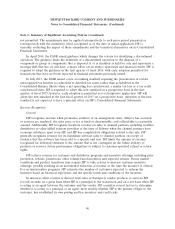

Revenue Recognition

General

HP recognizes revenue when persuasive evidence of an arrangement exists, delivery has occurred

or services are rendered, the sales price or fee is fixed or determinable, and collectibility is reasonably

assured. Additionally, HP recognizes hardware revenue on sales to channel partners, including resellers,

distributors or value-added solution providers at the time of delivery when the channel partners have

economic substance apart from HP, and HP has completed its obligations related to the sale. HP

generally recognizes revenue for its standalone software sales to channel partners on receipt of

evidence that the software has been sold to a specific end user. HP limits the amount of revenue

recognized for delivered elements to the amount that is not contingent on the future delivery of

products or services, future performance obligations or subject to customer-specified refund or return

rights.

HP reduces revenue for customer and distributor programs and incentive offerings, including price

protection, rebates, promotions, other volume-based incentives and expected returns. Future market

conditions and product transitions may require HP to take actions to increase customer incentive

offerings, possibly resulting in an incremental reduction of revenue at the time the incentive is offered.

For certain incentive programs, HP estimates the number of customers expected to redeem the

incentive based on historical experience and the specific terms and conditions of the incentive.

In instances when revenue is derived from sales of third-party vendor products or services, HP

records revenue on a gross basis when HP is a principal to the transaction and on a net basis when HP

is acting as an agent between the customer and the vendor. HP considers several factors to determine

whether it is acting as a principal or an agent, most notably whether HP is the primary obligor to the

customer, has established its own pricing and has inventory and credit risks.

90