HP 2014 Annual Report Download - page 53

Download and view the complete annual report

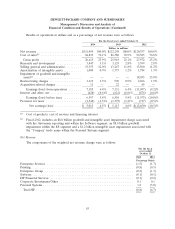

Please find page 53 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

solutions, our business-specific competitors are exerting increased competitive pressure in targeted

areas and are entering new markets, our emerging competitors are introducing new technologies and

business models, and our alliance partners in some businesses are increasingly becoming our

competitors in others. A third set of challenges relates to business model changes and our go-to-market

execution. The macroeconomic weakness we have experienced has moderated in some geographic

regions but remains an overall challenge. A discussion of some of these challenges at the segment level

is set forth below.

• In Personal Systems, we have been negatively impacted by the market shift towards tablet

products within mobility products, which has reduced the demand for PCs, particularly consumer

notebooks. If benefits from our new product investments in this area do not materialize, we will

continue to be negatively impacted by this trend. However, the pace of the market decline is

slowing with signs of stabilization and HP is gaining market share. In Personal Systems, we are

maintaining our strategic focus on profitable growth through improved market segmentation with

respect to multi-OS, multi-architecture, geography, customer segments and other key attributes.

In fiscal 2014, Personal Systems experienced revenue growth in commercial PCs with growth

across all product categories, particularly notebooks, along with growth in consumer notebooks.

The increase in demand was due in part to customers migrating from the Windows XP operating

system, benefits from the delayed installed base refresh cycle and new product introductions.

• In Printing, we are experiencing the impact of the growth in mobility and demand challenges in

consumer and commercial markets, as well as an overall competitive pricing environment. To be

successful in addressing these challenges, we need to continue to execute on our key initiatives

of focusing on products targeted at high usage categories, developing emerging market

opportunities and introducing new revenue delivery models to consumer customers. In fiscal

2014, Printing experienced a revenue decline and an increase in operating profit as we continued

our print strategies, with a focus on driving high value printer unit placements. In the consumer

market, our Ink in the Office products are driving unit volume due to demand for our OfficeJet

Pro product lines, particularly our OfficeJet Pro X printers which leverage our Page-Wide Array

technology. The Ink in the Office initiative targets shifting ink into SMBs more profitably. In the

commercial market, our focus is on placing higher value printer units which also offer a positive

annuity of toner. We are accomplishing this in two growth areas, in multi-function printers with

recently introduced products that are increasing demand and in managed print services, which

presents a strong after-market supplies opportunity. We plan to continue this focus on

replenishing the installed base with value-added units, and expanding our innovative ink and

laser programs.

• In EG, we are experiencing revenue challenges due to multiple market trends, including the

increasing demand for hyperscale computing infrastructure products, the transition to cloud

computing and a highly competitive pricing environment. In addition, demand for our Business

Critical Systems (‘‘BCS’’) products continues to weaken along with the overall market for UNIX

products and the effect of lower BCS revenue is impacting Technology Services (‘‘TS’’). To be

successful in overcoming these challenges, we must address business model shifts and

go-to-market execution challenges, and continue to pursue new product innovation in areas such

as cloud and data center computing, software-defined networking, storage, blade servers and

wireless networking. In fiscal 2014, EG experienced a decline in revenue and operating profit

due to the previously mentioned challenging market environment, in particular weak market

demand in BCS and market shifts impacting Storage. Elsewhere in EG, we experienced areas of

45